The Economics of Ideas

We have learned from the Solow model that better ideas are the key to economic growth in the long run. Capital accumulation alone will not create much growth in the United States or the other developed economies such as Japan and Western Europe because these economies already have so much capital that investment must be used to replace a lot of depreciated capital every period. Instead, these countries must develop new ideas to increase the productivity of capital and labor.

Ideas have some important and unusual properties: They can be freely shared by an unlimited number of people and they do not depreciate with greater use. As economist Paul Romer emphasizes, ideas often produce more ideas so growth may be in part self-sustaining. Thus, to better understand economic growth on the cutting edge, we must turn to the economics of ideas.

We will emphasize the following:

Ideas for increasing output are primarily researched, developed, and implemented by profit-seeking firms.

Ideas can be freely shared, but spillovers mean that ideas are underprovided.

Government has a role in improving the production of ideas.

The larger the market, the greater the incentive to research and develop new ideas.

Research and Development Is Investment for Profit

In Chapter 7, we emphasized that economic growth was not automatic, and we said that the factors of production do not fall from the sky like manna from heaven. In order to increase output, the factors of production must be produced and organized efficiently. All of this applies to ideas or technological knowledge just as much as to physical and human capital. Once again, incentives are the key. Economic growth requires institutions that encourage investment in physical capital, human capital, and technological knowledge (ideas).

In the United States, there are about 1.3 million scientists who research and develop new products, more than in any other country in the world, and most of these scientists and engineers, about 70%, work for private firms. (The ratios are broadly similar in other developed countries.)

Private firms invest in research and development when they expect to profit from their endeavors. Thus, the institutions we discussed in the last chapter— property rights, honest government, political stability, a dependable legal system, and competitive and open markets—also drive the generation of technological knowledge. When it comes to knowledge, other institutions are especially important. These institutions include a commercial setting that helps innovators to connect with capitalists, intellectual property rights such as copyrights and patents, and a high-quality educational system (we will turn to these issues shortly).

It’s not just the number of scientists and engineers that matters for economic growth, as many other people come up with new ideas on their jobs, at school, or at home in their garages. Mark Zuckerberg, for example, wrote the software for Facebook as a Harvard student. Just as important, the business culture and institutions of the United States are good at connecting innovators with businesspeople and venture capitalists looking to fund or otherwise take a chance on new ideas. Ideas without backers are sterile. In the United States, potential innovators know that if they come up with a good idea, that idea has a good chance of making it to the market. The incentive to discover new ideas is correspondingly strong.

American culture also supports entrepreneurs. People like SpaceX founder Elon Musk, for example, are lauded in the popular media. Historically, however, entrepreneurs were often attacked as job destroyers, as the sidebar on eighteenth-century British entrepreneur John Kay illustrates.

Compared with most other countries, the United States has a very good cultural and commercial infrastructure for supporting new ideas and their conversion into usable commercial products.

Artistic innovation also requires many individuals with a diversity of viewpoints, many sources of support and employment, and businesspeople looking to profit from and support innovations. It’s not surprising, therefore, that the United States is also a leader in artistic innovation. American movies, popular music, and dance have spread around the world. But the United States is not just good at popular culture: It is also a leader in abstract art, contemporary classical composition, avant-garde fiction and poetry, and modern dance, to name just a few fields. The lesson is that artistic, economic, and scientific innovations spring from similar sources.

A further significant part of the infrastructure for creativity is property rights. We now turn to one form of intellectual property rights, patents.

Patents Many ideas have peculiar properties that can make it difficult for private firms to recoup their investments in those ideas. In particular, new processes, products, and methods can be copied by competitors. The world’s first MP3 player was the Eiger Labs’s MPMan introduced in 1998. Ever heard of it? Probably not. Other firms quickly copied the idea and Eiger Labs lost out in the race to innovate. Imitators get the benefit of new ideas without having to pay the costs of development. Imitators, therefore, have lower costs so they tend to drive innovators out of the market unless some barrier prevents quick imitation.

Imitation often takes time and this does give innovators a chance to recoup their investments. The Apple iPad design, for example, is already being copied by other firms, but until that happened, Apple could exploit monopoly power to sell millions of iPads for high profits. That is what makes Apple willing to invest in research and development in the first place and that is why the iPad exists. Firms often compete not by offering the same product at a lower price but by offering substantially new and better products.

SEARCH ENGINE

You can find Apple’s patent on the iPad’s multipoint touchscreen (20,060,097,991) by searching at the U.S. Patent and Trademark Office.

