1 The Economics of the Euro

Currency unions have costs as well as benefits.

1. The Theory of Optimum Currency Areas

If countries decide it is in their self-interest by forming a currency union, it is an optimum currency area (OCA). When should a country join? The decision is similar to pegging or floating: it depends upon the benefits and costs.

a. Market Integration and Efficiency Benefits

A common currency is a fixed rate regime where E = 1. So we can invoke the benefits of fixed rates with which we are familiar: the greater the degree of integration between the home region (A) and the rest of the zone (B), the greater the benefits of the union.

b. Economic Symmetry and Stability Costs

Again, apply what we know about fixed rates: They are more desirable when countries face more symmetric macroeconomic shocks.

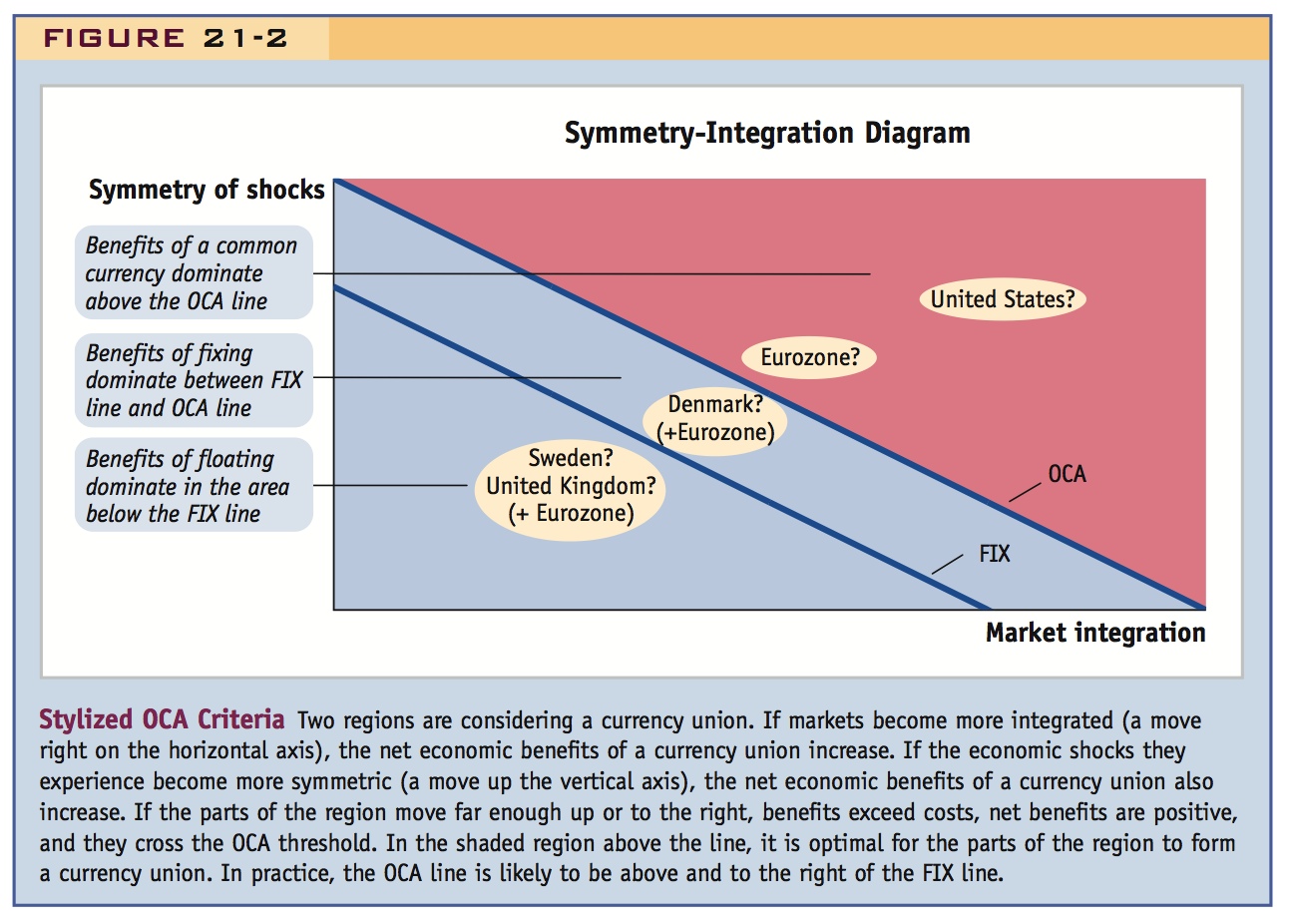

2. Simple Optimum Currency Area Criteria

Two rules of thumb: (1) As integration increases the benefits of the union increases. (2) As symmetry increases the costs of the union decrease. Draw the same symmetry-integration diagram: Above the OCA line the union makes sense; below the OCA it doesn’t.

3. What’s the Difference Between a Fix and a Currency Union?

Argue that the OCA line is above the FIX line. Why? Keeping a different currency preserves the option of exercising independent monetary policy in the future. If a country values that option, it will employ more stringent criteria in evaluating the union.

4. Other Optimum Currency Area Criteria

a. Labor Market Integration

The more mobile labor is between countries, the more easily the countries can adjust to asymmetric macro shocks. Therefore, the costs of the union will be lower the more integrated the labor markets are in the different countries: labor market integration shifts the OCA down.

b. Fiscal Transfers

Suppose there is a fiscal mechanism in place to transfer income from countries enjoying good shocks to countries suffering bad shocks. This would also reduce the effects of asymmetry, and lower the costs of the union: the OCA would shift down here too.

c.Monetary Policy and Nominal Anchoring

If the central bank of the union is more effective at fighting inflation than the home central bank, then losing control of monetary policy may be beneficial. The OCA shifts down. Examples include Italy, Greece, and Portugal.

d.Political Objectives

There may be political benefits from a union that also shift down the OCA. Example: entry of new states to the U.S. in the 19th century.

In the nineteenth century, economist John Stuart Mill thought it a “barbarism” that all countries insisted on “having, to their inconvenience and that of their neighbors, a peculiar currency of their own.” Barbaric or not, national currencies have always been the norm, while currency unions are rare.4 Economists presume that such outcomes reflect a deeper logic. A common currency may be more convenient and provide other benefits, but it also has some costs. For the “barbarism” of national currencies to persist, the costs must outweigh the benefits.

