Chapter 1: HEADLINES: The Wealth of Nations

See the full-size image.

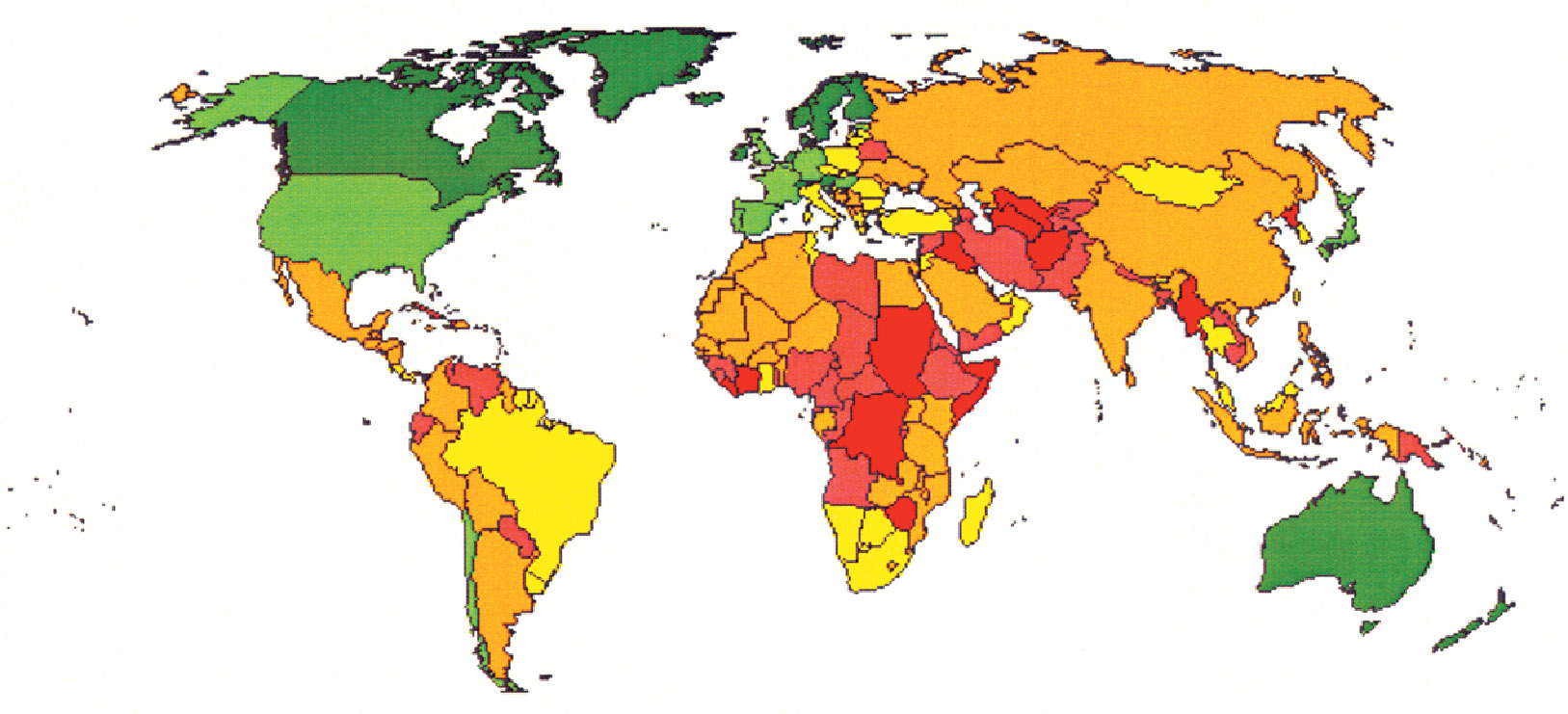

Social scientists have sought for centuries to understand the essential conditions that enable a nation to achieve prosperity. In The Wealth of Nations, Adam Smith said: “Little else is requisite to carry a state to the highest degree of opulence from the lowest barbarism, but peace, easy taxes, and a tolerable administration of justice; all the rest being brought about by the natural course of things.” The following article discusses the poor quality of governance in developing countries and the obstacle this poses to economic development.

It takes 200 days to register a newbusiness in Haiti and just two in Australia. This contrast perfectly encapsulates the gulf between one of the world’s poorest countries and one of the richest. A sophisticated market economy is a uniquely powerful engine of prosperity. Yet, in far too many poor countries, the law’s delays and the insolence of office prevent desperately needed improvements in economic performance.

That makes [the 2005] ”World Development Report” among the most important the World Bank has ever produced.* It is about how to make market economies work… . The report is based on two big research projects: surveys of the investment climate … in 53 countries; and the “doing business” project, which identifies obstacles to business in 130 countries… . The argument starts with growth. As the report rightly notes: “With rising populations, economic growth is the only sustainable mechanism for increasing a society’s standard of living.” Happily, “investment climate improvements in China and India have driven the greatest reductions in poverty the world has ever seen.” … Governmental failure is the most important obstacle business faces. Inadequate enforcement of contracts, inappropriate regulations, corruption, rampant crime and unreliable infrastructure can cost 25 per cent of sales. This is more than three times what businesses typically pay in taxes. Similarly, when asked to enumerate the obstacles they face, businesses list policy uncertainty, macroeconomic instability, taxes and corruption at the head of the list. What do these have in common? Incompetence and malfeasance by governments is again the answer… .

In many developing countries, the requirement is not less government but more and better directed government. What does this involve? Four requirements are listed: a reduction in the “rent-

One of the conclusions the report rightly draws from this list is that reform is not a one-

Turning these broad objectives into specific policy is a tricky business. The Bank describes its core recommendation as “delivering the basics.” These are: stability and security, which includes protection of property…, facilitating contract enforcement, curbing crime and compensating for expropriation; better regulation and taxation, which means focusing intervention where it is needed, broadening the tax base and lowering tax rates, and reducing barriers to trade; better finance and infrastructure, which requires both more competition and better regulation; and transforming labour market regulation, to foster skills, while avoiding the counterproductive interventions that so often destroy employment in the formal sector….

The world’s wealthy countries can also help by lifting their many barriers to imports from developing countries and by targeting aid on improving the investment climate.

Governments then are both the disease and the cure. This is why development is so hard and so slow. The big advance is in the richness of our understanding of what makes an economy thrive. But that understanding also demonstrates the difficulties. The Bank’s recognition of the nature of the disease is at least a first step towards the cure.

*A Better Investment Climate for Everyone, World Development Report 2005. Oxford University Press and the World Bank.

Source: Martin Wolf, “Sweep Away the Barriers to Growth,” Financial Times, October 5, 2004. From The Financial Times © The Financial Times Limited 2004. All Rights Reserved.

Questions to Consider

After reading The Wealth of Nations, consider the question(s) below. Then “submit” your response.