2 The History and Politics of the Euro

1. A Brief History of Europe

The EU project arose in response to the devastation of WWII, an attempt to maintain peace and stimulate prosperity.

a. Back from the Brink: Marshall Plan to Maastricht, 1945-1991

Marshall plan funds were allocated by a European High Authority, which undertook a series of initiatives to further European economic cooperation, including the European Coal and Steel Community (ECSC) and Euratom. In 1957, the Treaty of Rome created the European Economic Community (EEC). In 1967, the EEC, ECSC, and Euratom were merged and the European Communities (EC) was created. The EC was a political, as well an economic, institution. In the 1970s there were two big challenges, expansion of membership and monetary affairs: (1) Membership expanded to include Denmark, Ireland, and the UK, then later Greece, Portugal, and Spain. (2) Bretton Woods collapsed, in response to which the ERM was created to maintain fixed rates in Europe, and to move toward a currency union.

b. Crises and Opportunities: EMU and Other Projects, 1991-1999

The Single European Act reduces barriers between countries in 1992. The Soviet Union collapses and Germany reunites. Eastern countries and Turkey wanted to join. The Maastricht Treaty changed the name of the EC to the European Union (EU), created EU citizenship, and established a process for enlargement. Succeeding treaties defined rules for entry, established a zone for free movement of people, increased the rights of citizenship, and strengthened the powers of the European parliament. Maastricht also created the EMU, with the goal of creating a monetary union. The EMU was a “typically fragile” fixed rate regime, with its worst crisis in 1992. The UK left the EMU and never came back.

c. The Eurozone Is Launched: 1999 and Beyond

The euro started in 1999, administered by the ECB. There are 18 members of the Eurozone; 2 countries are waiting for admission; 8 countries did not join the ERM, although all except the UK and Sweden are expected to join. There is popular opposition to the euro in Denmark, Sweden, and the UK.

2. Summary

Europe has historically exhibited a preference for fixed rates. The EU project is increasing integration, so the OCA criteria will come closer to being satisfied. Still, it is unlikely that the Eurozone will ever be an OCA. The euro is fundamentally a political project. To see the implications of this fact, we will next look at the operational problems of the euro in its first decade.