The Theory of Optimum Currency Areas

Begin by defining what an OCA is, then assert that--being economists--our criterion for judging an OCA is a comparison of benefits and costs.

How does a country decide whether to join a currency union? To answer this question, let’s see if one country, Home, should join a currency union with another country, Foreign. (Our analysis can be generalized to a case in which Foreign consists of multiple members of a larger currency union.)

If countries make a decision that best serves their self-interest—that is, an optimizing decision—when they form a currency union, then economists use the term optimum currency area (OCA) to refer to the resulting monetary union. How can such a decision be made?

To decide whether joining the currency union serves its economic interests, Home must evaluate whether the benefits outweigh the costs. This decision is similar to the decision to select a fixed or floating exchange rate, which we discussed in an earlier chapter. Two familiar ideas from that previous discussion can be applied and extended to the currency union decision.

Market Integration and Efficiency Benefits Adopting a common currency implies that the two regions will have an exchange rate fixed at 1. Hence, the same market integration criterion we used to discriminate between fixed and floating regimes can be applied to the case of an OCA:

Assure them that we are on familiar turf, since we can invoke the same criteria as in the choice between fixed and flexible rates . . .

If there is a greater degree of economic integration between the home region (A) and the other parts of the common currency zone (B), the volume of transactions between the two and the economic benefits of adopting a common currency due to lowered transaction costs and reduced uncertainty will both be larger.

Economic Symmetry and Stability Costs When two regions adopt a common currency, each region will lose its monetary autonomy, and the monetary authorities who have control of the common currency will decide on a common monetary policy and set a common interest rate for all members. Hence, the similarity criterion we used to discriminate between fixed and floating regimes can be applied to the case of an OCA:

If a home country and its potential currency union partners are more economically similar or “symmetric” (they face more symmetric shocks and fewer asymmetric shocks), then it is less costly for the home country to join the currency union.

405

Simple Optimum Currency Area Criteria

We are now in a position to set out a theory of an optimum currency area by considering the net benefits of adopting a common currency. The net benefits equal the benefits minus the costs. The two main lessons we have just encountered suggest the following:

- As market integration rises, the efficiency benefits of a common currency increase.

- As symmetry rises, the stability costs of a common currency decrease.

Summing up, the OCA theory says that if either market integration or symmetry increases, the net benefits of a common currency will rise. If the net benefits are negative, the home country would stay out based on its economic interests. If the net benefits turn positive, the home country would join based on its economic interests.

Figure 21-2 illustrates the OCA theory graphically, using the same symmetry-integration diagrams used in the previous chapter on fixed and floating exchange rates. The horizontal axis measures market integration for the Home-Foreign pair. The vertical axis measures the symmetry of the shocks experienced by the Home-Foreign pair. If the Home-Foreign pair moves up and to the right in the diagram, then the benefits increase, the costs fall, and so the net benefit of a currency union rises. At some point, the pair crosses a threshold, the OCA line, and enters a region in which it will be optimal for them to form a currency union based on their economic interests.

. . . which means we can draw this familiar picture . . .

The figure looks familiar. The derivation of the OCA line here is identical to the derivation of the FIX line in a previous chapter, which raises an important question.

As back with the FIX diagram, talk through examples of different, emphasizing that there are cases--like Denmark--where it is best to fix, but not join the currency union.

406

What’s the Difference Between a Fix and a Currency Union?

. . . except that the conditions for an OCA are probably more stringent.

If choosing to fix and choosing to form a currency union were identical decisions, then the FIX and OCA lines would be one and the same. In reality, we think they are likely to differ—and that the OCA line is likely to be above the FIX line, as drawn in Figure 21-2. Thus, when countries consider forming a currency union, the economic tests (based on symmetry and integration) set a higher bar than they set for judging whether it is optimal to fix.

Why might this be so? To give a concrete example, let’s consider the case of Denmark, which we studied in an earlier chapter on exchange rates, as an example of the trilemma in Europe. The Danes are in the ERM, so the krone is pegged to the euro. But Denmark has spent a long time in the ERM and shows no signs of taking the next step into the Eurozone. This preference has been democratically expressed—proposals to join the Eurozone have been defeated by referendum. The Danish position looks slightly odd at first glance. Denmark appears to have ceded monetary autonomy to the ECB because its interest rate tracks the euro interest rate closely. Yet the Danes do not gain the full benefits of a currency union because transactions between Denmark and the Eurozone still require a change of currency.

This is probably crucial.

Still, one can make a logical case for Denmark to keep its own currency. By doing so, it better preserves the option to exercise monetary autonomy at some future date, even if the option is not being used currently. For one thing, even under the ERM, although the krone is pegged very tightly to the euro within ±2% by choice, the Danes could employ the full ±15% band allowed by ERM and give themselves much more exchange rate flexibility. (A ±15% band isn’t a very hard peg—recall that the standard de facto threshold for a peg is no more than ±2% variation in one year.) And because they have only gone as far as pegging to—and not joining—the euro, the Danes are always free to leave the ERM at some future date (as Sweden and the United Kingdom have done) if they want the even greater flexibility of a more freely floating exchange rate.

On the other hand, joining the Eurozone is essentially irreversible.

Now, contrast the position of Denmark with that of Italy, one of several countries in which rumors of departure from the Eurozone have surfaced from time to time (Greece is another example). Compared with a Danish exit from the ERM, an Italian exit from the euro would be messy, complicated, and costly. The actual process of retiring euros and reprinting and reintroducing new lira as money would be difficult enough. More seriously, however, all Italian contracts would have to be switched from euro to lira, in particular the private and public debt contracts. There would be a monumental legal battle over the implicit defaults that would follow from the “lirification” of such euro contracts. Some countries have tried these kinds of strategies, but the examples are not too encouraging. In the 1980s Liberia de-dollarized (and descended into economic crisis) and in 2002 Argentina legislated the “pesification” of its dollar contracts (and descended into economic crisis).

