Other Benefits and Costs of Stock Markets

Throughout this chapter, we’ve recommended against gambling with all or most of your money. We’ve recommended buy and hold, based on a diversified portfolio. But hey, maybe some of you are into gambling. You know what? If you want to take risk for the sake of risk alone, the U.S. stock market offers the best odds in the world, better than Las Vegas and better than your local bookie. In the U.S. stock market, people on average make money and that is because the productive capacity of the U.S. economy is expanding through economic growth. There is more profit to go around and that means you have a good chance of making some really lucrative investments.

Stock markets have uses beyond investment. First, new stock and bond issues are an important means of raising capital for new investment (investment now in the economic sense of increasing the capital stock). Stock markets also reward successful entrepreneurs and thus encourage people to start companies and look around for new ideas. The founders of Google are now very rich and selling company shares to the stock market helped make them so. A well functioning stock market helps companies such as Google get going or expand.

Second, the stock market gives us a better idea of how well firms are run. The stock price is a signal about the value of the firm. When the stock price is increasing, especially when it is increasing relative to other stocks, this is a signal that the firm is making the right investments for future profits. When the stock is declining, especially when it is declining relative to other stocks, this is a signal that something has gone wrong and perhaps management needs to be replaced. Some critics allege that Google has dominated Web search but failed with its maps, blog search services, and email accounts. It is not necessarily clear whether these endeavors are making money for the company. Will Google make YouTube into a profitable venture? Are the charges true that “Google has lost it”? It’s hard to say in the abstract. But we can look at Google’s share price and see if it is going up or down. Market prices give the public a daily report on whether the managers of a company are succeeding or failing.

Third, stock markets are a way of transferring company control from less competent people to more competent people. If a group of people think they know the right way to run a company, they can buy it and put their money where their mouth is, so to speak. Maybe a company should be merged, broken up, or simply taken in a new direction. The stock market is the ultimate venue where people bid for the right to make these decisions.

Bubble, Bubble, Toil, and Trouble

It’s worth pointing out that stock markets (and other asset markets) have a downside, namely that they can encourage speculative bubbles. A speculative bubble arises when stock prices rise far higher, and more rapidly, than can be accounted for by the fundamental prospects of the companies at hand. Bubbles are based in human psychology and often they are hard to understand. Nobel Prize–winning economist Vernon Smith, whom you met in Chapter 4, has found that speculative bubbles and crashes occur in experimental markets, even when traders are given enough information to easily calculate an asset’s true value.6 Inexperienced traders are more prone to bubbles, but even experienced traders can fall for bubbles when the trading environment changes. Speculative bubbles and crashes have significant costs, as we will discuss, so economists are trying to better understand bubbles and how market institutions can be designed to help avoid bubbles.

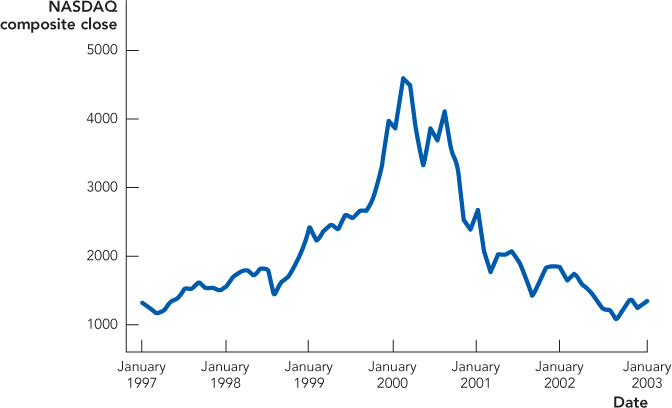

During the dot.com era, circa 2000, many Internet or dot.com stocks had very high prices even though many of these companies had never earned a dime of profit or for that matter any revenue. Many of the tech stocks were listed on the NASDAQ stock exchange. As you can see in Figure 10.5, in the space of five years the NASDAQ Composite Index more than tripled from a monthly average of about 1,200 to over 4,000 before falling back down again. Many people made a lot of money on the ride up and many people—maybe the same people, maybe others—lost a lot of money on the ride down.

If you can spot speculative bubbles on a consistent basis, yes, you can become very wealthy. But, of course, a speculative bubble is usually easier to detect with hindsight than at the time. Apple and Google might have looked like speculative bubbles, too; the only problem is that they never burst. Betting too soon that high prices will end is also one way to go bankrupt.

Speculative bubbles, and their bursting, can hurt an economy. During the rise of the bubble, capital is invested in areas where it is not actually very valuable. A second wave of problems comes when the bubble crashes. Lower stock prices (or lower home prices) mean that people feel poorer and so they will spend less. The collapse of the bubble also means that workers must move from one sector to another, such as from high tech to retailing, or from real estate to export industries. Shifting labor from one sector of an economy to another creates labor adjustment costs.

FIGURE 10.5

CHECK YOURSELF

Question 10.4

The Federal Reserve was criticized for not stepping in and bursting the housing bubble, which would have prevented the housing collapse. Do you think this criticism is valid, based on what you read in this section?

The Federal Reserve was criticized for not stepping in and bursting the housing bubble, which would have prevented the housing collapse. Do you think this criticism is valid, based on what you read in this section?

We saw both of these problems with the dot.com bubble and the real estate bubble leading up to the crash of housing prices in 2007–2008. During the dot.com boom years, for example, we invested too much in stringing fiber-optic cable across the world’s oceans—cable that later proved to be unprofitable. Similarly, during the housing boom we invested too much in houses that later were abandoned. In addition, the boom in housing prices led banks to be much too lax about the value of financial assets backed by portfolios of mortgages. When housing prices started to fall and people began to default on their mortgages, the value of these asset-backed securities plummeted and banks found themselves nearing bankruptcy. To stave off bankruptcy, these banks cut back on lending, transmitting problems in the housing markets to the wider economy and helping to generate the lengthy recession beginning in late 2008.

Yes, bubbles can be a problem, but few people doubt that we are better off with active trading in stock and asset markets. One partial solution is to have greater transparency in assessing the value of companies and assets. Economists continue to research asset markets and the possibility of limiting bubbles and subsequent crashes. But, for now, there is no surefire solution for getting rid of asset bubbles.