CHAPTER REVIEW

FACTS AND TOOLS

Question 14.10

1. True or false? A business that price-discriminates will generally charge some customers more than marginal cost, and it will generally charge other customers less than marginal cost.

Question 14.11

2. Two customers, Fred and Lamont, walk into Grady’s Used Pickups. Who probably has a more inelastic demand for one of Grady’s pickups: people like Lamont, who are good at shopping around, or people like Fred, who know what they like and just buy it?

Question 14.12

3. Who probably has more elastic demand for a Hertz rental car: someone who reserves a car online weeks before a trip, or someone who walks up to a Hertz counter after he walks off an airplane following a 4-hour flight? Who probably gets charged more?

Question 14.13

4. When arbitrage is easy in a market of would-be price discriminators, who is more likely to get priced out of the market: those with elastic demand or those with inelastic demand?

Question 14.14

5. There are people who absolutely must have the latest fashions. Can you classify them as probably having elastic or inelastic demand?

Question 14.15

6. Why would a firm hand out coupons for its products rather than just lowering the price? (Hint: At your school, what kind of students use coupons to buy their pizza? What kind of students never use coupons to buy their pizza?)

Question 14.16

7. Where will you see more price discrimination: in monopoly-type markets with just a few firms or in competitive markets with many firms? Why?

Question 14.17

8. When will a monopoly create more output: when it is allowed to and can perfectly price-discriminate or when the government bans price discrimination?

Question 14.18

9. Some razors, like Gillette’s Fusion and Venus razors, have disposable heads. The razor comes with an initial pack with a razor handle plus three or four heads; after that, you need to buy refills separately.

Where do you think Gillette gets more revenue: by selling the initial pack or by selling the refills?

The next time you buy a new razor, are you going to spend more time looking at the price of the razor or at the price of the refills?

THINKING AND PROBLEM SOLVING

Question 14.19

1. Subway, the fast-food chain, sells foot-long sandwiches for $5 each. However, Subway still sells 6-inch sandwiches for considerably more than $2.50 each, that is, at a higher price per inch of sub.

Can you think of a way that in theory you could make money from Subway’s pricing practices? Would this method work in practice? What does this tell you about the limits of arbitrage?

In many of our price discrimination examples, we think that businesses try to break customers into two groups: more price-sensitive and less price-sensitive. What kinds of Subway customers fit into the first group? Into the second?

Busy lawyers with 20-minute lunches

College students

Health-conscious soccer moms

Long-haul truck drivers

Question 14.20

2. A dry cleaner has a sign in its window: “Free Internet Coupons.” The dry cleaner lists its Web site, and indeed there are good discounts available with the coupons. Most customers don’t use the coupons.

What probably would be the main difference between customers who use the coupons and those who don’t?

Some people might think “The dry cleaner offers the coupons to get people in the door to try the place out, but then the customers will pay the normal high price afterward.” But the coupons are always there, so even repeat customers can keep using the coupons. Is this a mistake on the business owner’s part? (Hint: Think about marginal cost.)

Question 14.21

3.

When will a firm find it easier to price-discriminate: before the existence of eBay or afterward?

Which of the two “principles of price discrimination” does this invoke?

Question 14.22

4. As we saw in this chapter, drug companies often charge much more for the same drug in the United States than in other countries. Congress often considers passing laws to make it easier to import drugs from these low-price countries (it also considers passing laws to make it illegal to import these drugs, but that’s another story).

If one of these laws passes, and it becomes effortless to buy AIDS drugs from Africa or antibiotics from Latin America—drugs that are made by the same companies and have essentially the same quality controls as the drugs here in the United States—how will drug companies change the prices they charge in Latin America and Africa? Why?

Question 14.23

5. Some people think that businesses create monopolies by destroying their competition, and there is certainly some truth to that. But as we learned from Obi-Wan Kenobi, “[Y]ou will find that many of the truths we cling to depend greatly on our own point of view.” For instance, some people (Convenience Shoppers) love shopping at one particular store and will switch stores only when a product is outrageously expensive, while other people (Bargain Shoppers) will gladly spend hours looking through newspaper advertisements searching for the best deal.