Because the future cannot be known with certainty, countries may value the option to change their monetary and exchange rate regime in the future. Exit from a peg is easy—some might say too easy—and happens all the time. Exit from a common currency is much more difficult (the Eurozone has no exit procedure) and is expected to be costly. We conclude that because a country’s options are more limited after joining a common currency than after joining a peg, the country will set tougher conditions for the former; thus, the smaller OCA region must lie within the larger optimal fixing region (below and to the left), as shown in Figure 21-2.

407

Other Optimum Currency Area Criteria

These might be added to the degree of wage and price flexibility. In a neoclassical world, with rapid wage and price adjustment, the asymmetry of macro shocks wouldn't matter much.

Our simple model in Figure 21-2 illustrated two basic motives for joining a currency union, but there could be many other forces at work. These other considerations can still be examined using the same framework, which allows us to consider several additional arguments for joining a currency union.

As you discuss these other criteria, ask the students to be thinking about how the U.S. and Europe measure up.

Labor Market Integration In the analysis so far, the home and foreign countries trade goods and services, but labor is immobile between the two countries. But what if we suppose instead that Home and Foreign have an integrated labor market, so that labor is free to move between them: What effect will this have on the decision to form an optimum currency area?

Labor market integration allows for an alternative adjustment mechanism in the event of asymmetric shocks. For example, suppose Home and Foreign initially have equal output and unemployment. Suppose further that a negative shock hits Home, but not Foreign. If output falls and unemployment rises in Home, then labor will start to migrate to Foreign, where unemployment is lower. If this migration can occur with ease, the impact of the negative shock on Home will be less painful. Furthermore, there will be less need for Home to implement an independent monetary policy response for stabilization purposes. With an excess supply of labor in one region, adjustment can occur through migration.

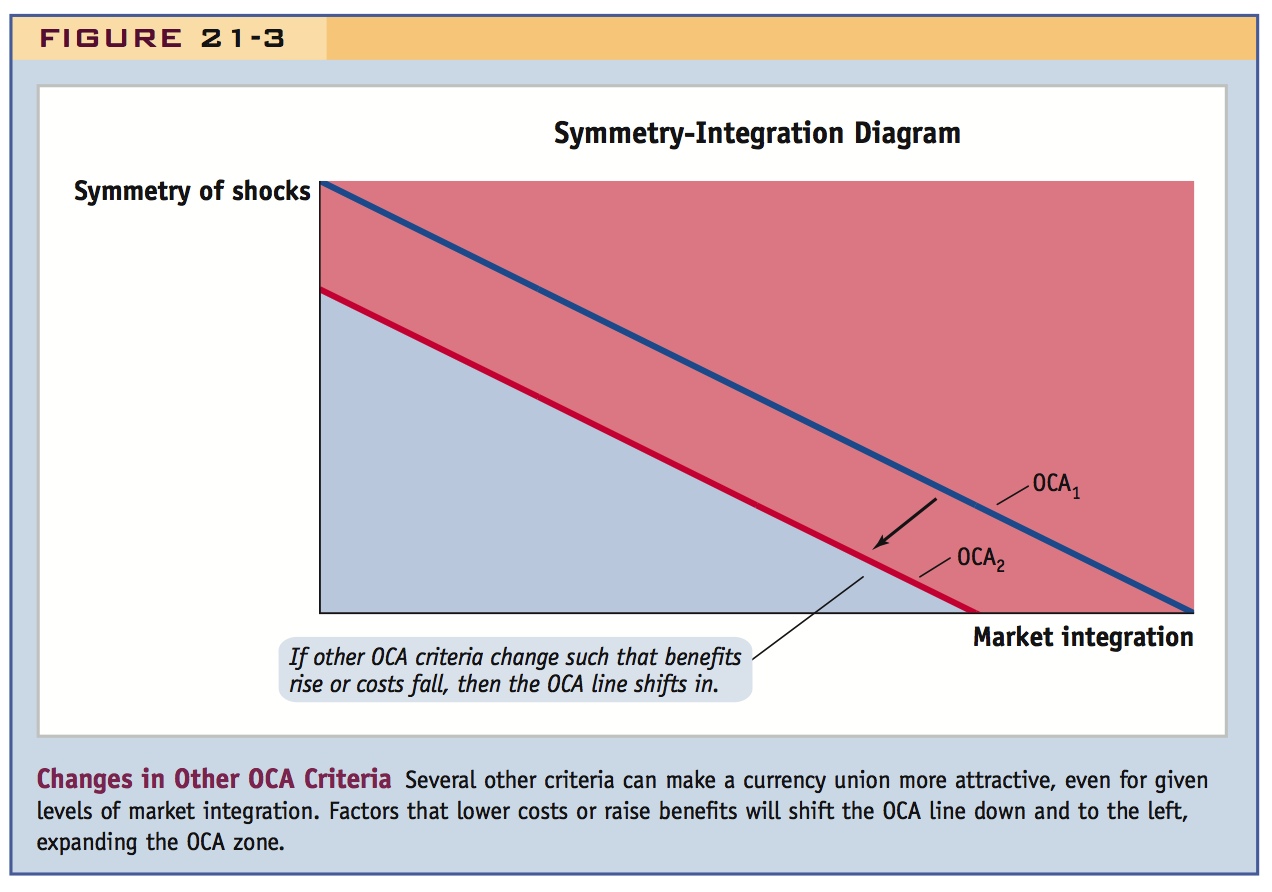

This reasoning suggests that the cost to Home of forming a currency union with Foreign, due to the loss of monetary policy autonomy, will be lower when the labor market integration between Home and Foreign is higher, because labor mobility provides an alternative mechanism through which Home can adjust to the shock. All else equal, the possibility of gains of this sort would lower the OCA threshold, as reflected in the shift down of the OCA line from OCA1 to OCA2 in Figure 21-3. This shift expands the shaded zone in which currency union is preferred: countries are more likely to want to form a currency union when their labor markets are more integrated.

Fiscal Transfers We have now examined two possible mechanisms through which countries in an OCA can cope with asymmetric shocks: monetary policy and labor markets, the key OCA trade-off emphasized by Robert Mundell. We have ignored fiscal policy. All else equal, one might argue that a country’s fiscal policy is autonomous and largely independent of whether a country is inside or outside a currency union. But there is one important exception: fiscal policy will not be independent when a currency union is built on top of a federal political structure with fiscal mechanisms that permit interstate transfers—a system known as fiscal federalism.

