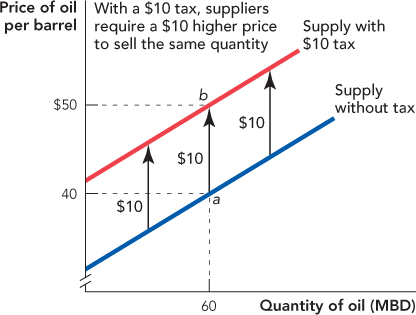

FIGURE 3.12

A Tax on Industry Output Shifts the Supply Curve Up by the Amount of the Tax When suppliers pay no tax, they are willing to supply 60 million barrels a day (MBD) of oil for a price of $40 per barrel. If they must pay a tax of $10 per barrel, they will be willing to supply 60 MBD for $10 more, or $50 a barrel. Thus, a tax shifts the supply curve up by the amount of the tax.

[Leave] [Close]