Apple also relies on patents to protect its innovations. A patent is a government grant of temporary monopoly rights, typically 20 years from the date of filing. Patents delay imitation, thus allowing innovative firms a greater period of monopoly power. Apple, for example, has patented one of the most distinctive features of the iPad, the multipoint touchscreen. Apple’s patent, filed in 2004, gives Apple the right to prevent other firms from copying its technology until 2024. Still, we may well see other similar devices in the near future if Apple licenses its technology to other firms. Furthermore, competitors are finding ways to produce the same effect using different methods—a majority of patented innovations are imitated within five years.

Nevertheless, Apple’s patent gives it some monopoly power, and as you know if you studied micro first, firms with monopoly power raise prices above competitive levels. Thus, patents increase the incentive to research and develop new products, but also increase monopoly power once the products are created. Monopoly power not only raises prices, it also means that innovations take longer to spread throughout the economy. The trade-off between creating incentives to research and develop new products while avoiding too much monopoly power is one of the trickiest in economic policy.2

Spillovers, and Why There Aren’t Enough Good Ideas

Even when a firm has a patent on its technological innovation and other firms cannot imitate in a direct way, ideas tend to spill over and benefit other firms and consumers. A new pharmaceutical will be patented, for example, but the mechanism of action—how the pharmaceutical works—can be examined and broadly copied by other firms to develop their own pharmaceuticals.

A good is non-rivalrous if one person’s consumption of the good does not limit another person’s consumption.

Spillovers have good and bad aspects. The good aspect of imitation or spillovers is that ideas are non-rivalrous. If you consume an apple, then I cannot consume the same apple. When it comes to eating an apple, it’s either you or me—we can’t share what we each consume so economists say that apples are rivalrous. But ideas can be freely shared. You can use the Pythagorean theorem and I can use the very same theorem at the very same time. The Pythagorean theorem can be shared by all of humanity, which is why economists say that ideas are non-rivalrous.

Since many ideas can be shared at low cost, they should be shared—that’s the way to maximize the benefit from an idea. The spillover or diffusion of ideas throughout the world is thus a good thing. For instance, the idea of breeding and growing corn originated in ancient Mexico but now people grow corn all over the world. Spillovers, however, mean that the originator of an idea doesn’t get all the benefits. And if the originator doesn’t get enough of the benefits, ideas will be underprovided. For this reason, while economists know that idea spillovers are good, they also know that spillovers mean that too few good ideas are produced in the first place.

To understand why spillovers mean that ideas will be underprovided, think about why firms explore for oil. Answer: to make money. So what would happen to the amount of exploration if whenever a firm struck oil, other firms jumped in and drilled wells right next door? Clearly, the incentive to explore would decline if firms didn’t have property rights to oil fields. Firms explore for ideas just as they explore for oil, and if other firms can set up right next door to exploit the same field of ideas, the incentive to explore will decline.