If a region also has fiscal federalism, then a third adjustment channel is available: when Home suffers a negative shock, the effects of the shock can be cushioned by fiscal transfers from Foreign, allowing more expansionary fiscal policy in Home than might otherwise be the case. For this argument to be compelling, however, the fiscal transfers must be large enough to make a difference. They must also help overcome some limit on the exercise of Home’s fiscal policy, that is, the transfers must finance policies that Home could not finance in some other way (e.g., by government borrowing).

If these conditions are satisfied, then the presence of fiscal transfers will lower the costs of joining a currency union. We show the possibility of gains of this sort in Figure 21-3, where, all else equal, enhanced fiscal transfers mean a lower OCA threshold and a shift down from OCA1 to OCA2. This shift expands the shaded zone in which currency union is preferred: the better the fiscal transfer mechanisms, the more the countries are likely to want to form a currency union, an alternative but important OCA criterion stressed by the international economist Peter Kenen.5

408

Monetary Policy and Nominal Anchoring One important aspect of Home joining a currency union is that Home’s central bank ceases to manage monetary policy (or ceases to exist altogether). Monetary policy is then carried out by a common central bank, whose policies and actions may be subject to different designs, objectives, and political oversight. This may or may not be a good thing, depending on whether the overall monetary policy performance of Home’s central bank is (or is expected to be) as good as that of the common central bank.

For example, suppose that Home suffers from chronic high inflation that results from an inflation bias of Home policy makers—the inability to resist the political pressure to use expansionary monetary policy for short-term gains. In the long run, on average, inflation bias leads to a higher level of expected inflation and actual inflation. But average levels of unemployment and output are unchanged because higher inflation is expected and inflation has no real effects in the long run.

Suppose that the common central bank of the currency union would be a more politically independent central bank that could resist political pressures to use expansionary monetary policy for short-term gains. It performs better by delivering low inflation on average, and no worse levels of unemployment or output. In this case, joining the currency union improves economic performance for Home by giving it a better nominal anchor: in this scenario, loss of monetary autonomy can be a good thing.

409

Discussion: These countries were borrowing the inflation-fighting credibility of the Bundesbank when they joined the ERM, but what made them different from, say, Denmark, in deciding to join the euro?

There is a possibility that this criterion was important for several Eurozone member states that historically have been subject to high inflation—for example, Italy, Greece, and Portugal. We can represent the possibility of monetary policy gains of this sort in Figure 21-3, where, all else equal, a worsening in the home nominal anchor (or an improvement in the currency union’s nominal anchor) shifts the OCA line down. For countries with a record of high and variable inflation, the OCA threshold will fall, so again the OCA line moves down from OCA1 to OCA2. This shift also expands the shaded zone in which currency union is preferred: given levels of market integration and symmetry, high-inflation countries are more likely to want to join the currency union and the larger are the monetary policy gains of this sort. (Later on we consider the concerns of the low-inflation countries in this scenario.)

Vitally important.

Political Objectives Finally, we turn to noneconomic gains and the possibility that countries will join a currency union even if it makes no pure economic sense for them to do so. For instance, one can imagine that Home’s “political welfare” may go up, even if pure economic welfare goes down. How?

Suppose a state or group of states is in a situation in which forming a currency union has value for political, security, strategic, or other reasons. For example, when the United States expanded westward in the nineteenth century, it was accepted, without question, that new territories and states would adopt the U.S. dollar. In recent times, eastward expansion of the EU comes with an assumption that, in the end, accession to the union will culminate in monetary union. These beliefs, assumptions, and accords did not rest very much, if at all, on any of the OCA criteria we have discussed so far. Instead, they were an act of political faith, of a belief in the states’ common political future, a statement about destiny.

Political benefits can also be represented in Figure 21-3 by the OCA line shifting down from OCA1 to OCA2. In this scenario, for countries between OCA1 and OCA2, there are economic costs to forming a currency union, but these are outweighed by the political benefits. The political dimension has played a significant part in EU and Eurozone history, a topic we discuss later in the chapter.

