PROBLEMS

- The following questions refer to Side Bar: Key Provisions of the GATT.

Question

If the United States applies a tariff to a particular product (e.g., steel) imported from one country, what is the implication for its steel tariffs applied to all other countries according to the “most favored nation” principle?

Prob 8 1a. If the United States applies a tariff to a particular product (e.g., steel) imported from one country, what is the implication for its steel tariffs applied to all other countries according to the “most favored nation” principle?Question

Is Article XXIV an exception to most favored nation treatment? Explain why or why not.

Prob 8 1b. Is Article XXIV an exception to most favored nation treatment? Explain why or why not.Question

Under the GATT articles, instead of a tariff, can a country impose a quota (quantitative restriction) on the number of goods imported? What has been one exception to this rule in practice?

Prob 8 1c. Under the GATT articles, instead of a tariff, can a country impose a quota (quantitative restriction) on the number of goods imported? What has been one exception to this rule in practice?

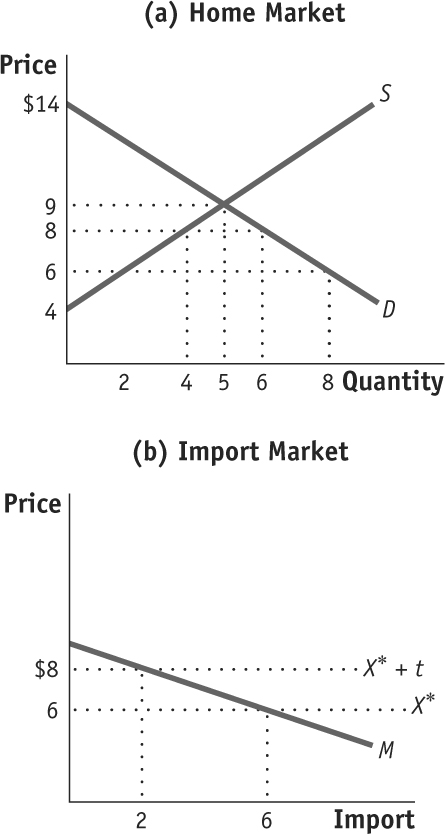

- Consider a small country applying a tariff t to imports of a good like that represented in Figure 8-5.

Question

Suppose that the country decides to reduce its tariff to t′. Redraw the graphs for the Home and import markets and illustrate this change. What happens to the quantity and price of goods produced at Home? What happens to the quantity of imports?

Prob 8 2a. Suppose that the country decides to reduce its tariff to t′. Redraw the graphs for the Home and import markets and illustrate this change. What happens to the quantity and price of goods produced at Home? What happens to the quantity of imports?Question

Are there gains or losses to domestic consumer surplus due to the reduction in tariff? Are there gains or losses to domestic producer surplus due to the reduction in tariff? How is government revenue affected by the policy change? Illustrate these on your graphs.

Prob 8 2b. Are there gains or losses to domestic consumer surplus due to the reduction in tariff? Are there gains or losses to domestic producer surplus due to the reduction in tariff? How is government revenue affected by the policy change? Illustrate these on your graphs.Question

What is the overall gain or loss in welfare due to the policy change?

Prob 8 2c. What is the overall gain or loss in welfare due to the policy change?

- Consider a large country applying a tariff t to imports of a good like that represented in Figure 8-9.

Question

How does the export supply curve in panel (b) compare with that in the small-country case? Explain why these are different.

Prob 8 3a. How does the export supply curve in panel (b) compare with that in the small-country case? Explain why these are different.Question

Explain how the tariff affects the price paid by consumers in the importing country and the price received by producers in the exporting country. Use graphs to illustrate how the prices are affected if (i) the export supply curve is very elastic (flat) or (ii) the export supply curve is inelastic (steep).

Prob 8 3b. Explain how the tariff affects the price paid by consumers in the importing country and the price received by producers in the exporting country. Use graphs to illustrate how the prices are affected if (i) the export supply curve is very elastic (flat) or (ii) the export supply curve is inelastic (steep).

Question

Consider a large country applying a tariff t to imports of a good like that represented in Figure 8-9. How does the size of the terms-of-trade gain compare with the size of the deadweight loss when (i) the tariff is very small and (ii) the tariff is very large? Use graphs to illustrate your answer.

Prob 8 4. Consider a large country applying a tariff t to imports of a good like that represented in Figure 8-9. How does the size of the terms-of-trade gain compare with the size of the deadweight loss when (i) the tariff is very small and (ii) the tariff is very large? Use graphs to illustrate your answer.Question

If the foreign export supply is perfectly elastic, what is the optimal tariff Home should apply to increase welfare? Explain.

Prob 8 5a. If the foreign export supply is perfectly elastic, what is the optimal tariff Home should apply to increase welfare? Explain.Question

If the foreign export supply is less than perfectly elastic, what is the formula for the optimal tariff Home should apply to increase welfare?

