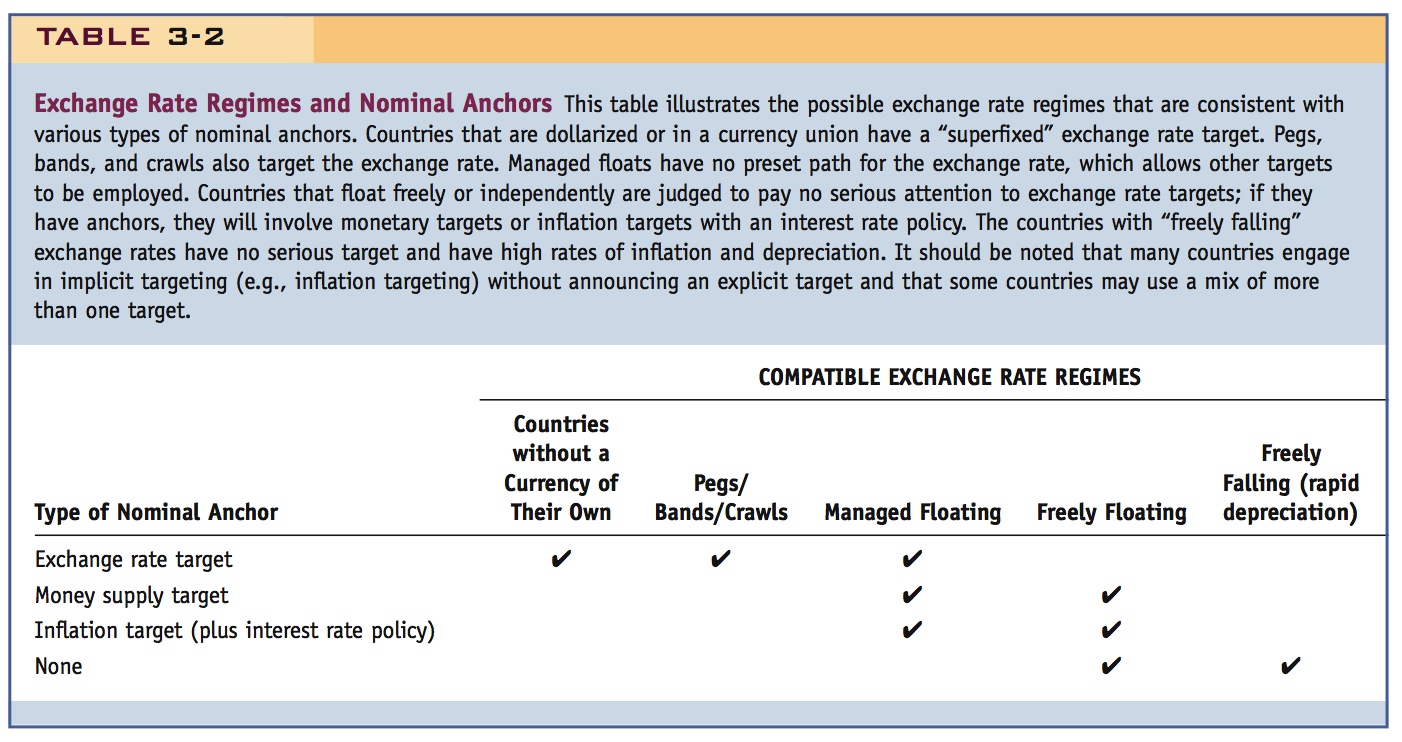

TABLE 3-2: Exchange Rate Regimes and Nominal Anchors This table illustrates the possible exchange rate regimes that are consistent with various types of nominal anchors. Countries that are dollarized or in a currency union have a “superfixed” exchange rate target. Pegs, bands, and crawls also target the exchange rate. Managed floats have no preset path for the exchange rate, which allows other targets to be employed. Countries that float freely or independently are judged to pay no serious attention to exchange rate targets; if they have anchors, they will involve monetary targets or inflation targets with an interest rate policy. The countries with “freely falling” exchange rates have no serious target and have high rates of inflation and depreciation. It should be noted that many countries engage in implicit targeting (e.g., inflation targeting) without announcing an explicit target and that some countries may use a mix of more than one target.