Using Elasticities for Quick Predictions (Optional)

Economists are often asked to predict how shifts in demand and supply will change market prices. Two simple price-change formulas make it possible to make quick predictions for price changes using elasticities.12

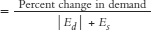

Percent change in price from a shift in demand

Percent change in price from a shift in demand

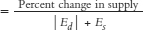

Percent change in price from a shift in supply

Percent change in price from a shift in supply

These formulas are approximations that work well when the percent change in demand or supply is small, say, 10% or less.13 Let’s apply the formula to an interesting problem.

How Much Would the Price of Oil Fall if the Arctic National Wildlife Refuge Were Opened Up for Drilling?

The Arctic National Wildlife Refuge (ANWR) is the largest of Alaska’s 16 national wildlife refuges. It is believed to contain significant deposits of petroleum. Former President George W. Bush argued in favor of drilling in ANWR.

Increasing our domestic energy supply will help lower gasoline prices and utility bills. We can and should produce more crude oil here at home in environmentally responsible ways. The most promising site for oil in America is a 2,000 acre site in the Arctic National Wildlife Refuge, and thanks to technology, we can reach this energy with little impact on the land or wildlife.14

Some environmentalists disagree about whether the oil can be produced in environmentally responsible ways. We will leave that debate to others. What do economists say about the former president’s assertion that “Increasing our domestic energy supply will help lower gasoline prices and utility bills”? An increase in supply will lower prices, but by how much?

85

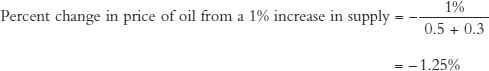

The Department of Energy’s Energy Information Service (EIS) predicts that production from ANWR will average about 800,000 barrels per day, or a little bit less than 1% of worldwide oil production. Let’s be generous and suppose that ANWR increases world supply by 1%. Since the elasticity of demand for oil is about −0.5 and in the long run the best estimate of the elasticity of supply is about 0.3, using our price formula, we have

A 1.25% fall in price won’t seem like very much when you are gassing up at the pump, but don’t forget that every user of oil in the world will benefit from the fall in price–so a fall of 1.25% is nothing to sneeze at.

So should we drill for oil in ANWR or not? The answer will depend on the value of conservation, the costs of drilling for oil (including the costs of a potential oil spill such as occured in the Gulf of Mexico), and the price and quantity of oil that can be recovered. Not an easy calculation!