PROBLEMS

- One could view the United States as a currency union of 50 states. Compare and contrast the Eurozone and the United States in terms of the optimum currency area (OCA) criteria.

- After German reunification and the disintegration of Communist rule in Eastern Europe, several countries sought to join the European Union (EU) and later the Economic and Monetary Union (EMU). Why do you believe these countries were eager to integrate with Western Europe? Do you think policy makers in these countries believe that OCA criteria are self-fulfilling? Explain.

- The Maastricht Treaty places strict requirements on government budgets and national debt. Why do you think the Maastricht Treaty called for fiscal discipline? If it is the central bank that is responsible for maintaining the fixed exchange rate, then why does fiscal discipline matter? How might this affect the gains/losses for joining a currency union?

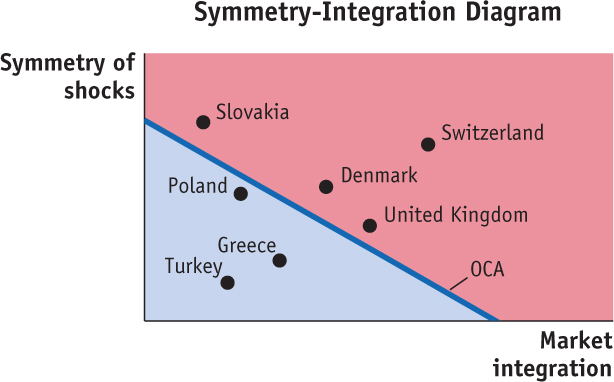

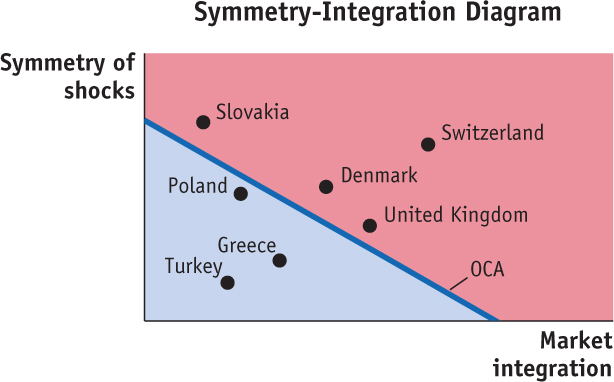

- The following figure shows some hypothetical OCA criteria with the Eurozone for selected countries. Assume that these are based solely on economic criteria—that is, without reference to other political considerations. Refer to the diagram in responding to the questions that follow.

- Which of the countries satisfy the OCA criteria for joining a monetary union?

- Compare Poland and the United Kingdom in terms of the OCA criteria regarding market integration with the Eurozone. Discuss one possible source of differences in integration (with the EU) in the two countries.

- Compare Poland and the United Kingdom in terms of the OCA criteria regarding symmetric versus asymmetric shocks (relative to the Eurozone). Discuss one possible source of differences in symmetry (with the EU) in the two countries.

- Suppose that policy makers in both Poland and the United Kingdom care only about being able to use policy in response to shocks. Which is more likely to seek membership in the EMU and why?

- What did the ERM crises reveal about the preferences of the United Kingdom? Why has the United Kingdom sought membership only in the EU without seeking membership in the Eurozone? Consider other costs and benefits not in the diagram, both economic and political.

- What did membership in the Eurozone reveal about the preferences of Greece? Consider other costs and benefits not in the diagram, both economic and political.

- Congress established the Federal Reserve System in 1914. Up to this point, the United States did not have a national currency; Federal Reserve notes are still the paper currency in circulation today. Earlier attempts at establishing a central bank were opposed on the grounds that a central bank would give the federal government monopoly over money. This was a reflection of the historic debate between maintaining states’ rights versus establishing a strong centralized authority in the United States. That is, the creation of the Fed and a national currency would mean that states would no longer have the authority to control the money supply on a regional level. Discuss the debate between states’ rights versus centralized authority in the context of the EMU and the European Central Bank.

- In recent years there have been reports that a group of six Gulf countries (Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates) were considering the introduction of a single currency. Currently, these countries use currencies that are effectively pegged to the U.S. dollar. These countries rely heavily on oil exports to the rest of the world, and political leaders in these countries are concerned about diversifying trade. Based on this information, discuss the OCA criteria for this group of countries. What are the greatest potential benefits? What are the potential costs?

- Before taking office as the new Federal Reserve chairman, Ben Bernanke advocated for the adoption of an inflation target to promote price stability in the United States. Compare and contrast the Fed and the European Central Bank in terms of their commitment to price stability and economic stability. Which central bank has more independence to pursue price stability as a primary objective? Explain.

- Why do countries with less independent central banks tend to have higher inflation rates? Is it possible for the central bank to increase output and reduce unemployment in the long run? In the long run, is the German model a good one? Explain why or why not.

- Compare the Maastricht Treaty convergence criteria with the OCA criteria. How are these convergence criteria related to the potential benefits and costs associated with joining a currency union? If you were a policy maker in a country seeking to join the EMU, which criterion would you eliminate and why?