PROBLEMS

110

- Suppose that two countries, Vietnam and Côte d’Ivoire, produce coffee. The currency unit used in Vietnam is the dong (VND). Côte d’Ivoire is a member of Communauté Financière Africaine (CFA), a currency union of West African countries that use the CFA franc (XOF). In Vietnam, coffee sells for 5,000 dong (VND) per pound. The exchange rate is 30 VND per 1 CFA franc, EVND/XOF = 30.

Question

If the law of one price holds, what is the price of coffee in Côte d’Ivoire, measured in CFA francs?

Prob 3 1a. If the law of one price holds, what is the price of coffee in Côte d’Ivoire, measured in CFA francs?Question

Assume the price of coffee in Côte d’Ivoire is actually 160 CFA francs per pound of coffee. Compute the relative price of coffee in Côte d’Ivoire versus Vietnam. Where will coffee traders buy coffee? Where will they sell coffee in this case? How will these transactions affect the price of coffee in Vietnam? In Côte d’Ivoire?

Prob 3 1b. Assume the price of coffee in Côte d’Ivoire is actually 160 CFA francs per pound of coffee. Compute the relative price of coffee in Côte d’Ivoire versus Vietnam. Where will coffee traders buy coffee? Where will they sell coffee in this case? How will these transactions affect the price of coffee in Vietnam? In Côte d’Ivoire?

- Consider each of the following goods and services. For each, identify whether the law of one price will hold, and state whether the relative price

is greater than, less than, or equal to 1. Explain your answer in terms of the assumptions we make when using the law of one price.

is greater than, less than, or equal to 1. Explain your answer in terms of the assumptions we make when using the law of one price.Question

Rice traded freely in the United States and Canada

Prob 3 2a. Rice traded freely in the United States and CanadaQuestion

Sugar traded in the United States and Mexico; the U.S. government imposes a quota on sugar imports into the United States

Prob 3 2b. Sugar traded in the United States and Mexico; the U.S. government imposes a quota on sugar imports into the United StatesQuestion

The McDonald’s Big Mac sold in the United States and Japan

Prob 3 2c. The McDonald’s Big Mac sold in the United States and JapanQuestion

Haircuts in the United States and the United Kingdom

Prob 3 2d. Haircuts in the United States and the United Kingdom

Question

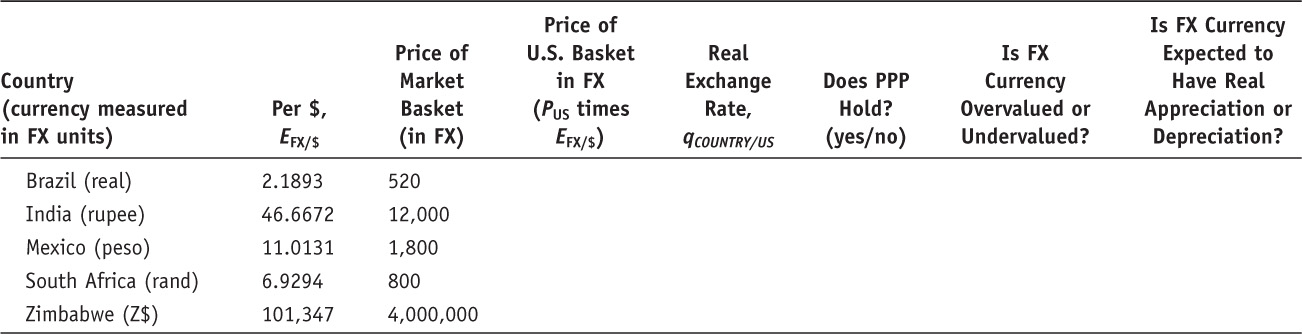

Use the table that follows to answer this question. Treat the country listed as the home country, and treat the United States as the foreign country. Suppose the cost of the market basket in the United States is PUS = $190. Check to see whether PPP holds for each of the countries listed, and determine whether we should expect a real appreciation or real depreciation for each country (relative to the United States) in the long run. For the answer, create a table similar to the one shown and fill in the blank cells. (Hint: Use a spreadsheet application such as Excel.)

Prob 3 3. Use the table that follows to answer this question. Treat the country listed as the home country, and treat the United States as the foreign country. Suppose the cost of the market basket in the United States is PUS = $190. Check to see whether PPP holds for each of the countries listed, and determine whether we should expect a real appreciation or real depreciation for each country (relative to the United States) in the long run. For the answer, create a table similar to the one shown and fill in the blank cells. (Hint: Use a spreadsheet application such as Excel.)

