PROBLEMS

Question 13.1

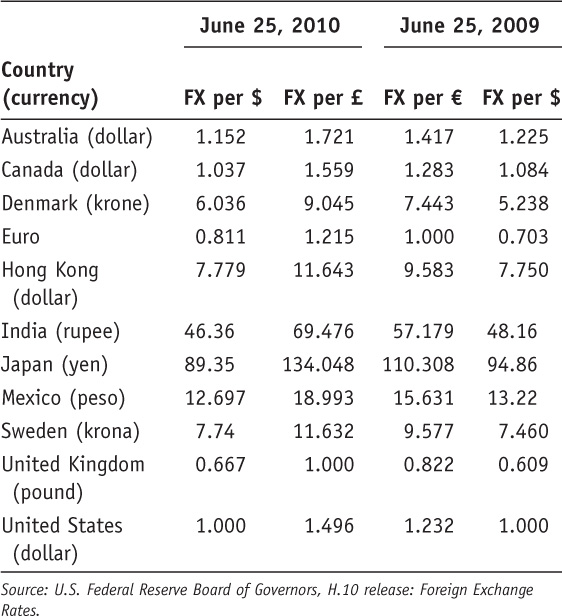

1. Refer to the exchange rates given in the following table:

Based on the table provided, answer the following questions:

- Compute the U.S. dollar–yen exchange rate E$/¥ and the U.S. dollar–Canadian dollar exchange rate E$/C$ on June 25, 2010, and June 25, 2009.

- What happened to the value of the U.S. dollar relative to the Japanese yen and Canadian dollar between June 25, 2009, and June 25, 2010? Compute the percentage change in the value of the U.S. dollar relative to each currency using the U.S. dollar-foreign currency exchange rates you computed in (a).

- Using the information in the table for June 25, 2010, compute the Danish krone–Canadian dollar exchange rate Ekrone/C$.

- Visit the website of the Board of Governors of the Federal Reserve System at http://www.federalreserve.gov/. Click on “Economic Research and Data” and then “Statistics: Releases and Historical Data.” Download the H.10 release Foreign Exchange Rates (weekly data available). What has happened to the value of the U.S. dollar relative to the Canadian dollar, Japanese yen, and Danish krone since June 25, 2010?

- Using the information from (d), what has happened to the value of the U.S. dollar relative to the British pound and the euro? Note: The H.10 release quotes these exchange rates as U.S. dollars per unit of foreign currency in line with long-standing market conventions.

60

Question 13.2

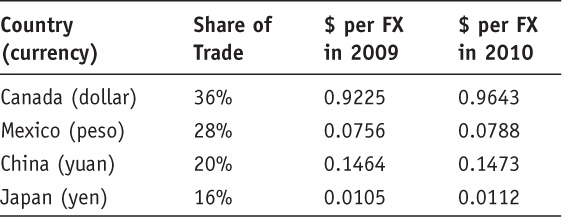

2. Consider the United States and the countries it trades with the most (measured in trade volume): Canada, Mexico, China, and Japan. For simplicity, assume these are the only four countries with which the United States trades. Trade shares and exchange rates for these four countries are as follows:

- Compute the percentage change from 2009 to 2010 in the four U.S. bilateral exchange rates (defined as U.S. dollars per unit of foreign exchange, or FX) in the table provided.

- Use the trade shares as weights to compute the percentage change in the nominal effective exchange rate for the United States between 2009 and 2010 (in U.S. dollars per foreign currency basket).

- Based on your answer to (b), what happened to the value of the U.S. dollar against this basket between 2009 and 2010? How does this compare with the change in the value of the U.S. dollar relative to the Mexican peso? Explain your answer.

Question 13.3

3. Go to the website for Federal Reserve Economic Data (FRED): http://research.stlouisfed.org/fred2/.

Locate the monthly exchange rate data for the following:

- Canada (dollar), 1980–2012

- China (yuan), 1999–2004, 2005–2009, and 2009–2010

- Mexico (peso), 1993–1995 and 1995–2012

- Thailand (baht), 1986–1997 and 1997–2012

- Venezuela (bolivar), 2003–2012

Look at the graphs and make your own judgment as to whether each currency was fixed (peg or band), crawling (peg or band), or floating relative to the U.S. dollar during each time frame given.

Question 13.4

4. Describe the different ways in which the government may intervene in the forex market. Why does the government have the ability to intervene in this way, while private actors do not?

Question 13.5

5. Suppose quotes for the dollar–euro exchange rate E$/€ are as follows: in New York $1.50 per euro, and in Tokyo $1.55 per euro. Describe how investors use arbitrage to take advantage of the difference in exchange rates. Explain how this process will affect the dollar price of the euro in New York and Tokyo.

Question 13.6

6. Consider a Dutch investor with 1,000 euros to place in a bank deposit in either the Netherlands or Great Britain. The (one-year) interest rate on bank deposits is 2% in Britain and 4.04% in the Netherlands. The (one-year) forward euro–pound exchange rate is 1.575 euros per pound and the spot rate is 1.5 euros per pound. Answer the following questions, using the exact equations for UIP and CIP as necessary.

- What is the euro-denominated return on Dutch deposits for this investor?

- What is the (riskless) euro-denominated return on British deposits for this investor using forward cover?

- Is there an arbitrage opportunity here? Explain why or why not. Is this an equilibrium in the forward exchange rate market?

- If the spot rate is 1.5 euros per pound, and interest rates are as stated previously, what is the equilibrium forward rate, according to covered interest parity (CIP)?

- Suppose the forward rate takes the value given by your answer to (d). Compute the forward premium on the British pound for the Dutch investor (where exchange rates are in euros per pound). Is it positive or negative? Why do investors require this premium/discount in equilibrium?

- If uncovered interest parity (UIP) holds, what is the expected depreciation of the euro (against the pound) over one year?

- Based on your answer to (f), what is the expected euro–pound exchange rate one year ahead?

61

Question 13.7

7. You are a financial adviser to a U.S. corporation that expects to receive a payment of 40 million Japanese yen in 180 days for goods exported to Japan. The current spot rate is 100 yen per U.S. dollar (E$/¥ = 0.01000). You are concerned that the U.S. dollar is going to appreciate against the yen over the next six months.

- Assuming the exchange rate remains unchanged, how much does your firm expect to receive in U.S. dollars?

- How much would your firm receive (in U.S. dollars) if the dollar appreciated to 110 yen per U.S. dollar (E$/¥ = 0.00909)?

- Describe how you could use an options contract to hedge against the risk of losses associated with the potential appreciation in the U.S. dollar.

Question 13.8

8. Consider how transactions costs affect foreign currency exchange. Rank each of the following foreign exchanges according to their probable spread (between the “buy at” and “sell for” bilateral exchange rates) and justify your ranking.

- An American returning from a trip to Turkey wants to exchange his Turkish lira for U.S. dollars at the airport.

- Citigroup and HSBC, both large commercial banks located in the United States and United Kingdom, respectively, need to clear several large checks drawn on accounts held by each bank.

- Honda Motor Company needs to exchange yen for U.S. dollars to pay American workers at its Ohio manufacturing plant.

- A Canadian tourist in Germany pays for her hotel room using a credit card.