When both kinds of people, the Convenience Shoppers and the Bargain Shoppers, are shopping at the same Walmart, who is more likely to stick to their prearranged shopping list, and who is more likely to splurge on a little something?

Which group does Walmart have monopoly power over? Which group does Walmart have no monopoly power over?

Does this mean that the same shop can simultaneously be a “monopolist” to some customers and a “competitive firm” to other customers? Why or why not?

Does this mean that Darth Vader really did kill Anakin Skywalker?

Question 14.24

6. Where are you more likely to see businesses “bundling” a lot of goods into one package: in industries with high fixed costs and low marginal costs (like computer games or moviemaking), or in industries with low fixed costs and high marginal costs (like doctor visits, where the doctor’s time is expensive)?

Question 14.25

7. Isn’t it surprising that movies, with tickets that cost around $10, often use vastly more economic resources than stage plays where tickets can easily cost $100?

Compare, for example, a live stage performance of Shakespeare’s Hamlet with a movie of Hamlet.

In which field is the marginal cost of one more showing lower: on stage or on screen?

“Bundling” in a movie or stage performance might show up in the form of adding special effects, expensive actors, or fancy costumes: Some customers might not be too interested in an Elizabethan revenge drama, but they show up to see Liam Neeson waving an authentic medieval dagger. Is it better to think of these extra expenses as “fixed costs” or “marginal costs”?

In which setting will it be easier for a business to cover its total costs: in a “bundled” stage production or in a “bundled” movie production?

Question 14.26

8. When is a pharmaceutical company more likely to spend $100 million to research a new drug: when it knows it will be able to charge different prices in different countries or when it knows that it will be required to charge the same price in different countries? Why?

Question 14.27

9. True or false? A price-discriminating business will sometimes be willing to spend money to make a product worse.

Question 14.28

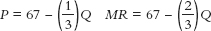

10. Let’s calculate the profit from price discrimination. The average daily demand for dinners at Paradise Grille, an upscale casual restaurant, is as follows:

Demand for dinners by senior citizens:

P = 50 – 0.5Q MR = 50 – Q

Demand for dinners by others:

P = 100 – Q MR = 100 – 2Q

Marginal cost = 10 in both cases

What is the profit-maximizing price for each group?

Translate this into real-world jargon: If you owned this restaurant, what “senior citizen discount” would you offer, in percent?

Ignoring fixed costs, how much profit would Paradise Grille make if it did this?

If it became illegal to discriminate on the basis of age, you would face only one demand curve. Adding up these two demand curves turns out to yield

What are the optimal price and quantity in this unified market? Are the total meals sold in this discrimination-free market higher or lower than in part a?

What is the profit in this discrimination-free market?

Question 14.29

11. At the Kennedy Center for the Performing Arts in Washington, D.C., if you make a $120 donation per year, you are allowed to go to a small room before the concert and drink free coffee and eat free cookies. If you make a donation of $1,200 per year, you are allowed to go to a different small room before the concert and drink the same free coffee and eat the same free cookies. There are always a lot of people in both rooms before the concert: Why doesn’t everybody just pay the $120 instead of the higher price?

CHALLENGES

Question 14.30

1. In the following table, we consider how Alex, Tyler, and Monique would fare under à la carte pricing and under bundling for cable TV when there are two channels: Lifetime and the Food Network.

Alex and Tyler like to watch Project Runway so they each place a higher value on Lifetime than on the Food Network. Monique is practicing to be an Iron Chef in her second life so she places a higher value on the Food Network than on Lifetime.

Maximum Willingness to Pay for Cable TV

|

|

Alex |

Tyler |

Monique |

|---|---|---|---|

|

Lifetime |

10 |

15 |

3 |

|

The Food Network |

7 |

4 |

9 |

|

The Bundle |

15 |

19 |

12 |

If the channels are priced individually, the most profitable prices for the cable operator turn out to be 10 for Lifetime and 7 for the Food Network. At these prices, who buys what channel and how much profit is there?

Let’s just check to see if these prices really are profit-maximizing. What would profit be if the cable company raised Lifetime to a price of 11 and Food Network to a price of 8?