Prob 3 3. Use the table that follows to answer this question. Treat the country listed as the home country, and treat the United States as the foreign country. Suppose the cost of the market basket in the United States is PUS = $190. Check to see whether PPP holds for each of the countries listed, and determine whether we should expect a real appreciation or real depreciation for each country (relative to the United States) in the long run. For the answer, create a table similar to the one shown and fill in the blank cells. (Hint: Use a spreadsheet application such as Excel.)Question

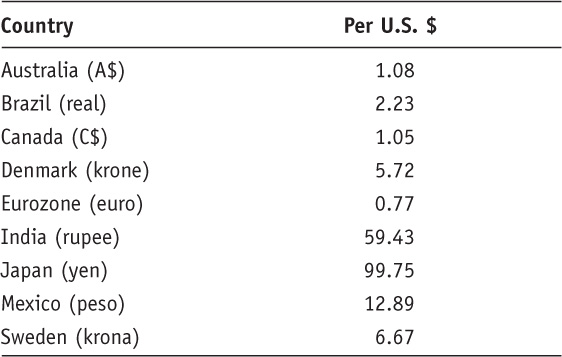

Table 3-1 in the text shows the percentage undervaluation or overvaluation in the Big Mac, based on exchange rates in July 2012. Suppose purchasing power parity holds in the long run, so that these deviations would be expected to disappear. Suppose the local currency prices of the Big Mac remained unchanged. Exchange rates one year later on July 1, 2013, were as follows (Source: ft.com):

Based on these data and Table 3-1, calculate the change in the exchange rate from July 2012 to July 2013, and state whether the direction of change was consistent with the PPP-implied exchange rate using the Big Mac Index. How might you explain the failure of the Big Mac Index to correctly predict the change in the nominal exchange rate between July 2012 and July 2013?Prob 3 4. Table 3-1 in the text shows the percentage undervaluation or overvaluation in the Big Mac, based on exchange rates in July 2012. Suppose purchasing power parity holds in the long run, so that these deviations would be expected to disappear. Suppose the local currency prices of the Big Mac remained unchanged. Exchange rates one year later on July 1, 2013, were as follows (Source: ft.com):- You are given the following information. The current dollar-pound exchange rate is $2 per pound. A U.S. basket that costs $100 would cost $120 in the United Kingdom. For the next year, the Fed is predicted to keep U.S. inflation at 2% and the Bank of England is predicted to keep U.K. inflation at 3%. The speed of convergence to absolute PPP is 15% per year.

Question

What is the expected U.S. minus U.K. inflation differential for the coming year?

Prob 3 5a. What is the expected U.S. minus U.K. inflation differential for the coming year?Question

What is the current U.S. real exchange rate qUS/UK with the United Kingdom?

Prob 3 5b. What is the current U.S. real exchange rate qUS/UK with the United Kingdom?Question

How much is the dollar overvalued/undervalued?

Prob 3 5c. How much is the dollar overvalued/undervalued?Question

What do you predict the U.S. real exchange rate with the United Kingdom will be in one year’s time?

Prob 3 5d. What do you predict the U.S. real exchange rate with the United Kingdom will be in one year’s time?Question

What is the expected rate of real depreciation for the United States (versus the United Kingdom)?

Prob 3 5e. What is the expected rate of real depreciation for the United States (versus the United Kingdom)?Question

What is the expected rate of nominal depreciation for the United States (versus the United Kingdom)?

Prob 3 5f. What is the expected rate of nominal depreciation for the United States (versus the United Kingdom)?Question

What do you predict will be the dollar price of one pound a year from now?

Prob 3 5g. What do you predict will be the dollar price of one pound a year from now?

Question

Describe how each of the following factors might explain why PPP is a better guide for exchange rate movements in the long run versus the short run: (i) transactions costs, (ii) nontraded goods, (iii) imperfect competition, (iv) price stickiness. As markets become increasingly integrated, do you suspect PPP will become a more useful guide in the future? Why or why not?

Prob 3 6. Describe how each of the following factors might explain why PPP is a better guide for exchange rate movements in the long run versus the short run: (i) transactions costs, (ii) nontraded goods, (iii) imperfect competition, (iv) price stickiness. As markets become increasingly integrated, do you suspect PPP will become a more useful guide in the future? Why or why not?- Consider two countries: Japan and Korea. In 1996 Japan experienced relatively slow output growth (1%), while Korea had relatively robust output growth (6%). Suppose the Bank of Japan allowed the money supply to grow by 2% each year, while the Bank of Korea chose to maintain relatively high money growth of 12% per year.

For the following questions, use the simple monetary model (where L is constant). You will find it easiest to treat Korea as the home country and Japan as the foreign country.Question

What is the inflation rate in Korea? In Japan?

