PROBLEMS

Question

Explain how increasing returns to scale in production can be a basis for trade.

Prob 6 1. Explain how increasing returns to scale in production can be a basis for trade.Question

Why is trade within a country greater than trade between countries?

Prob 6 2. Why is trade within a country greater than trade between countries?- Starting from the long-run equilibrium without trade in the monopolistic competition model, as illustrated in Figure 6-5, consider what happens when the Home country begins trading with two other identical countries. Because the countries are all the same, the number of consumers in the world is three times larger than in a single country, and the number of firms in the world is three times larger than in a single country.

Question

Compared with the no-trade equilibrium, how much does industry demand D increase? How much does the number of firms (or product varieties) increase? Does the demand curve D/NA still apply after the opening of trade? Explain why or why not.

Prob 6 1a. Compared with the no-trade equilibrium, how much does industry demand D increase? How much does the number of firms (or product varieties) increase? Does the demand curve D/NA still apply after the opening of trade? Explain why or why not.Question

Does the d1 curve shift or pivot due to the opening of trade? Explain why or why not.

Prob 6 1b. Does the d1 curve shift or pivot due to the opening of trade? Explain why or why not.Question

Compare your answer to (b) with the case in which Home trades with only one other identical country. Specifically, compare the elasticity of the demand curve d1 in the two cases.

Prob 6 1c. Compare your answer to (b) with the case in which Home trades with only one other identical country. Specifically, compare the elasticity of the demand curve d1 in the two cases.Question

Illustrate the long-run equilibrium with trade, and compare it with the long-run equilibrium when Home trades with only one other identical country.

Prob 6 1d. Illustrate the long-run equilibrium with trade, and compare it with the long-run equilibrium when Home trades with only one other identical country.

- Starting from the long-run trade equilibrium in the monopolistic competition model, as illustrated in Figure 6-7, consider what happens when industry demand D increases. For instance, suppose that this is the market for cars, and lower gasoline prices generate higher demand D.

Question

Redraw Figure 6-7 for the Home market and show the shift in the D/NT curve and the new short-run equilibrium.

Prob 6 4a. Redraw Figure 6-7 for the Home market and show the shift in the D/NT curve and the new short-run equilibrium.Question

From the new short-run equilibrium, is there exit or entry of firms, and why?

Prob 6 4b. From the new short-run equilibrium, is there exit or entry of firms, and why?Question

Describe where the new long-run equilibrium occurs, and explain what has happened to the number of firms and the prices they charge.

Prob 6 4c. Describe where the new long-run equilibrium occurs, and explain what has happened to the number of firms and the prices they charge.

Question

Our derivation of the gravity equation from the monopolistic competition model used the following logic:

(i) Each country produces many products.

(ii) Each country demands all of the products that every other country produces.

(iii) Thus, large countries demand more imports from other countries.

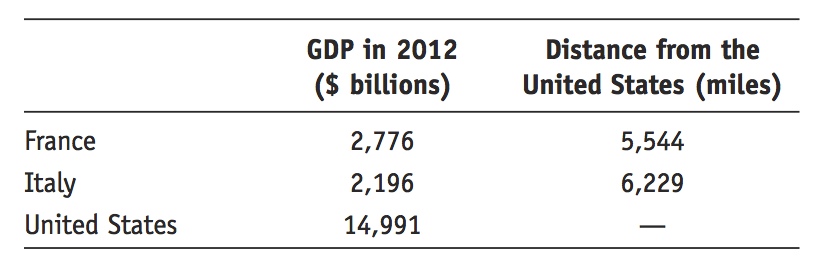

The gravity equation relationship does not hold in the Heckscher-Ohlin model. Explain how the logic of the gravity equation breaks down in the Heckscher-Ohlin model; that is, which of the statements just listed is no longer true in the Heckscher-Ohlin model?Prob 6 5. Our derivation of the gravity equation from the monopolistic competition model used the following logic:(i) Each country produces many products.(ii) Each country demands all of the products that every other country produces.(iii) Thus, large countries demand more imports from other countries.The gravity equation relationship does not hold in the Heckscher-Ohlin model. Explain how the logic of the gravity equation breaks down in the Heckscher-Ohlin model; that is, which of the statements just listed is no longer true in the Heckscher-Ohlin model?- The United States, France, and Italy are among the world’s largest producers. To answer the following questions, assume that their markets are monopolistically competitive, and use the gravity equation with B = 93 and n = 1.25.

Question

Using the gravity equation, compare the expected level of trade between the United States and France and between the United States and Italy.

Prob 6 6a. Using the gravity equation, compare the expected level of trade between the United States and France and between the United States and Italy.Question

The distance between Paris and Rome is 694 miles. Would you expect more French trade with Italy or with the United States? Explain what variable (i.e., country size or distance) drives your result

Prob 6 6b. The distance between Paris and Rome is 694 miles. Would you expect more French trade with Italy or with the United States? Explain what variable (i.e., country size or distance) drives your result.