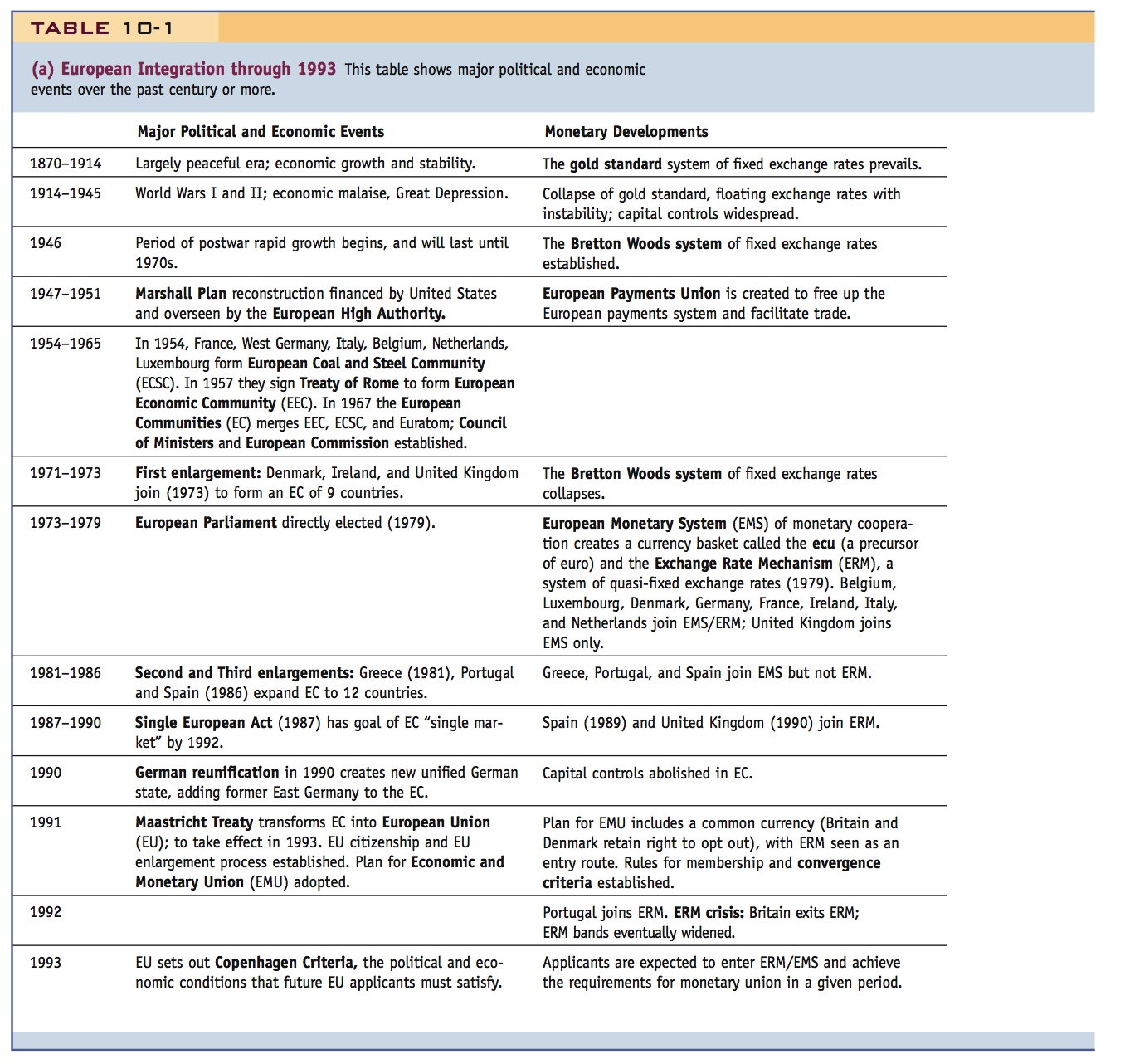

The political origins of the European Union and the euro project can be found in the past. As long ago as 1861, the eminent French writer and statesman Victor Hugo could imagine that “a day will come in which markets open to commerce and minds open to ideas will be the sole battlefields.” The timeline in Table 10-1 provides a summary of some of the most important events that have shaped European economic history since 1870. The course of events reveals a European project guided by politics as well as economics.

A Brief History of Europe

This survey would probably be useful for most American students, for whom most of this would be new. It also establishes the importance of the euro as an essential part of the effort to achieve European unification.

The table shows major political and economic events since 1870 and highlights the most important developments affecting monetary policy over the same period. The table is divided into two periods: panel (a) sketches the more distant history that shaped the creation of the EU and progress toward EMU, culminating in the Maastricht Treaty of 1991; panel (b) supplies more detail on important recent events affecting the EU and the EMU project.

The EU project emerged as a cooperative response to a history of noncooperation among nations on the continent, which twice in the twentieth century spilled over into violent military conflict, in World War I (1914–1919) and World War II (1939–1945). Even during the interwar years, political tensions ran high and economic cooperation suffered. The situation was not helped by the punishing economic burdens placed on Germany by the Allied powers after World War I.7 Matters only became worse during the severe economic downturn that was the Great Depression of the 1930s: protectionism surged again and the gold standard collapsed amid beggarthy-neighbor devaluations (as discussed in the chapter on fixed and floating regimes).

In 1945, as a weak Europe emerged from the devastation of World War II, many feared that peace would only bring about a return to dire economic conditions. More economic suffering might also sow the seeds of more conflict in the future. At an extreme, some feared it would undermine the legitimacy of European capitalism, with the neighboring Soviet bloc all too eager to spread its alternative Communist model.