Prob 3 7a. What is the inflation rate in Korea? In Japan?Question

What is the expected rate of depreciation in the Korean won relative to the Japanese yen (¥)?

Prob 3 7b. What is the expected rate of depreciation in the Korean won relative to the Japanese yen (¥)?Question

Suppose the Bank of Korea increases the money growth rate from 12% to 15%. If nothing in Japan changes, what is the new inflation rate in Korea?

Prob 3 7c. Suppose the Bank of Korea increases the money growth rate from 12% to 15%. If nothing in Japan changes, what is the new inflation rate in Korea?Question

Using time series diagrams, illustrate how this increase in the money growth rate affects the money supply MK, Korea’s interest rate, prices PK, real money supply, and Ewon/¥ over time. (Plot each variable on the vertical axis and time on the horizontal axis.)

Prob 3 7d. Using time series diagrams, illustrate how this increase in the money growth rate affects the money supply MK, Korea’s interest rate, prices PK, real money supply, and Ewon/¥ over time. (Plot each variable on the vertical axis and time on the horizontal axis.)Question

Suppose the Bank of Korea wants to maintain an exchange rate peg with the Japanese yen. What money growth rate would the Bank of Korea have to choose to keep the value of the won fixed relative to the yen?

Prob 3 7e. Suppose the Bank of Korea wants to maintain an exchange rate peg with the Japanese yen. What money growth rate would the Bank of Korea have to choose to keep the value of the won fixed relative to the yen?Question

Suppose the Bank of Korea sought to implement policy that would cause the Korean won to appreciate relative to the Japanese yen. What ranges of the money growth rate (assuming positive values) would allow the Bank of Korea to achieve this objective?

Prob 3 7f. Suppose the Bank of Korea sought to implement policy that would cause the Korean won to appreciate relative to the Japanese yen. What ranges of the money growth rate (assuming positive values) would allow the Bank of Korea to achieve this objective?

- This question uses the general monetary model, where L is no longer assumed constant, and money demand is inversely related to the nominal interest rate. Consider the same scenario described at the beginning of the previous question. In addition, the bank deposits in Japan pay a 3% interest rate, i¥ = 3%.

Question

Compute the interest rate paid on Korean deposits.

Prob 3 8a. Compute the interest rate paid on Korean deposits.Question

Using the definition of the real interest rate (nominal interest rate adjusted for inflation), show that the real interest rate in Korea is equal to the real interest rate in Japan. (Note that the inflation rates you computed in the previous question will be the same in this question.)

Prob 3 8b. Using the definition of the real interest rate (nominal interest rate adjusted for inflation), show that the real interest rate in Korea is equal to the real interest rate in Japan. (Note that the inflation rates you computed in the previous question will be the same in this question.)Question

Suppose the Bank of Korea increases the money growth rate from 12% to 15% and the inflation rate rises proportionately (one for one) with this increase. If the nominal interest rate in Japan remains unchanged, what happens to the interest rate paid on Korean deposits?

Prob 3 8c. Suppose the Bank of Korea increases the money growth rate from 12% to 15% and the inflation rate rises proportionately (one for one) with this increase. If the nominal interest rate in Japan remains unchanged, what happens to the interest rate paid on Korean deposits?Question

Using time series diagrams, illustrate how this increase in the money growth rate affects the money supply MK; Korea’s interest rate; prices PK; real money supply; and Ewon/¥ over time. (Plot each variable on the vertical axis and time on the horizontal axis.)

Prob 3 8d. Using time series diagrams, illustrate how this increase in the money growth rate affects the money supply MK; Korea’s interest rate; prices PK; real money supply; and Ewon/¥ over time. (Plot each variable on the vertical axis and time on the horizontal axis.)

- Both advanced economics and developing countries have experienced a decrease in inflation since the 1980s (see Table 3-3 in the text). This question considers how the choice of policy regime has influenced such global disinflation. Use the monetary model to answer this question.

Question

The Swiss Central Bank currently targets its money growth rate to achieve policy objectives. Suppose Switzerland has output growth of 3% and money growth of 8% each year. What is Switzerland’s inflation rate in this case? Describe how the Swiss Central Bank could achieve an inflation rate of 2% in the long run through the use of a nominal anchor.

Prob 3 9a. The Swiss Central Bank currently targets its money growth rate to achieve policy objectives. Suppose Switzerland has output growth of 3% and money growth of 8% each year. What is Switzerland’s inflation rate in this case? Describe how the Swiss Central Bank could achieve an inflation rate of 2% in the long run through the use of a nominal anchor.Question

Like the Federal Reserve, the Reserve Bank of New Zealand uses an interest rate target. Suppose the Reserve Bank of New Zealand maintains a 6% interest rate target and the world real interest rate is 1.5%. What is the New Zealand inflation rate in the long run? In 1997 New Zealand adopted a policy agreement that required the bank to maintain an inflation rate no higher than 2.5%. What interest rate targets would achieve this objective?