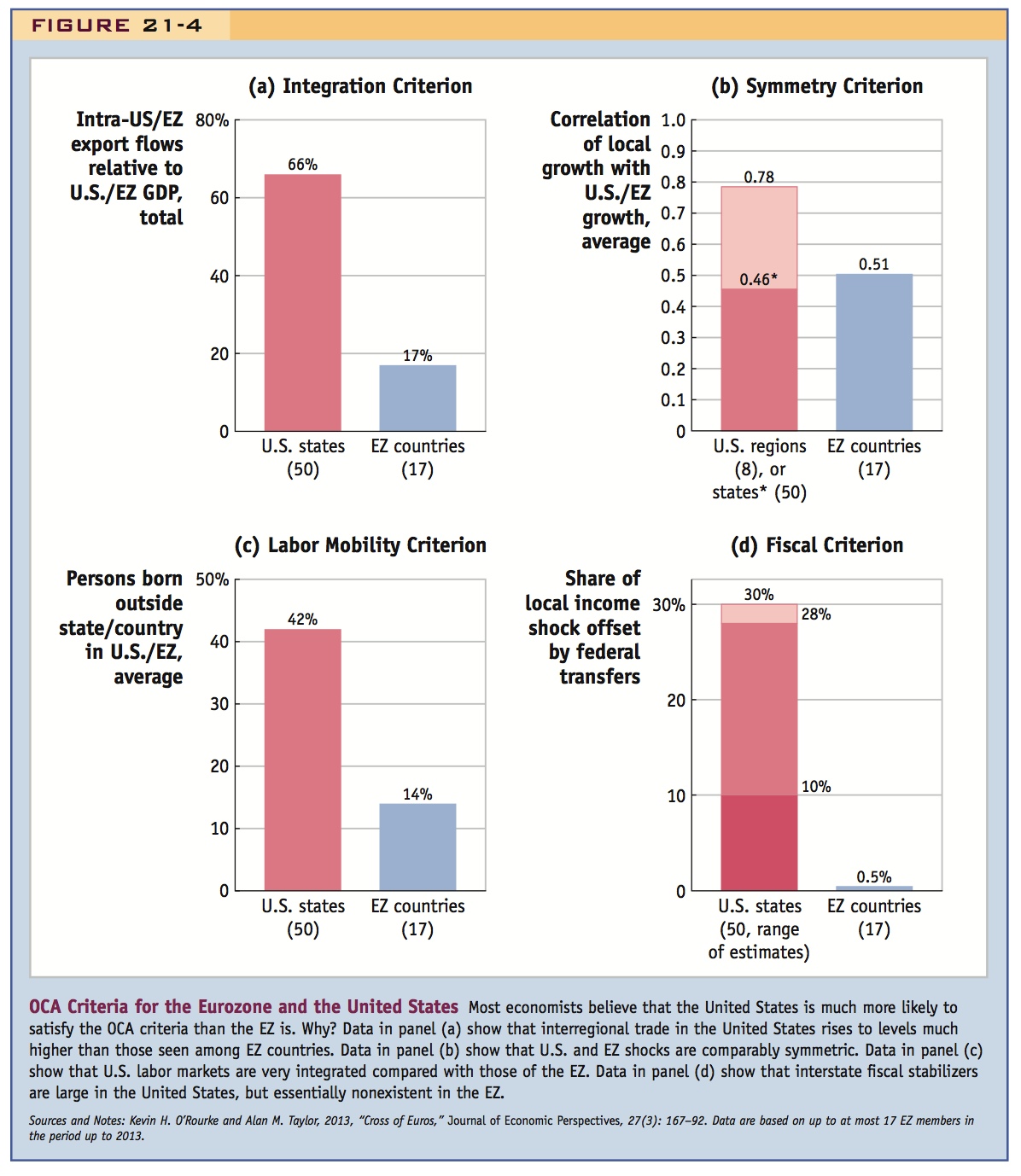

Comparing the U.S. and Eurozone as OCAs. U.S. states are more integrated than EU countries, although the EU is becoming more integrated. Shocks in the U.S. and EU exhibit a similar degree of symmetry. But this could change if EU countries start to specialize more. Labor is much less mobile in Europe than in the U.S.; furthermore European labor markets are much less flexible than in the U.S. In the U.S., the Federal government makes transfers to states in downturns; in Europe there is no transfer mechanism. Overall, Europe is further from being an OCA than the U.S. Most economists think Europe is not an OCA.

5. Are the OCA Criteria Self-Fulfilling?

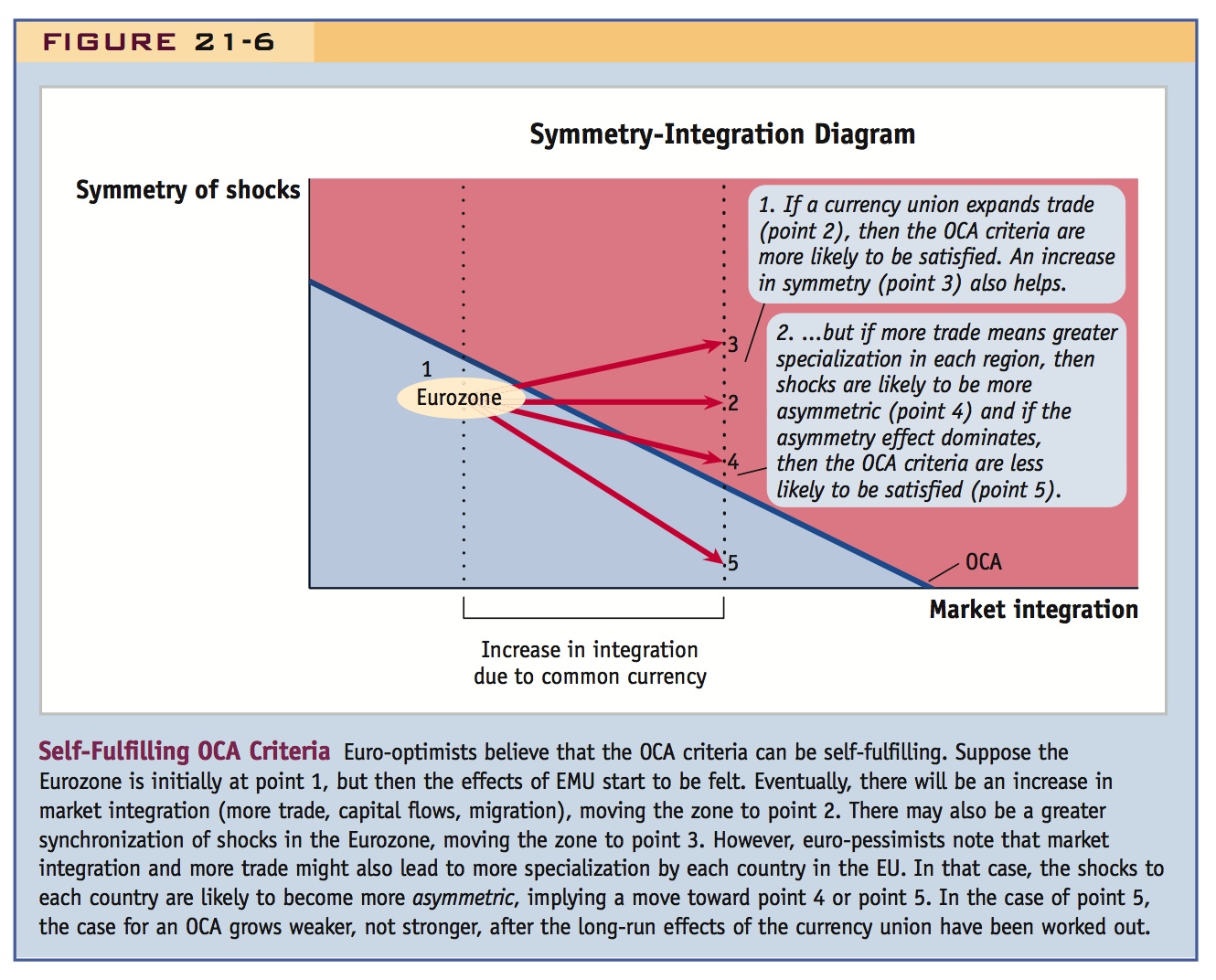

Perhaps the OCA criteria are not exogenous, but can evolve endogenously in response to the existence of the union itself. Example: joining a union may encourage integration. This is an argument used by “euro-optimists”: Maybe the Eurozone is not an OCA now, but it might be someday. But endogeneity can have the opposite effect: Maybe greater integration will encourage specialization that will make shocks more asymmetric.

