CHAPTER REVIEW

FACTS AND TOOLS

Question 24.3

1. Determine whether the following situations represent problems caused by asymmetric information. If so, determine whether they represent problems of moral hazard or adverse selection.

Unrest in the Middle East causes oil speculators to buy up oil futures, driving gasoline prices higher.

Page 460Karol is halfway to work before he realizes that he forgot to lock the back door. Because he has renter’s insurance, he decides it is not worth being late just to go home to lock the door.

Joanne applies for a job as a part-time manager at a fast-food restaurant. Her MBA makes her overqualified for the job, yet the position goes to someone else who doesn’t have a college degree.

Frances lives in an apartment above a restaurant, and her apartment always smells like burgers and fries. She has tried unsuccessfully to get the restaurant owner to remedy the problem.

The potential costs of long-term care (such as a nursing home stay) can be very high and also very uncertain. Despite this, the private market for long-term care in the United States has remained fairly small.

Question 24.4

2. Describe how the following facts represent solutions to problems of asymmetric information.

Auto insurance rates are higher for teenagers than for nonteenagers.

Your car insurance coverage probably includes a deductible—an amount that you have to pay out-of-pocket before your insurance coverage kicks in.

Many states have laws like Virginia’s that give customers the right to keep or inspect parts that are removed by an auto mechanic.

For many couples, weddings are lavish affairs that cost tens of thousands of dollars and are attended by hundreds of guests.

Question 24.5

3. George Akerlof ‘s model of the used car market results in a market where only lemons are sold and there is no market for high-quality used cars. But, in fact, we observe that the used car market is a robust market where millions of used cars of varying quality are sold. Does that mean Akerlof ‘s model is wrong? Why or why not?

Question 24.6

4. In September of 2008, the Federal Reserve announced a “bailout” for AIG, which had gone bankrupt after having its credit rating downgraded in the wake of the financial crisis of 2007–2008. Can you think of an argument against such a bailout that is related to the material in this chapter? Where’s the information asymmetry?

Question 24.7

5. Explain the difference between moral hazard and adverse selection. In general, which problem is more likely to arise prior to making a transaction, and which problem is more likely to arise after the transaction has been made?

THINKING AND PROBLEM SOLVING

Question 24.8

1. Consider the market for medical insurance. What information might buyers in this market have that insurance companies don’t have? Here’s a harder question: What information might sellers of medical insurance have that buyers don’t have?

Question 24.9

2. Health economists use the phrase “supplier-induced demand” to describe the ability that physicians have to influence their patients’ demand for medical care. One of the reasons that this ability exists is asymmetric information.

What do physicians know more about than patients?

If physicians can influence their patients’ demand, then what would prevent them from always providing diagnoses of severe conditions that require expensive (profitable) treatments?

Health economists point out that third-party payment schemes (such as medical insurance that pays your medical bills for you) also contribute to supplier-induced demand. How would third-party payment exacerbate the problems of asymmetric information?

Question 24.10

3. Evan Soltas is a popular economics blogger (http://esoltas.blogspot.com/) who began capturing the attention of top economics thinkers while still in high school. His understanding of economics and economics issues would have been impressive even for a professional economist with years of training. After graduating from high school, he went off to Princeton to major in economics. Since Evan doesn’t have much to learn about economics—at least not much at the undergraduate level—this decision might seem confusing to some people, but you’re a gifted economist now too. Explain Evan’s decision.

Question 24.11

4. Suppose your band is about to take off, so you go out and buy a brand new Marshall Tube Head and Cabinet amplifier for the list price of about $4,200. Your band immediately breaks up after you’ve used it only once. You hang on to it for a year or so in case your drummer and bass player can work out their differences, but it never happens. You finally decide to sell it on Craigslist. Since you know it’s been used only once, and it’s been properly stored for a year, you reason that it’s still worth close to what you paid for it, so you list it for $3,800—almost 10% off of the new price. How is this going to turn out?

Question 24.12

5. Kaplan Test Prep offers courses and private tutoring arrangements that prepare students for standardized tests, such as the GRE, GMAT, or LSAT (tests that you may take soon). Kaplan offers students a “Higher Score Guarantee,” which essentially promises that your score when you take the test after completing a Kaplan course will be higher than your prior test score (or your “diagnostic” score if it’s your first time taking the test). If it’s not, you can take the course again or get your money back.

Discuss how this guarantee functions as insurance.

Discuss how this guarantee functions as a signal.

Question 24.13

6. Consider the following unusual insurance products. For each one, determine whether you think this insurance product could exist in the marketplace, or whether it would be subject to moral hazard or adverse selection (or both).

GPA insurance for people with 4.0 GPAs after two years of college that pays out if you ever have a semester with a GPA lower than 3.50.

GPA insurance for anyone that pays out if you ever have a semester with a GPA lower than 3.50.

Loneliness insurance that pays out if you reach a certain age and still have not married.

Toe-stubbing insurance that pays out any time you stub your toe.

Insurance that pays out if and only if you get hit and killed by a school bus.

Question 24.14

7. When the cause of death is suicide, life insurance policies typically pay out only when the suicide occurred after an exclusionary period has passed, usually around a year after purchasing the life insurance. Why do life insurance companies insist on an exclusionary period? If you compared suicide rates in the year before and the year after the exclusionary period, what do you predict you would find?

Question 24.15

8. You are driving on a trip and have two choices on the highway to stop for a snack: a well-known chain or a local that you have never heard of but that looks okay. What lessons from this chapter might lead you to choose the chain even if you think that their food is just average? Might you choose differently if you had access to the Internet? Might you choose differently if these two choices were in your neighborhood?