What could be done? In a speech in Zurich, on September 19, 1946, Winston Churchill presented his vision:

417

And what is the plight to which Europe has been reduced?…Over wide areas a vast quivering mass of tormented, hungry, care-worn and bewildered human beings gape at the ruins of their cities and their homes, and scan the dark horizons for the approach of some new peril, tyranny or terror.…That is all that Europeans, grouped in so many ancient states and nations…have got by tearing each other to pieces and spreading havoc far and wide. Yet all the while there is a remedy.…It is to recreate the European family, or as much of it as we can, and to provide it with a structure under which it can dwell in peace, in safety and in freedom. We must build a kind of United States of Europe.

Say that part of the rationale of the EU was to prevent economic and political dominance of Germany, and that the adoption of a common currency was a way of cementing Germany into the European economy.

Back from the Brink: Marshall Plan to Maastricht, 1945–1991 Into this crisis stepped the United States, to offer what has gone down in history as the most generous and successful reconstruction plan ever undertaken, the Marshall Plan.8 From 1947 to 1951 Americans poured billions of dollars worth of aid into the war-torn regions of Western Europe to rebuild economic infrastructure (the Soviet bloc refused to take part in the plan).

The Marshall Plan required that the funds be allocated and administered by a European High Authority, composed of representatives of all countries, which encouraged collective action to solve common problems. Many cooperative arrangements were soon established: to smooth international payments and help trade (European Payments Union, or EPU, in 1950); to encourage trade and diminish rivalries in key goods like coal and steel (European Coal and Steel Community, or ECSC, in 1954); and to promote atomic and nuclear science without military rivalry (Euratom, in 1957).

In 1957 the Treaty of Rome was signed by six countries—France, West Germany, Italy, Belgium, Netherlands, and Luxembourg. They agreed to create the European Economic Community, or EEC, with plans for deeper economic cooperation and integration. In 1967 they went further and merged the EEC, the ECSC, and Euratom to create a new organization referred to as the European Communities, or EC. Two supranational bodies were created: the Council of Ministers, a decision-making body formed of national ministers, and an administrative body, the European Commission.

The dropping of the word “economic” (in the move from EEC to EC) was significant. By the 1960s two future paths had emerged. Would the EC create just a zone of economic integration? Or would it go further and aspire to a political union or a federal system of states—and if so, how far? The question has been hotly debated ever since.

In the 1970s, two major challenges to the EC project emerged: problems of expansion and problems of monetary affairs. The expansion problem involved deciding when and how to admit new members. By 1973 the first enlargement added Denmark, Ireland, and the United Kingdom. The EC (i.e., the Council of Ministers) viewed these states as the right type to gain entry—they had solid credentials in terms of economic development and stability, and all were established democracies. In contrast, the second and third enlargements included countries with weaker economic and political claims—but all the same, Greece (1981), Portugal (1986), and Spain (1986) were soon admitted to the growing club.

418

The problem of monetary affairs was precipitated by the collapse of the Bretton Woods system of fixed exchange rates in the early 1970s. As we saw in the fixed-floating chapter, the world had been operating since 1946 under a system of fixed dollar exchange rates with monetary autonomy, with the trilemma being resolved through the imposition of capital controls. In the 1970s, this system broke down and floating exchange rates became the norm in the advanced economies. At that time, except for wars and crises, Europe had spent roughly a century under some form of a fixed exchange rate system, and European policy makers worried that exchange rate instability might compromise their goals for economic union. Indeed, as early as 1969, the EC’s visionary Werner Report anticipated a path via a transitional fixed exchange rate system toward a single currency within 10 years, although the process would take much longer than that. European leaders did take the first and fateful step down this road when they announced that they would create essentially a new mini–Bretton Woods of their own, the European Monetary System, or EMS, which began operation in 1979.