Optimum Currency Areas: Europe Versus the United States

At first glance, the theory of optimum currency areas helpfully sets out the important criteria by which we can judge whether it is in a country’s interest to join a currency union. But while the OCA criteria work well in theory, in reality, the costs and benefits of a currency union cannot be measured with any great accuracy.

Recognizing this, we can try an alternative approach and use comparative analysis to shed some light on the issue by answering a slightly different question: How does Europe compare with the United States on each of the OCA criteria? Clearly, if one took the view that the United States works well as a common currency zone, and if we find that Europe performs as well as or better than the United States on the OCA criteria, then these findings would lend indirect support to the economic logic of the euro.

Goods Market Integration European countries trade a lot with one another. But as far as we can tell (the available data are not entirely comparable), the individual states within the United States trade even more with one another. For the 50 U.S. states shown in Figure 21-4, panel (a), inter-state trade is about 66% of U.S. GDP. The figure for 17 Eurozone countries is typically much smaller, and their trade with one another is only about 17% of Eurozone GDP. At best, it might be argued that the creation of a “single market” in the EU is still a work in progress (as we see in the next section), and so these intra-EU trade flows will likely rise further as the EU’s internal market becomes more integrated. On this test, Europe is probably behind the United States for now.

410

411

Symmetry of Shocks A direct way to look at the symmetry of shocks is to compare the correlation of a state or region’s GDP annual growth rate with the annual GDP growth of the entire zone. These data are shown in Figure 21-4, panel (b), and the Eurozone countries compare more favorably with the U.S. states and regions on this test: for 50 U.S. states and 17 Eurozone countries, the average correlation with the entire zone’s GDP growth rate is close to 0.5 (the much larger 8 U.S. census regions show a much higher correlation with the nation, of course). This result is not too surprising: there is no strong consensus that EU countries are more exposed to local shocks than the regions of the United States. However, as we see in a moment, one potential problem for the EU is what happens in the future: one effect of greater EU goods market integration could be that EU countries start to specialize more, and thus become more dissimilar. In that case, the risk of asymmetric shocks will increase and the EU will be less likely to satisfy the OCA criteria.

Labor Mobility The data in Figure 21-4, panel (c), show what is well known: labor in Europe is much less mobile between states than it is in the United States. More than 40% of U.S. residents were born outside the state in which they live. In the Eurozone, only 14% of people were born in a different country than the one in which they live. (The same is true, as one would expect, of the year-to-year flow of people between regions: it is also an order of magnitude larger in the United States than in Europe.) There are obvious explanations for this: differences in culture and language present obstacles to intra-EU migration that are largely absent in the United States. In addition, although the EU is working to ease such frictions, the local regulatory environment and red tape make it difficult for Europeans to live and work in another EU country, even if they have a legal right to do so. Finally, labor markets in Europe are generally less flexible, making it harder to hire and fire workers, something that may dissuade workers from moving from one place to another in search of better opportunities. Economists have found that differences in unemployment across EU regions tend to be larger and more persistent than they are across the individual states of the United States. In short, the labor market adjustment mechanism is weaker in Europe. On this test, Europe is far behind the United States.

Fiscal Transfers The data in Figure 21-4, panel (d), from a survey of the literature, show that when a U.S. state goes into a recession, for every $1 drop in that state’s GDP, the federal government compensates with an offsetting transfer of between 10 cents and 30 cents (this range may be too low: the 28-cent figure is the most recent and is based on Federal income tax variation alone). Stabilizing transfers of this kind are possible only when states agree to engage in fiscal federalism, whereby substantial taxing and spending authority are given to the central authority. The United States has such stabilizing transfers, but the EU and the Eurozone do not. Although individual states in the Eurozone achieve similar results within their own borders, at the level of the Eurozone as a whole, the fiscal transfer mechanism is nonexistent, offsetting less then 1 cent for every €1 of a nation’s GDP decline. (The EU budget is little more than 1% of EU GDP and is devoted to other purposes, notably agricultural subsidies, which do not vary much over the business cycle).