Prob 3 9b. Like the Federal Reserve, the Reserve Bank of New Zealand uses an interest rate target. Suppose the Reserve Bank of New Zealand maintains a 6% interest rate target and the world real interest rate is 1.5%. What is the New Zealand inflation rate in the long run? In 1997 New Zealand adopted a policy agreement that required the bank to maintain an inflation rate no higher than 2.5%. What interest rate targets would achieve this objective?Question

The central bank of Lithuania maintains an exchange rate band relative to the euro. This is a prerequisite for joining the Eurozone. Lithuania must keep its exchange rate within ±15% of the central parity of 3.4528 litas per euro. Compute the exchange rate values corresponding to the upper and lower edges of this band. Suppose PPP holds. Assuming Eurozone inflation is currently 2% per year and inflation in Lithuania is 5%, compute the rate of depreciation of the lita. Will Lithuania be able to maintain the band requirement? For how long? Does your answer depend on where in the band the exchange rate currently sits? A primary objective of the European Central Bank is price stability (low inflation) in the current and future Eurozone. Is an exchange rate band a necessary or sufficient condition for the attainment of this objective?

Prob 3 9c. The central bank of Lithuania maintains an exchange rate band relative to the euro. This is a prerequisite for joining the Eurozone. Lithuania must keep its exchange rate within ±15% of the central parity of 3.4528 litas per euro. Compute the exchange rate values corresponding to the upper and lower edges of this band. Suppose PPP holds. Assuming Eurozone inflation is currently 2% per year and inflation in Lithuania is 5%, compute the rate of depreciation of the lita. Will Lithuania be able to maintain the band requirement? For how long? Does your answer depend on where in the band the exchange rate currently sits? A primary objective of the European Central Bank is price stability (low inflation) in the current and future Eurozone. Is an exchange rate band a necessary or sufficient condition for the attainment of this objective?

Question

Several countries that have experienced hyperinflation adopt dollarization as a way to control domestic inflation. For example, Ecuador has used the U.S. dollar as its domestic currency since 2000. What does dollarization imply about the exchange rate between Ecuador and the United States? Why might countries experiencing hyperinflation adopt dollarization? Why might they do this rather than just fixing their exchange rate?

Prob 3 10. Several countries that have experienced hyperinflation adopt dollarization as a way to control domestic inflation. For example, Ecuador has used the U.S. dollar as its domestic currency since 2000. What does dollarization imply about the exchange rate between Ecuador and the United States? Why might countries experiencing hyperinflation adopt dollarization? Why might they do this rather than just fixing their exchange rate?- You are the central banker for a country that is considering the adoption of a new nominal anchor. When you take the position as chairperson, the inflation rate is 4% and your position as the central bank chairperson requires that you achieve a 2.5% inflation target within the next year. The economy’s growth in real output is currently 3%. The world real interest rate is currently 1.5%. The currency used in your country is the lira. Assume prices are flexible.

Question

Why is having a nominal anchor important for you to achieve the inflation target? What is the drawback of using a nominal anchor?

Prob 3 11a. Why is having a nominal anchor important for you to achieve the inflation target? What is the drawback of using a nominal anchor?Question

What is the growth rate of the money supply in this economy? If you choose to adopt a money supply target, which money supply growth rate will allow you to meet your inflation target?

Prob 3 11b. What is the growth rate of the money supply in this economy? If you choose to adopt a money supply target, which money supply growth rate will allow you to meet your inflation target?Question

Suppose the inflation rate in the United States is currently 2% and you adopt an exchange rate target relative to the U.S. dollar. Compute the percent appreciation/depreciation in the lira needed for you to achieve your inflation target. Will the lira appreciate or depreciate relative to the U.S. dollar?

Prob 3 11c. Suppose the inflation rate in the United States is currently 2% and you adopt an exchange rate target relative to the U.S. dollar. Compute the percent appreciation/depreciation in the lira needed for you to achieve your inflation target. Will the lira appreciate or depreciate relative to the U.S. dollar?Question

Your final option is to achieve your inflation target using interest rate policy. Using the Fisher equation, compute the current nominal interest rate in your country. What nominal interest rate will allow you to achieve the inflation target?

Prob 3 11d. Your final option is to achieve your inflation target using interest rate policy. Using the Fisher equation, compute the current nominal interest rate in your country. What nominal interest rate will allow you to achieve the inflation target?