Question

What evidence is there that Canada is better off under the free-trade agreement with the United States?

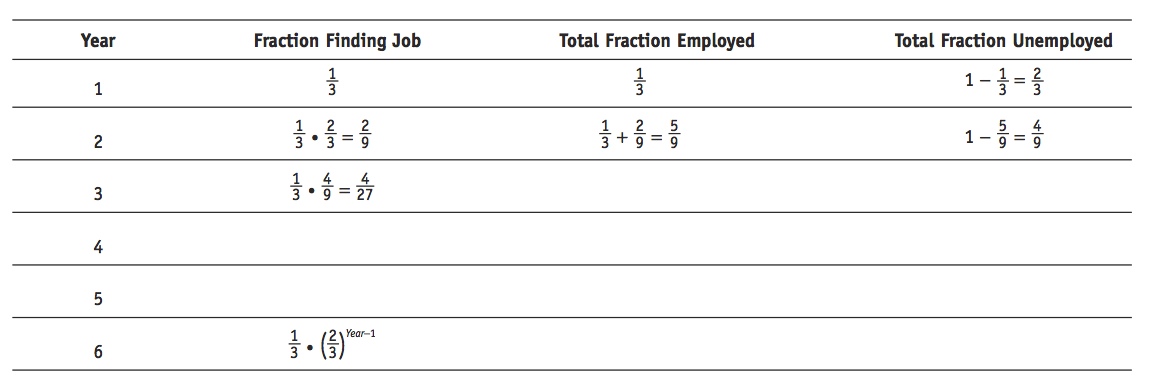

Prob 6 7. What evidence is there that Canada is better off under the free-trade agreement with the United States?- In the section “Gains and Adjustment Costs for the United States Under NAFTA,” we calculated the lost wages of workers displaced because of NAFTA. Prior experience in the manufacturing sector shows that about two-thirds of these workers obtain new jobs within three years. One way to think about that reemployment process is that one-third of workers find jobs in the first year, and another one-third of remaining unemployed workers find a job each subsequent year. Using this approach, in the table that follows, we show that one-third of workers get a job in the first year (column 2), leaving two-thirds of workers unemployed (column 4). In the second year, another

of workers get a job (column 2), so that

of workers get a job (column 2), so that  of the workers are employed (column 3). That leaves 1 -

of the workers are employed (column 3). That leaves 1 -  of the workers unemployed (column 4) at the end of the second year.

of the workers unemployed (column 4) at the end of the second year.

Question

Fill in two more rows of the table using the same approach as for the first two rows.

Prob 6 8a. Fill in two more rows of the table using the same approach as for the first two rows.Question

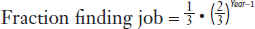

Notice that the fraction of workers finding a job each year (column 2) has the formula

Using this formula, fill in six more values for the fraction of workers finding a job (column 2), up to year 10.Prob 6 8b. Notice that the fraction of workers finding a job each year (column 2) has the formulaUsing this formula, fill in six more values for the fraction of workers finding a job (column 2), up to year 10.Question

To calculate the average spell of unemployment, we take the fraction of workers finding jobs (column 2), multiply it by the years of unemployment (column 1), and add up the result over all the rows. By adding up over 10 rows, calculate what the average spell of unemployment is. What do you expect to get when adding up over 20 rows?

Prob 6 8c. To calculate the average spell of unemployment, we take the fraction of workers finding jobs (column 2), multiply it by the years of unemployment (column 1), and add up the result over all the rows. By adding up over 10 rows, calculate what the average spell of unemployment is. What do you expect to get when adding up over 20 rows?Question

Compare your answer to (c) with the average three-year spell of unemployment. Was that number accurate?

Prob 6 8d. Compare your answer to (c) with the average three-year spell of unemployment on page 186. Was that number accurate?

Question

Of two products, rice and paintings, which product do you expect to have a higher index of intra-industry trade? Why?

Prob 6 9a. Of two products, rice and paintings, which product do you expect to have a higher index of intra-industry trade? Why?Question

Access the U.S. TradeStats Express website at http://tse.export.gov/. Click on “National Trade Data” and then “Global Patterns of U.S. Merchandise Trade.” Under the “Product” section, change the item to rice (HS 1006) and obtain the export and import values. Do the same for paintings (HS 9701); then calculate the intra-industry trade index for rice and paintings in 2012. Do your calculations confirm your expectation from part (a)? If your answers did not confirm your expectation, explain.

Prob 6 9b. Access the U.S. TradeStats Express website at http://tse.export.gov/. Click on “National Trade Data” and then “Global Patterns of U.S. Merchandise Trade.” Under the “Product” section, change the item to rice (HS 1006) and obtain the export and import values. Do the same for paintings (HS 9701); then calculate the intra-industry trade index for rice and paintings in 2012. Do your calculations confirm your expectation from part (a)? If your answers did not confirm your expectation, explain.