412

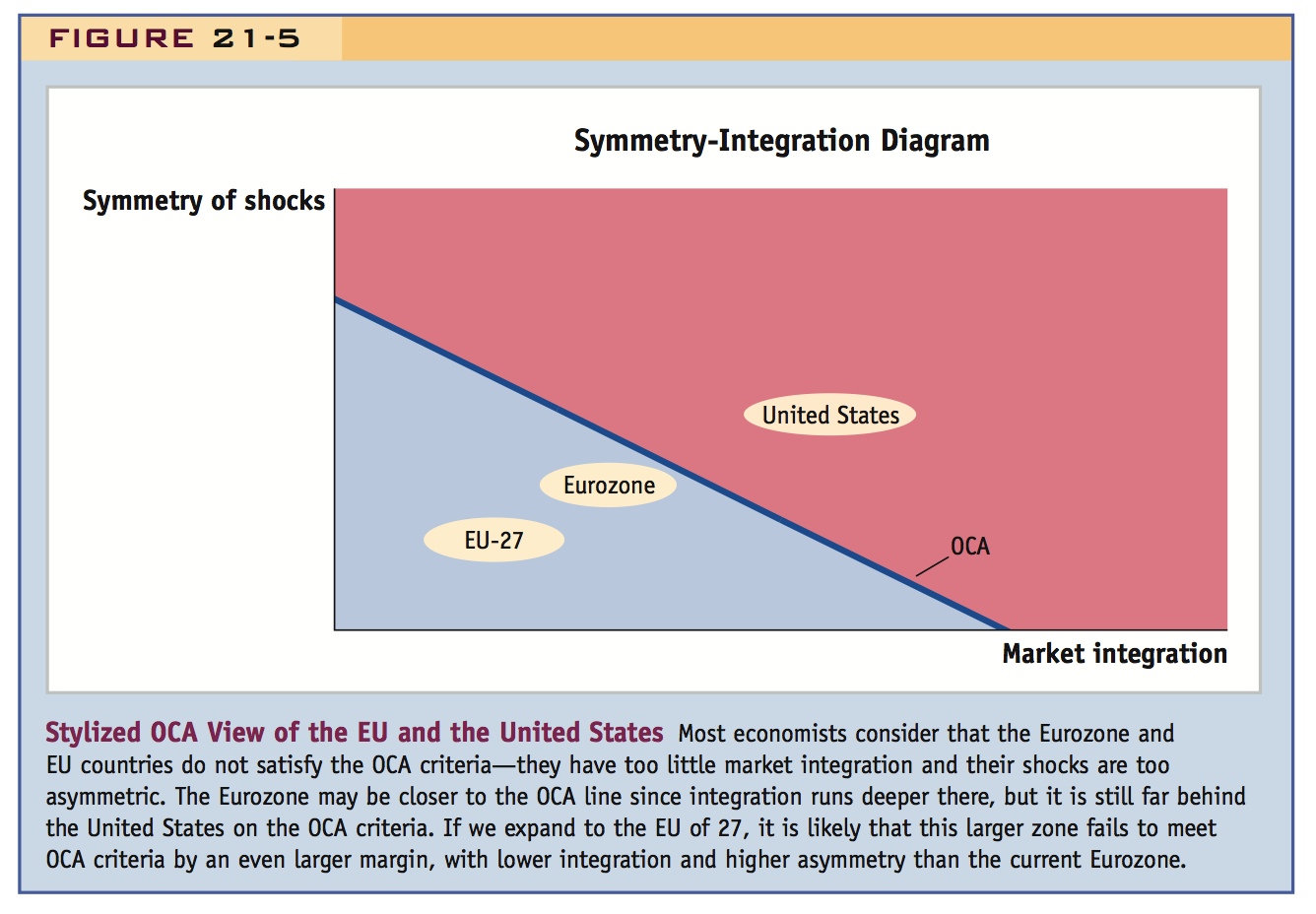

Summary On the simple OCA criteria, the EU falls short of the United States as a successful optimum currency area, as shown in Figure 21-5. Goods market integration is a little bit weaker, fiscal transfers are negligible, and labor mobility is very low. At best, one can note that economic shocks in the EU are fairly symmetric, but this fact alone gives only limited support for a currency union given the shortcomings in other areas.

Some economists argue that the economic stability costs are exaggerated: they have doubts about stabilization policy in theory (e.g., the Keynesian view that prices are sticky in the short run) or in practice (e.g., the caveats about policy activism noted in the chapter on short-run macroeconomic policies). But most economists think there are still costs involved when a country sacrifices monetary autonomy. They worry that some or all Eurozone countries now have an inappropriate one-size-fits-all monetary policy, and that there are additional risks such as the absence of a well-defined lender of last resort mechanism in the Eurozone.

On balance, economists tend to believe that the EU, and the current Eurozone within it, were not an optimum currency area in the 1990s when the EMU project took shape and that nothing much has happened yet to alter that judgment.

This may a bit of a surprise to most students, so explain that the U.S. has a mechanism for making stabilizing transfers, while the EU has none at all.

This will probably be consistent with the students' prior knowledge.

The students may suggest historical and recent counterexamples of serious asymmetric shocks.

Are the OCA Criteria Self-Fulfilling?

Our discussion so far has taken a fairly static view of the OCA criteria. Countries treat all of the conditions just discussed as given, and, assuming they have adequate information, they can then judge whether the costs of forming a currency union outweigh the benefits. However, another school of thought argues that some of the OCA criteria are not given (i.e., exogenous) and fixed in stone, but rather they are economic outcomes (i.e., endogenous) determined by, among other things, the creation of the currency union itself. In other words, even if the Eurozone isn’t an OCA now, by adopting a common currency, it might become an OCA in the future.

413

Consider goods market integration, for example. The very act of joining a currency union might be expected to promote more trade, by lowering transaction costs. Indeed, that is one of the main supposed benefits. In that case, if the OCA criteria were applied ex ante (before the currency union forms), then many countries might exhibit low trade volumes. Their low integration might mean that the OCA criteria are not met, and the currency union might not be formed based on those characteristics. However, if the currency union went ahead anyway, then it might be the case that ex post (after the currency union is up and running) countries would trade so much more that in the end the OCA criteria would indeed be satisfied.

Maybe split the class into teams of "euro-optimists" and "euro-pessimists," and stage a debate.

This kind of argument is favored by euro-optimists, who see the EU single-market project as an ongoing process and the single currency as one of its crucial elements. This logic suggests that the OCA criteria can be self-fulfilling, at least for a group of countries that are ex ante close to—but not quite—fulfilling the OCA requirements. For example, suppose the EU started out at point 1 in Figure 21-6, just below the OCA line. If the EU countries would only “just do it” and form a monetary union, then they would wake up and discover that they had jumped to point 2 once the common currency had boosted trade among them, and, hey, presto: while monetary union didn’t make sense beforehand, it does after the fact. Thus, even if the EU or the Eurozone does not look like an OCA now, it might turn out to be an OCA once it is fully operational. However, Euro-pessimists doubt that this self-fulfilling effect will amount to much. Evidence is mixed, and the exact magnitude of this effect is subject to considerable dispute (see Headlines: Currency Unions and Trade).6

414

A further argument made by optimists is that greater integration under the EU project might also enhance other OCA criteria. For example, if goods markets are better connected, a case can be made that shocks will be more rapidly transmitted within the EU and will be felt more symmetrically. Thus, creating the Eurozone will not only boost trade but also increase the symmetry of shocks, corresponding to a shift from point 1 to point 3 in Figure 21-6. Such a process would strengthen the OCA argument even more.

Set against this optimistic view is the pessimistic prospect that further goods market integration might also lead to more specialization in production. According to this argument, once individual firms can easily serve the whole EU market, and not just their national market, they will exploit economies of scale and concentrate production. Some sectors in the EU might end up becoming concentrated in a few locations. Whereas in the past trade barriers and other frictions allowed every EU country to produce a wide range of goods, in the future we might see more clustering (the United States provides many examples, such as the auto industry in Detroit, financial services in New York City, entertainment in Los Angeles, or technology in Silicon Valley and San Francisco). If specialization increases, each country will be less diversified and will face more asymmetric shocks. In Figure 21-6, this might correspond to a move from point 1 to point 4, where the case for OCA would strengthen, though not by much; or even a move to point 5, where the costs of asymmetric shocks are so large that they dominate the gains from market integration, so that the case for an OCA is weakened.