At the profit-maximizing prices, how much total consumer surplus would there be for the three of them? (Recall that consumer surplus is just each customer’s willingness to pay minus the amount each person actually paid.)

Now consider what happens under bundling: Customers get a take-it-or-leave-it offer of both channels or nothing at all. The profit-maximizing bundle price turns out to be 12, and at that price, Alex, Tyler, and Monique all subscribe. How much consumer surplus is there at this price? How much profit? And, most important, what would profit equal if the cable company raised the price to 13 instead?

Question 14.31

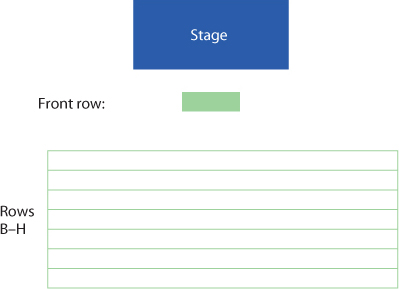

2. Consider the following seating arrangement for a concert hall:

The front row seats only two people. Rows B–H, about 50 feet back from the front row, seat 20 people per row.

Would these front-row seats sell for more or for less than the front-row seats at a typical concert hall? Why?

Why don’t we see concert halls set up like this?

Question 14.32

3.

In competitive markets in the long run, if there are two kinds of steaks, “regular” and “high-quality Angus beef,” and the regular beef sells at a lower price, is this an example of price discrimination?

How is this different from the HP printer story in this chapter?

Question 14.33

4. Amanda and Yvonne are thinking of going out to the movies. Amanda likes action flicks more, but Yvonne likes a little bit of romance. Warner Bros. is trying to decide what kind of movies to make this year. Should it make one movie for release this summer, an action flick with a romantic subplot, or should it make two movies for release this summer: an action flick and a romantic drama?

Here’s the two friends’ willingness to pay for the separate kinds of movies. As you can see, both Amanda and Yvonne are annoyed by the idea of a hybrid movie: Each would rather see her favorite kind of movie.

Maximum Willingness to Pay for a Movie Ticket

|

|

Amanda |

Yvonne |

|---|---|---|

|

Pure action |

$10 |

$2 |

|

Pure romance |

$2 |

$10 |

|

Action + romance |

$9 |

$9 |

Now, let’s look at this from Warner Bros.’ point of view. You’re the midlevel executive who has to decide which project to green light. Your marketing people have figured out that there are 5 million people like Amanda and 5 million people like Yvonne in the United States, and they’ll only see one film per summer. To make things simple, assume that the marginal cost of showing the movie one more time is zero, and that ticket prices are fixed at $8.

If the cost of producing any of the three films is $30 million, what should the studio do: make the two films or just the one hybrid film? Of course, the right way to find the answer is to figure out which choice would generate the most profit for Warner Bros.

Of course, the hybrid might cost a bit more to make. What if the hybrid costs $40 million to make, the pure action flick $30 million, and the romance a mere $15 million? What’s the best choice now: one hybrid or two pure films?

Let’s see how much prices would have to change for the answer to this question to change. Holding all else equal, how low would the cost of the pure romance film have to fall before the two-movie deal would get the green light?

(Hard) There’s an underlying principle here: The “unbundled” two-movie deal won’t get the green light unless its total cost is less than what? The answer is not a number—it’s an idea. Is this likely to happen in the real world? Why or why not?

Question 14.34

5. Think about the kind of 40-year-old who pulls out a faded, obviously expired student ID to get a discount ticket at a movie theater: What can you predict about his or her willingness to pay for a full-price movie? Is the movie theater making a mistake when it lets him or her pay the student price?

Question 14.35

6. We mentioned that airlines charge much more for flights booked at the last minute than for flights booked well in advance, even for exactly the same flight. This is because people who tend to book at the last minute tend to have inelastic demand. Think of other characteristics that airlines use to vary their pricing: Do you think these characteristics are correlated with business travel or any other sort of inelastic demand? (If you don’t fly too often, just ask someone who does: “What’s the key to getting the lowest possible airfare?”)

WORK IT OUT

If Congress passed a privacy law making it illegal for colleges to ask for parents’ tax returns, would that tend to help students from high-income families or students from low-income families?