Prob 8 5b. If the foreign export supply is less than perfectly elastic, what is the formula for the optimal tariff Home should apply to increase welfare?Question

What happens to Home welfare if it applies a tariff higher than the optimal tariff?

Prob 8 5c. What happens to Home welfare if it applies a tariff higher than the optimal tariff?

- Rank the following in ascending order of Home welfare and justify your answers. If two items are equivalent, indicate this accordingly.

Question

Tariff of t in a small country corresponding to the quantity of imports M

Prob 8 6a. Tariff of t in a small country corresponding to the quantity of imports MQuestion

Tariff of t in a large country corresponding to the same quantity of imports M

Prob 8 6b. Tariff of t in a large country corresponding to the same quantity of imports MQuestion

Tariff of t′ in a large country corresponding to the quantity of imports M′ > M

Prob 8 6c. Tariff of t′ in a large country corresponding to the quantity of imports M′ > M

- Rank the following in ascending order of Home welfare and justify your answers. If two items are equivalent, indicate this accordingly.

Question

Tariff of t in a small country corresponding to the quantity of imports M

Prob 8 7a. Tariff of t in a small country corresponding to the quantity of imports MQuestion

Quota with the same imports M in a small country, with quota licenses distributed to Home firms and no rent seeking

Prob 8 7b. Quota with the same imports M in a small country, with quota licenses distributed to Home firms and no rent seekingQuestion

Quota of M in a small country with quota licenses auctioned to Home firms

Prob 8 7c. Quota of M in a small country with quota licenses auctioned to Home firmsQuestion

Quota of M in a small country with the quota given to the exporting firms

Prob 8 7d. Quota of M in a small country with the quota given to the exporting firmsQuestion

Quota of M in a small country with quota licenses distributed to rent-seeking Home firms

Prob 8 7d. Quota of M in a small country with quota licenses distributed to rent-seeking Home firms

Question

Why did President George W. Bush suspend the U.S. tariffs on steel 17 months ahead of schedule?

Prob 8 8. Why did President George W. Bush suspend the U.S. tariffs on steel 17 months ahead of schedule?Question

What provision of U.S. trade law was used by President Barack Obama to apply a tariff on tires imported from China? Does this provision make it easier or harder to apply a tariff than Section 201?

Prob 8 9. What provision of U.S. trade law was used by President Barack Obama to apply a tariff on tires imported from China? Does this provision make it easier or harder to apply a tariff than Section 201?Question

No U.S. tire producers joined in the request for the tariff on tires in 2009. Rather, the petition for a tariff on tires imported from China was brought by the United Steelworkers of America, the union who represents workers in the tire industry. Why did major tire manufacturers operating in the United States, such as Goodyear, Michelin, Cooper, and Bridgestone, not support the tariff?

Prob 8 10. No U.S. tire producers joined in the request for the tariff on tires in 2009. Rather, the petition for a tariff on tires imported from China was brought by the United Steelworkers of America, the union who represents workers in the tire industry. Why did major tire manufacturers operating in the United States, such as Goodyear, Michelin, Cooper, and Bridgestone, not support the tariff?- Suppose Home is a small country. Use the graphs below to answer the questions.

Question

Calculate Home consumer surplus and producer surplus in the absence of trade.

Prob 8 11a. Calculate Home consumer surplus and producer surplus in the absence of trade.Question

Now suppose that Home engages in trade and faces the world price, P* = $6. Determine the consumer and producer surplus under free trade. Does Home benefit from trade? Explain.

Prob 8 11b. Now suppose that Home engages in trade and faces the world price, P* = $6. Determine the consumer and producer surplus under free trade. Does Home benefit from trade? Explain.Question

Concerned about the welfare of the local producers, the Home government imposes a tariff in the amount of $2 (i.e., t = $2). Determine the net effect of the tariff on the Home economy.

Prob 8 11c. Concerned about the welfare of the local producers, the Home government imposes a tariff in the amount of $2 (i.e., t = $2). Determine the net effect of the tariff on the Home economy.

- Refer to the graphs in Problem 11. Suppose that instead of a tariff, Home applies an import quota limiting the amount Foreign can sell to 2 units.

Question

Determine the net effect of the import quota on the Home economy if the quota licenses are allocated to local producers.

Prob 8 12a. Determine the net effect of the import quota on the Home economy if the quota licenses are allocated to local producers.Question

Calculate the net effect of the import quota on Home welfare if the quota rents are earned by Foreign exporters.

Prob 8 12b. Calculate the net effect of the import quota on Home welfare if the quota rents are earned by Foreign exporters.Question

How do your answers to parts (a) and (b) compare with part (c) of Problem 11?

Prob 8 12c. How do your answers to parts (a) and (b) compare with part (c) of Problem 11?

- Consider a small country applying a tariff t as in Figure 8-5. Instead of a tariff on all units imported, however, we will suppose that the tariff applies only to imports in excess of some quota amount M′ (which is less than the total imports). This is called a “tariff-rate quota” (TRQ) and is commonly used on agricultural goods.

