Passive vs. Active Investing

Many people invest in the stock market through a mutual fund. A mutual fund pools money from many customers and invests the money in many firms, in return, of course, for a management fee. Some of these mutual funds, called “active funds,” are run by managers who try to pick stocks—these mutual funds often charge higher than average fees. Other mutual funds are called “passive funds” because they simply attempt to mimic a broad stock market index such as Standard and Poor’s 500 (S&P 500), a basket of 500 large firms broadly representative of the U.S. economy.

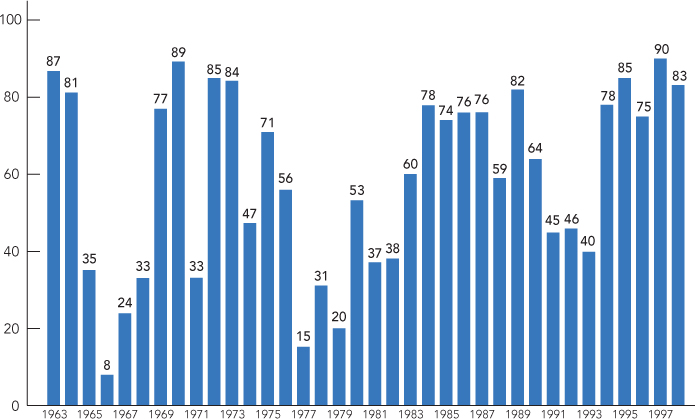

Figure 10.1 shows that in a typical year passive investing in the S&P 500 Index beats about 60% of all mutual funds. In any given year, some mutual funds beat the index, but what is telling is that the funds that beat the index are different nearly every year! In other words, the funds that beat the index in one year probably just got lucky that year. One study that looked over 10 years found that passive investing beat 97.6% of all mutual funds!2 Overall, it is clear that very few mutual fund managers can consistently beat the market averages.

FIGURE 10.1

It is possible that a very small number of experts can systematically beat the stock market. Sometimes Warren Buffett, who promotes long-term investing for value, is cited as an example of a person who sees farther than the rest of the market. He started out as a paperboy and worked his way up to $52 billion by purchasing undervalued stocks.

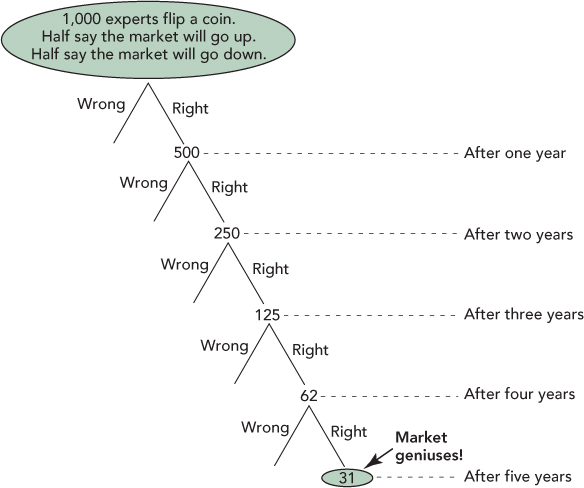

Some economists even think that Buffett, and a few others like him, just got lucky. If enough people are out there trying to pick stocks, you’re going to have a few who get lucky many times in a row. Take a look at Figure 10.2. At the top of the figure, we start out with 1,000 experts, each of whom flips a coin to predict whether the market will go up or down in the following year. After one year, 500 of the experts will turn out to be right. After two years, 250 experts will have been right two years in a row. At the end of five years, just 31 out of 1,000 experts will have been right five years in a row. The experts who get it correct every time will be lauded as geniuses on CNBC and their advice will be eagerly sought. But the reality is that they just got lucky.

FIGURE 10.2

Is Buffett skilled or lucky? We’re not so sure, but we do know this: Right now there is a small industry of people following the moves of Warren Buffett, trying to guess what he will say and do next. It is harder and harder for Buffett to get a big jump on the rest of the stock market. Even if Buffett could beat the market at first, it is not so clear he can beat the market any longer.