10 Stock Markets and Personal Finance

CHAPTER OUTLINE

Passive vs. Active Investing

Why Is It Hard to Beat the Market?

How to Really Pick Stocks, Seriously

Other Benefits and Costs of Stock Markets

Takeaway

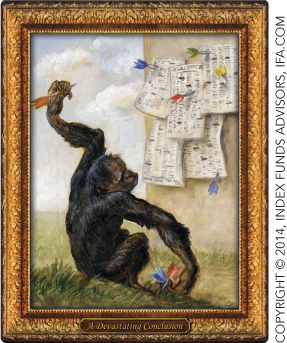

In 1992, television reporter John Stossel decided to challenge the experts of Wall Street. As a student, Stossel had taken classes from economist Burton Malkiel whose book A Random Walk Down Wall Street claimed that the money and fame that went to stock-picking gurus were a sham and a waste. According to Malkiel: “A blindfolded monkey throwing darts at a newspaper’s financial pages could select a portfolio that would do just as well as one carefully selected by experts.”1

Instead of using a monkey, Stossel himself threw darts at a giant wall-sized version of the stock pages of the Wall Street Journal. Stossel followed his portfolio for nearly a year and compared the return with the portfolios picked by major Wall Street experts. Stossel’s portfolio beat 90% of the experts! Not surprisingly, none of the experts would speak to him on camera about their humiliating loss. The lesson, according to Stossel, is that if you are paying an expert a lot of money to pick your stocks, it is probably you who are the monkey.

In this chapter, we explain why Stossel’s amusing experiment is backed up by economic theory and by many careful empirical studies. We will also be giving you some investment advice in this chapter. No, we can’t promise you the secret to getting rich. Most of the get rich quick schemes sold in books, investment seminars, and newsletters are scams. Economics, however, does provide some important lessons for investing wisely. We can’t tell you how to get rich quick, but we can perhaps help you to get richer slowly.

Throughout this chapter, we emphasize a core principle of economics: There’s no such thing as a free lunch. That’s just another way of saying that you shouldn’t expect something for nothing, or tradeoffs are everywhere. Let’s see how the principle applies to personal finance.