Some speculate that certain other OCA criteria could be affected by the adoption of the euro: maybe the common currency will encourage greater labor and capital mobility? Maybe it will encourage more fiscal federalism? As with the arguments about the effects on trade creation and specialization, evidence for these claims is fuzzy. We cannot make a definitive judgment until the Eurozone experiment has run for a few more years and there are sufficient data to make reliable statistical inferences.

Summary

6. Summary

We have developed a theory of the economic costs and benefits of a monetary union. Most economists think that the Eurozone is not an OCA. Then why does it exist? Politics.

For that matter, students may inquire as to whether the U.S. is an OCA.

We have seen how a calculation of economic costs and benefits can help us decide whether a common currency makes sense. Based on these criteria alone, it appears that the Eurozone is almost certainly not an optimum currency area, nor the larger EU. Admittedly, this conclusion does not apply with equal force to the entire Eurozone. Some subgroups of countries may satisfy the OCA criteria. For decades Luxembourg has, in fact, used the Belgian franc as a currency; and the Dutch guilder has been closely tied to the German mark. The BeNeLux countries, and maybe Austria too, have always been well integrated with Germany and therefore stronger candidates for a currency union. Other countries also had strong criteria for joining: for Italy, perhaps, where monetary policy was often more erratic, a better nominal anchor might have outweighed other negatives.

415

An article from 2006 arguing that the euro has not stimulated trade much

Currency Unions and Trade

Will Eurozone trade rise as a result of the adoption of the euro? The effects seen so far do not appear to be very large.

In the continuing controversies about Europe’s bold experiment in monetary union, there has at least been some agreement about where the costs and benefits lie. The costs are macroeconomic, caused by forgoing the right to set interest rates to suit the specific economic conditions of a member state. The benefits are microeconomic, consisting of potential gains in trade and growth as the costs of changing currencies and exchange-rate uncertainty are removed.

A recent…study* by Richard Baldwin, a trade economist at the Graduate Institute of International Studies in Geneva, scythes through [previous] estimates. He works out that the boost to trade within the euro area from the single currency is much smaller: between 5% and 15%, with a best estimate of 9%. Furthermore, the gain does not build up over time but has already occurred. And the three European Union countries that stayed out—Britain, Sweden and Denmark—have gained almost as much as founder members, since the single currency has raised their exports to the euro zone by 7%.

Interest in the potential trade gains from the euro was primed…by a startling result from research into previous currency unions. In 2000 Andrew Rose, an economist at the University of California, Berkeley, reported that sharing a currency boosts trade by 235%.** Such a number looked too big to be true. It clashed with earlier research that found exchange-rate volatility reduced trade only marginally.…

Despite such worries, researchers continued to find large trade effects from currency unions. Mr. Baldwin explains why these estimates are unreliable. The main problem is that most of the countries involved are an odd bunch of small, poor economies that are in unions because of former colonial arrangements. Such is their diversity that it is impossible to model the full range of possible influences on their trade. But if some of the omitted factors are correlated with membership of a monetary union, the estimate of its impact on trade is exaggerated. And causality is also likely to run the other way: small, open economies, which would in any case trade heavily, are especially likely to share a currency.…

The intractable difficulties in working out the trade effect from previous currency unions means that previous estimates are fatally flawed. But the euro has now been in existence since the start of 1999, with notes and coins circulating since January 2002, so there is an increasing body of evidence based on its experience. That has certainly highlighted the macroeconomic disadvantages for its 12 member states. The loss of monetary sovereignty has hobbled first Germany and, more recently, Italy.

Despite these drawbacks, some studies have pointed to a substantial increase in trade within the euro area arising from monetary union, for example, by 20–25% in the first four years. As with the previous currency unions, however, many other explanatory influences might have come into play. Fortunately, unlike those earlier unions, there is a “control” group: the three countries that stayed out. This is particularly useful because they have shared other relevant aspects of membership of the EU, such as trade policy. It is on the basis of this that Mr. Baldwin reaches his best estimate of a 9% increase in trade within the euro area because of monetary union.

As important, he establishes that the boost to trade did not occur, as expected, by lowering the transaction costs for trade within the euro area. Had it done so, the stimulus would have been a fall in the prices of goods traded between euro-zone members relative to those traded with countries outside the currency union. However, Mr. Baldwin fails to find either this expected relative decline or the trade diversion it would have generated from the three countries that stayed out. He argues that another mechanism was at work. The introduction of the euro has in effect brought down the fixed cost of trading in the euro area. This has made it possible for companies selling products to just a few of the 12 member states to expand their market across more or all of them. This explains why the boost to trade has essentially been a one-off adjustment; and why countries that stayed out have benefited almost as much as those that joined.

[T]here is also an important lesson for the 12 members of the euro area. Even if their economies were insufficiently aligned to be best suited for a currency union, one hope has been that the euro would make them converge as they trade much more intensively with one another. The message from Mr. Baldwin’s report is that this is too optimistic. Countries in the euro area will have to undertake more reforms, such as making their labour markets more flexible, if they are to make the best of life with a single monetary policy.

Source: Excerpted from “Economics Focus: The Euro and Trade,” Economist, June 22, 2006. © The Economist Newspaper Limited, London (June 22, 2006).

* Richard Baldwin, In or Out: Does It Matter? An Evidence-Based Analysis of the Euro’s Trade Effects (London: Centre for Economic Policy Research, 2006).

** Andrew K. Rose, 2000, “One Money, One Market: The Effect of Common Currencies on Trade,” Economic Policy, 30, April, 7–45.

416

The key point here.

So if the EU is not an OCA, then why does the euro exist? The euro project was seen as something bigger. This was a currency designed to unify a whole continent of disparate economies, to include France and Germany, Italy and the United Kingdom, to run from west to east, from Scandinavia to the Mediterranean—and it developed with very little reference to the OCA criteria. To understand why the euro happened, we need to study political logic, the topic of the next section.