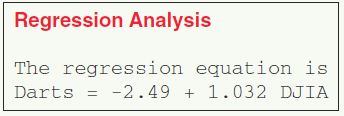

Chapter 3 Case Study (Continued). Use the following information for Exercises 65–68. Shown here is the regression equation for the linear relationship between the randomly selected Darts portfolio and the Dow Jones Industrial Average (DJIA), from the Chapter 3 Case Study. (Note: This is for the entire data set, not the small sample taken in the Exercise 39 data set.)

Question 4.163

65. In this exercise, we examine the intercept.

- Which variable is the variable and which is the variable? Work by analogy with the previous exercises.

- What is the value of the intercept?

- Interpret the meaning of this value for the intercept. Does it make sense?

- Would the estimate in (c) be considered extrapolation? Why or why not?

4.2.65

(a) Darts is the y variable and DJIA is the variable. (b) −2.49 (c) When the Dow Jones Industrial Average changes 0%, the portfolios chosen by the Darts decreases by 2.49%. Since the Dow Jones Industrial Average is based on a different set of stocks than the stock portfolio selected by the Darts, this situation makes sense. (d) The estimate in (c) would not be considered extrapolation since a value of lies within the range of the x-values of the data set.