Question

Redraw Figure 8-5, introducing the quota amount M′. Remember that the tariff applies only to imports in excess of this amount. With this in mind, what is the rectangle of tariff revenue collected? What is the rectangle of quota rents? Explain briefly what quota rents mean in this scenario.

Prob 8 13a. Redraw Figure 8-5, introducing the quota amount M′. Remember that the tariff applies only to imports in excess of this amount. With this in mind, what is the rectangle of tariff revenue collected? What is the rectangle of quota rents? Explain briefly what quota rents mean in this scenario.Question

How does the use of a TRQ rather than a tariff at the same rate affect Home welfare? How does the TRQ, as compared with a tariff at the same rate, affect Foreign welfare? Does it depend on who gets the quota rents?

Prob 8 13b. How does the use of a TRQ rather than a tariff at the same rate affect Home welfare? How does the TRQ, as compared with a tariff at the same rate, affect Foreign welfare? Does it depend on who gets the quota rents?Question

Based on your answer to (b), why do you think TRQs are used quite often?

Prob 8 13c. Based on your answer to (b), why do you think TRQs are used quite often?

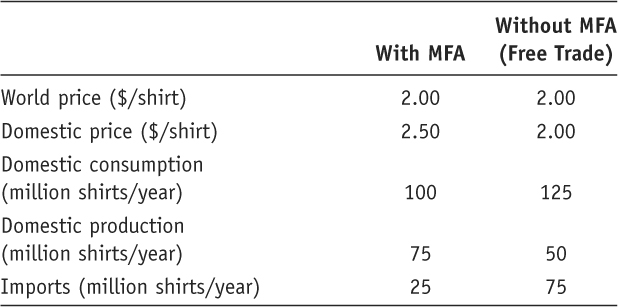

- Consider the following hypothetical information pertaining to a country’s imports, consumption, and production of T-shirts following the removal of the MFA quota:

Question

Graph the effects of the quota removal on domestic consumption and production.

Prob 8 14a. Graph the effects of the quota removal on domestic consumption and production.Question

Determine the gain in consumer surplus from the removal of the quota.

Prob 8 14b. Determine the gain in consumer surplus from the removal of the quota.Question

Determine the loss in producer surplus from the removal of the quota.

Prob 8 14c. Determine the loss in producer surplus from the removal of the quota.Question

Calculate the quota rents that were earned under the quota.

Prob 8 14d. Calculate the quota rents that were earned under the quota.Question

Determine how much the country has gained from removal of the quota.

Prob 8 14e. Determine how much the country has gained from removal of the quota.

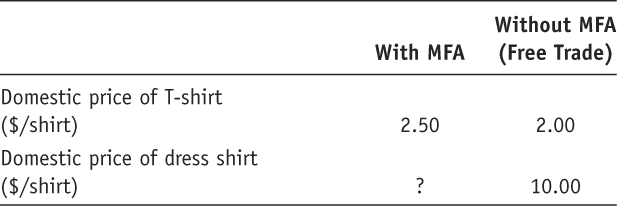

- Suppose that a producer in China is constrained by the MFA to sell a certain number of shirts, regardless of the type of shirt. For a T-shirt selling for $2.00 under free trade, the MFA quota leads to an increase in price to $2.50. For a dress shirt selling for $10.00, the MFA will also lead to an increase in price.

Question

Suppose that the MFA leads to an increase in the price of dress shirts from $10 to $11. Will the producer be willing to export both T-shirts and dress shirts? (Remember that only a fixed number of shirts can be exported, but of any type.) Explain why or why not.

Prob 8 15a. Suppose that the MFA leads to an increase in the price of dress shirts from $10 to $11. Will the producer be willing to export both T-shirts and dress shirts? (Remember that only a fixed number of shirts can be exported, but of any type.) Explain why or why not.Question

For the producer to be willing to sell both T-shirts and dress shirts, what must be the price of dress shirts under the MFA?

Prob 8 15b. For the producer to be willing to sell both T-shirts and dress shirts, what must be the price of dress shirts under the MFA?Question

Based on your answer to part (b), calculate the price of dress shirts relative to T-shirts before and after the MFA. What has happened to the relative price due to the MFA?

Prob 8 15c. Based on your answer to part (b), calculate the price of dress shirts relative to T-shirts before and after the MFA. What has happened to the relative price due to the MFA?Question

Based on your answer to part (c), what will happen to the relative demand in the United States for dress shirts versus T-shirts from this producer due to the MFA?

Prob 8 15d. Based on your answer to part (c), what will happen to the relative demand in the United States for dress shirts versus T-shirts from this producer due to the MFA?Question

Thinking now of the total export bundle of this producer, does the MFA lead to quality upgrading or downgrading? How about the removal of the MFA?

Prob 8 15e. Thinking now of the total export bundle of this producer, does the MFA lead to quality upgrading or downgrading? How about the removal of the MFA?