CHALLENGES

Question 24.16

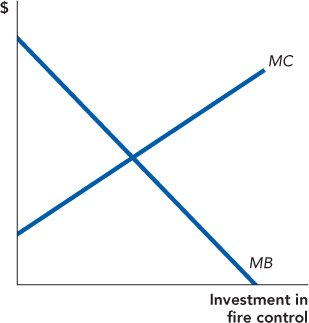

1. Consider a restaurant that wants to avoid kitchen fires. The restaurant could make many investments both to avoid the fires in the first place and to quickly and safely put them out if they do occur. Suppose that the marginal cost (MC) and marginal benefit (MB) of these investments in fire control technologies is illustrated in the following figure.

If no fire insurance is available, how much investment in fire control would the restaurant purchase?

If full insurance is available, how much investment in fire control would the restaurant purchase?

The moral hazard incentivized by full insurance creates a deadweight loss. Show the deadweight loss in the diagram.

Suppose that the insurance policy would only cover 50% of the losses from fire; that is, the restaurant has a 50% copay. How much fire control would the restaurant purchase?

Suppose that the insurance policy would cover only 50% of the losses but the insurance company also offered a discount on insurance to restaurants that installed water sprinklers or other fire suppression technologies. How would the curves shift? What quantity of fire investment would be purchased? Comment on the role of copays and discounts.

Question 24.17

2. “Black box” insurance is a new type of auto insurance that requires that the buyer install a black box in their car that monitors speed, distance traveled, acceleration, time of day, and other factors. Discuss the effects of this type of insurance on different drivers and their behavior. The terms “adverse selection,” “moral hazard,” and “signaling” should all be relevant.

Question 24.18

3. Home cleaning services and general contractors often advertise that they are bonded. What this means is that the seller of the service has put up money with a third party that is available to the buyer if, for example, the cleaners damage or steal property or if the general contractor fails to complete the project or completes it in a substandard way. Using the concepts of moral hazard and signaling, explain the purpose of bonding. As a bonus, why is bonding used for these services in particular?

Question 24.19

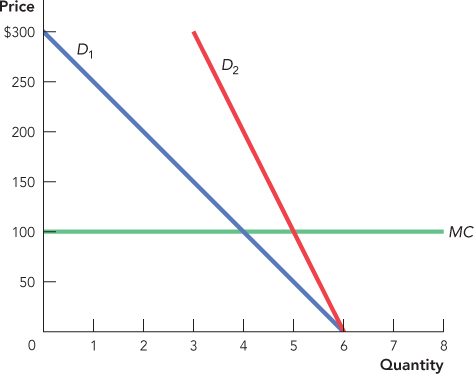

4. The following demand and supply diagram represents the market for routine outpatient appointments with a primary care physician. D1 shows the annual demand for a typical patient when he or she has no insurance and must pay the entire price of the appointment out-of-pocket. D2 shows how the typical patient responds to the price when he or she has to pay only 50% out-of-pocket, with the rest covered by medical insurance.

Can you explain the shape/position of demand curve D2?

Suppose the marginal cost of an appointment is $100 and the market is perfectly competitive. Answer all of the following questions twice: once considering a market without medical insurance and once considering a market with medical insurance.

How many physician appointments will the typical patient have each year without and with insurance?

How much will the patient pay for physician appointments each year? How much will be paid by the insurance company?

What is the total annual value to the patient of the appointments?

Comparing your answers to parts c and d, what is the amount of net total surplus generated by the market for these physician appointments?

How does this relate to the chapter?

Question 24.20

5. Human-made diamonds, which are just as beautiful and essentially indistinguishable from mined diamonds, are becoming much cheaper to produce. Diamond engagement rings, therefore, could soon become much less expensive. Great news for people who plan to get married, right? Or wrong? Explain.

WORK IT OUT

A private equity firm is considering whether to take over another firm, called the “target.” The target has several projects in the pipeline so no one is certain exactly what the target is worth but estimates are that it is worth anywhere between 0 and 100, with each value equally likely. Although the value of the target is uncertain, the private equity firm knows that the target is currently ill managed and that in their hands they could increase the target’s value by 50%, that is, multiply the target’s value by a factor of 3/2. If the firm is currently worth 60, for example, it would be worth 60 × (3/2) = 90 after new management is installed.

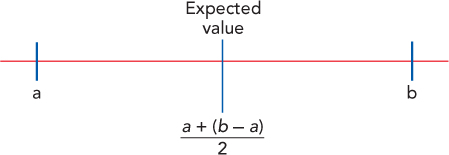

Find a mutually profitable price for the acquisition, that is, a price such that, on average or in expectation, the owners of both the target and the private equity firm expect to profit. (Hint: It helps to know that, when any outcome between a and b is equally likely, the expected or average outcome is a + (b − a)/2, as illustrated in the diagram. (FYI, if you have taken statistics, this is a property of the uniform distribution.)

Now assume that the current owners of the target know whether the projects in the pipeline are going well or not and so they know the current value of the firm. Only the outsider buyer, the private equity firm, is uncertain about the value of the target, which they continue to estimate is worth between 0 and 100, with each value equally likely. Until the target is bought, information about its true value cannot be credibly communicated to the potential buyer. Naturally, the current owners will sell only if the private equity firm offers them at least as much or more than the current value.

Notice that we have transformed a problem of uncertain but symmetric information into a problem of asymmetric information.

Consider the mutually profitable price that you arrived at in part a. Is the price still mutually profitable? Why or why not? If not, find a new mutually profitable price for the acquisition (if you can). Remember that it is still the case that the firm will be worth 50% more if it is acquired by the buyer.

Comment on asymmetric information and trade.