419

420

The centerpiece of the EMS was the Exchange Rate Mechanism (ERM), a fixed exchange rate regime based on bands. The ERM defined each currency’s central parity against a basket of currencies, the so-called ecu (European currency unit), the precursor to the euro. In practice, the non-German currencies ended up being pegged to the German mark, the central reserve currency in the system (just as the U.S. dollar had been the central reserve currency in the Bretton Woods system).

The ERM permitted a range of fluctuation on either side of the central value or parity: a narrow band of ±2.25% for most currencies (the escudo, lira, peseta, and pound were at times permitted a wider band of ±6%). In 1979 all EC countries except the United Kingdom joined the ERM; later, Spain joined in 1989, the United Kingdom in 1990, and Portugal in 1992. In principle, it was a “fixed but adjustable” system and the central parities could be changed, giving potential encouragement to speculators (also like Bretton Woods).

Crises and Opportunities: EMU and Other Projects, 1991–1999 The EC entered the 1990s with the drive for further integration still going strong. Since 1979 a directly elected European parliament had been at work. In 1987 the Single European Act was passed with the goal of reducing further the barriers between countries through the creation of a “single market” by 1992.

If, within the EC, the political momentum was still strong, it was soon given another push by the end of the Cold War in 1989. The Soviet Union disintegrated and Communist rule in Eastern Europe came to an end, symbolized by the fall of the Berlin Wall. What was the EC going to do in response? The Germans had no doubts—East and West Germany would be reunited quickly, to form Germany again. German reunification was formally completed on October 3, 1990. For the EC as a whole, though, there was the question of how to react to the new states on their eastern flank.

The countries of Eastern Europe were eager to move quickly and decisively away from Communism and autocracy and toward capitalism and democracy, and they saw joining the EC as a natural means to that end. From a political and security standpoint, the EC could hardly say no to the former Communist countries, and so plans for further eastern enlargement had to be made rather quickly. Other countries also waited in the wings. In the early 1990s wars broke out in the Balkans, forcing the EC to confront the big hole in its map between Italy and Greece. Did the former Yugoslav states and Albania belong in “Europe,” too? And discussion of the eastern frontier of the EC soon brought to the fore the question of Turkey, a country that has had EC associate member status since 1963 and yet had to wait until 2005 for formal admission talks to begin.

In the face of these political challenges, the EC needed to act with purpose, and the grandest treaty to date, the 1991 Treaty on European Union, or the Maastricht Treaty, was the response, reasserting more than ever the goal of creating an “ever closer union among the peoples of Europe.” Adding more federal flavor, the treaty gave the EC a new name, the European Union, or EU, and created a notion of EU citizenship. The treaty also laid down the process for enlargement that would eventually take the EU, via three further enlargements to 15 in 1995, 25 in 2004, and 27 in 2007.

421

Later political developments in the 1990s built on Maastricht. The 1993 Copenhagen Criteria provided formal conditions for new members wanting admission, such as rule of law, human rights, democracy, and so on. The 1995 Schengen Treaty established a zone for the free movement of people (though Ireland and the United Kingdom opted out). The 1997 Amsterdam Treaty forged ahead in EU foreign and security policy and strengthened the rights of EU citizenship and the powers of the European parliament.

The most ambitious part of the Maastricht Treaty was its economic element: the EU-wide goal of Economic and Monetary Union (EMU). The economic union would take the idea of a single market even further—to all goods and services, to capital markets, to labor markets—and would call on the European Commission to ensure that national laws and regulations did not stand in the way. But more than this, monetary union would propose a new currency (soon given the name “euro”) for the entire EU. Under the plan for the euro, countries would transition from their pegged rates within the ERM into an irrevocable peg with the euro at an appointed date. But this plan almost immediately came into doubt.