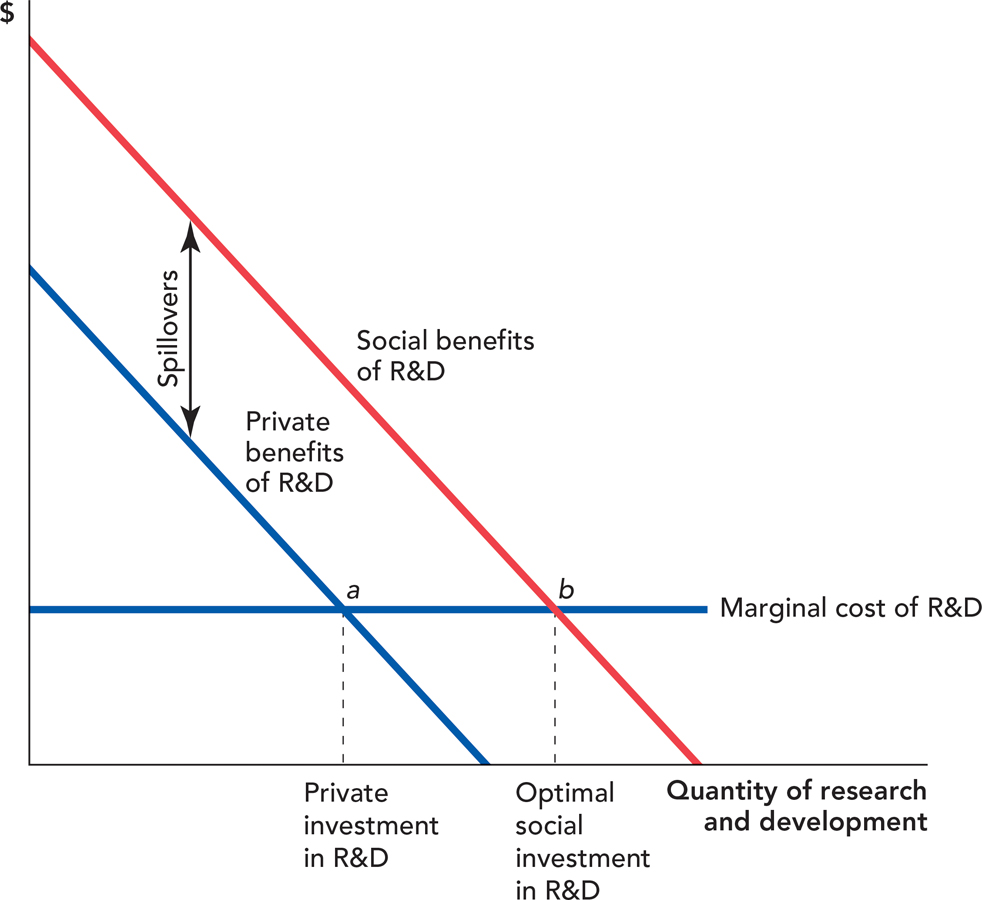

Figure 8.12 illustrates the argument in a diagram. A profit-maximizing firm invests in research and development (R&D) so long as the private marginal benefit is larger than the marginal cost. As a result, private investment occurs until point a in Figure 8.12. Spillovers, however, mean that the social benefit of R&D exceeds the private benefit so the optimal social investment is found where the marginal social benefit just equals the marginal cost at point b. Since the private benefit to R&D is less than the social benefit, private investment in R&D is less than ideal.

FIGURE 8.12

Government’s Role in the Production of New Ideas

Can anything be done to increase the production off new ideas? We have already mentioned one important government policy that affects the production of new ideas, namely patents. Patents reduce spillovers and thus increase the incentive to produce new ideas, but they can also slow down the spread of new ideas.

The government could also subsidize the production of new ideas. Returning to Figure 8.12, a subsidy or tax break to R&D expenditures, for example, will shift the (private) marginal cost of R&D curve down, thus increasing private investment.

The argument for government subsidies is strongest when the spillovers are largest. The modern world is founded on mathematics, physics, and molecular biology—basic ideas in these fields have many applications so spillovers can be large. But even if the social benefits to basic science are large, the private returns can be small. It’s probably easier to make a million dollars producing pizza than it is to make a million dollars producing mathematical theorems. In fact, Thomas S. Monaghan made a billion dollars producing pizza (he’s the founder of Domino’s), while mathematicians Ron Rivest, Adi Shamir, and Leonard Adleman didn’t make nearly so much on their RSA algorithm even though their algorithm is used to encrypt data sent over the Internet and thus forms the backbone for all Internet commerce.

The large spillovers to basic science suggest a role for government subsidies to universities, especially the parts of universities that produce innovations and the basic science behind innovations. Perhaps most important, universities produce scientists. Most of the 1.3 million scientists who research and develop new products in the United States were trained in government-subsidized universities. Thus, subsidies to the hard sciences support the private development of new ideas and those initial subsidies are likely to pay for themselves many times over.

Market Size and Research and Development

Imagine that there are two diseases that if left untreated are equally deadly. One of the diseases is rare, the other one is common. If you had to choose, would you rather be afflicted with the rare disease or the common disease? Take a moment to think about this question because there is a right answer.

If you don’t want to die, it’s much better to have the common disease. The reason? The costs of developing drugs for rare and common diseases are about the same, but the revenues are greater, the more common the disease. Pharmaceutical companies concentrate on drugs for common diseases because larger markets mean more profits.

CHECK YOURSELF

Question 8.11

What would happen to the incentive to produce new ideas if all countries imposed high tax rates on imports?

What would happen to the incentive to produce new ideas if all countries imposed high tax rates on imports?

Question 8.12

What are spillovers and how do they affect the production of ideas?

What are spillovers and how do they affect the production of ideas?

Question 8.13

Some economists have proposed that the government offer large cash prizes for the discovery of cures for diseases like malaria that affect people in developing countries. What economic reasons might there be to support a prize for malaria research rather than, say, cancer research?

Some economists have proposed that the government offer large cash prizes for the discovery of cures for diseases like malaria that affect people in developing countries. What economic reasons might there be to support a prize for malaria research rather than, say, cancer research?

As a result, there are more drugs to treat common diseases than to treat rare diseases, and more drugs means greater life expectancy. Patients diagnosed with rare diseases—those ranked at the bottom quarter in terms of how frequently they are diagnosed—are 45% more likely to die before age 55 than are patients diagnosed with more common diseases.3

Larger markets mean increased incentives to invest in research and development, more new drugs, and greater life expectancy. So imagine this: If China and India were as wealthy as the United States, the market for cancer drugs would be eight times larger than it is today.

China and India are not yet wealthy countries but what this thought experiment tells us is that people in the United States benefit tremendously when other countries grow rich.

Like pharmaceuticals, new computer chips, software, and chemicals also require large R&D expenditures. As India, China, and other countries including the United States become wealthier, companies will increase their worldwide R&D investments.