The ERM proved to be a typically fragile fixed exchange rate system. As we saw in the last chapter, its worst moment came in 1992. In the ERM crisis, several ERM countries suffered exchange rate crises and their pegs broke: the British pound, Italian lira, Portuguese escudo, and Spanish peseta. (Other non-ERM currencies such as the Swedish krona and the Finnish markka pegged to the mark also experienced crises and broken pegs.) Even the currencies that stayed within the ERM had to have their bands widened so much as to make their pegs look more like floats for a while. The whole system was reduced to a near shambles.

As we saw in the past two chapters, the fundamental cause of these crises was a tension between the macroeconomic objectives of the center country, Germany (tight monetary policy to prevent overheating after a large fiscal shock caused by reunification), and the objectives of the pegging countries (whose authorities wanted to use expansionary monetary policy to boost output during a period of global slowdown).

The ghosts of the 1992 crisis still roam today. Many countries rejoined the ERM, some at a new rate or with a wider band: Spain, Italy, and Portugal all regrouped, reentered ERM, and ultimately adopted the euro. But Britain permanently left the ERM and turned its back on the common currency. Sweden, officially committed to the euro, has never shown any interest in joining even the ERM. Today, in both Britain and Sweden, public opposition to the euro remains high. And there is always the fear that another ERM crisis could erupt in new EU members that are pegging to the euro as part of their preparation for joining the common currency.

Still, despite the exchange rate crisis in 1992, the ERM was patched up, and most countries remained committed to the plan to launch the euro. The ERM bands were widened in 1993 to a very slack ±15%, and most were happy to live within those limits and get ready for euro admission.

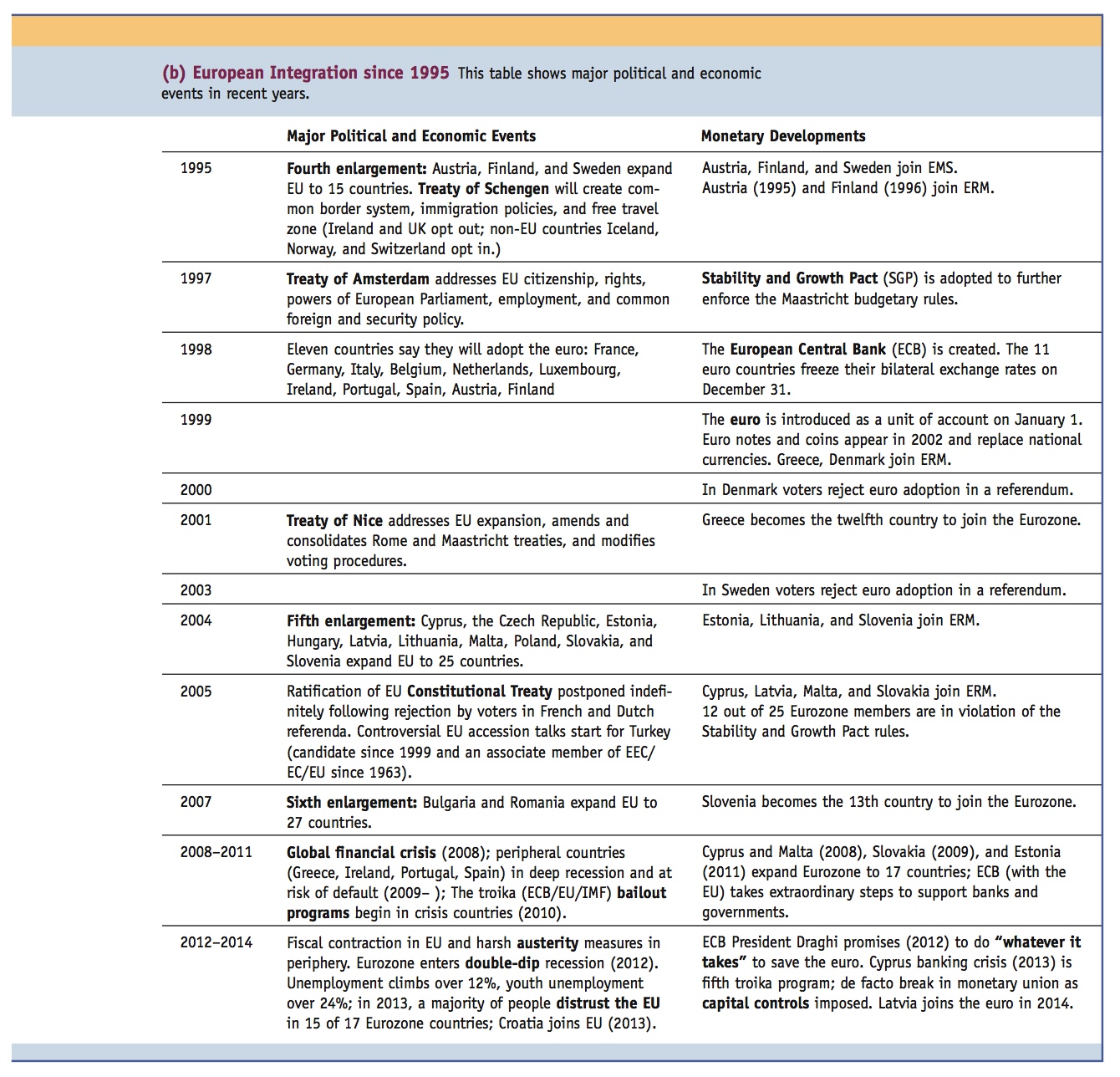

The Eurozone Is Launched: 1999 and Beyond The euro was launched in 11 countries on January 1, 1999, and administered by a newly created central bank, the European Central Bank (ECB).9 The ECB took control of monetary policy in all Eurozone countries on that date from each national central bank.10 The national central banks still have responsibilities. They represent their country on the ECB Council, and still supervise and regulate their own country’s financial system. The euro immediately became the unit of account in the Eurozone, and a gradual transition took place as euros began to enter circulation and national currencies were withdrawn.

422

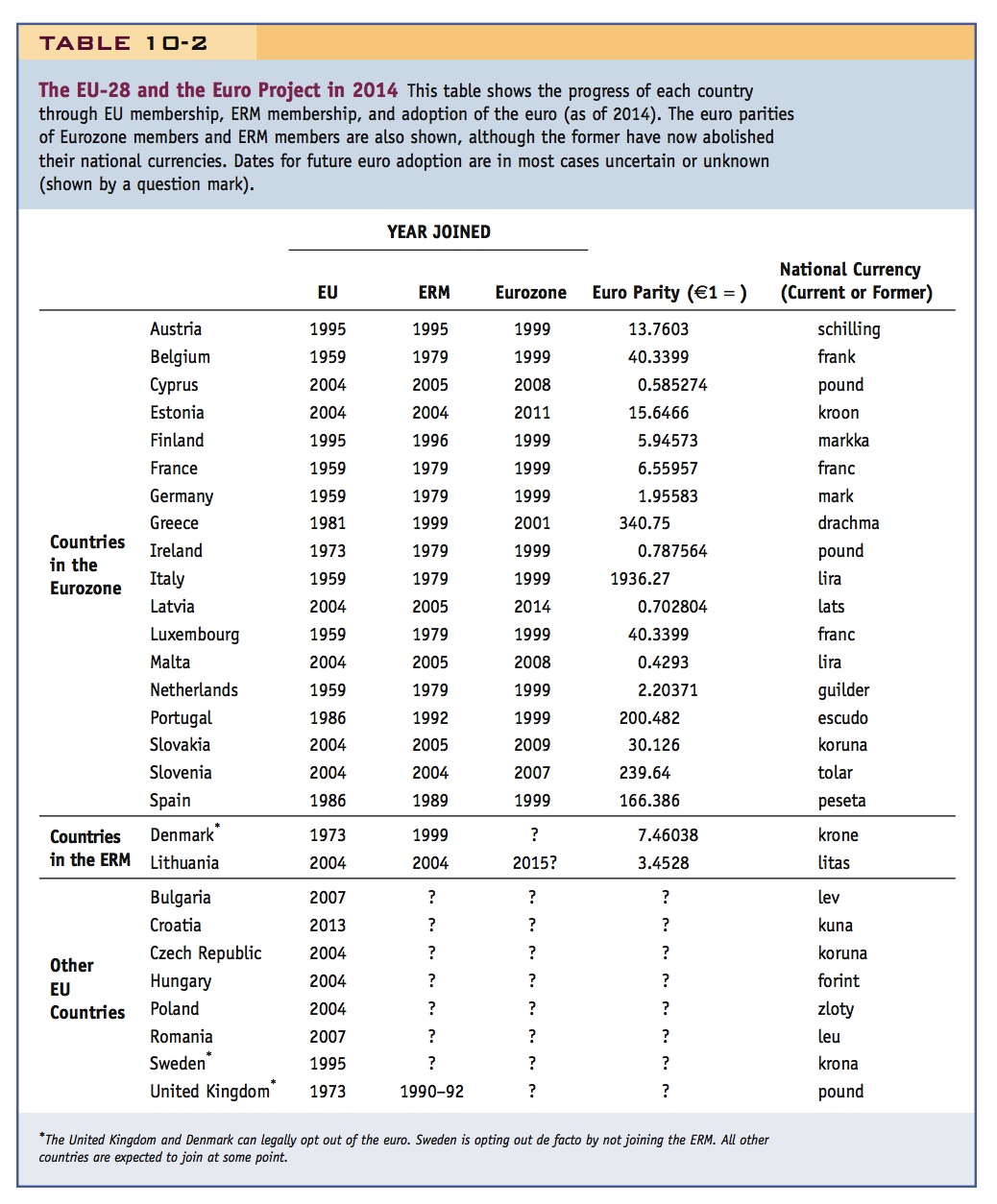

Table 10-2 shows the history and current state of the EU at the time of this writing in 2014. The table shows the dates of membership in the EU, the ERM, and the Eurozone. Also shown are the fixed exchange rate parities of all ERM and euro members—for the latter, these were frozen upon euro entry and became obsolete once the national currencies were retired.11

As of 2014, the Eurozone contains 18 “in” countries. Eleven made the switch to the euro in 1999, Greece entered in 2001, Slovenia in 2007, Cyprus and Malta in 2008, Slovakia in 2009, Estonia in 2011, and Latvia in 2014. There are 10 “out” countries. In the ERM “waiting room,” there are 2 countries; one of them, Denmark, has been waiting a long time. There are 8 countries not in ERM, although all except the United Kingdom and Sweden are expected to join the ERM and the euro in the medium term of five to 10 years. Of the “out” countries, only Denmark and the United Kingdom can legally opt out of the euro indefinitely, although Sweden is acting as if it can, too; all of these last three countries have popular opposition to the euro and are not expected to adopt the euro anytime soon.

Summary

History shows that the countries of Europe have some deep tendency to prefer fixed exchange rates to floating rates. Apart from brief crisis episodes in times of turmoil (during wars, the Great Depression, and the early 1970s), most European countries have maintained pegged exchange rates against each other since the 1870s. They have now taken the additional step of adopting a common currency.

There have certainly been some economic changes in Europe that make it more likely to satisfy the OCA criteria now than at anytime in the past. The EU project has pushed forward a process of deep economic integration, with major steps such as EMU and the Schengen Treaty bringing Europe closer to the ideal of a single market. But integration is still very much a work in progress, and the OCA criteria are unlikely to be met soon.

Instead, European history leads us to the conclusion that the common currency fits as part of a political project rather than as a purely economic choice. To consider some of the implications of this conclusion, in the remainder of this chapter we consider some of the operational issues and problems faced by the Eurozone during its first decade of existence.

423