Question 16

Screen 1 of 1

Chapter 19. Question 16

19.1 Screen 1 of 1

Question 16

true

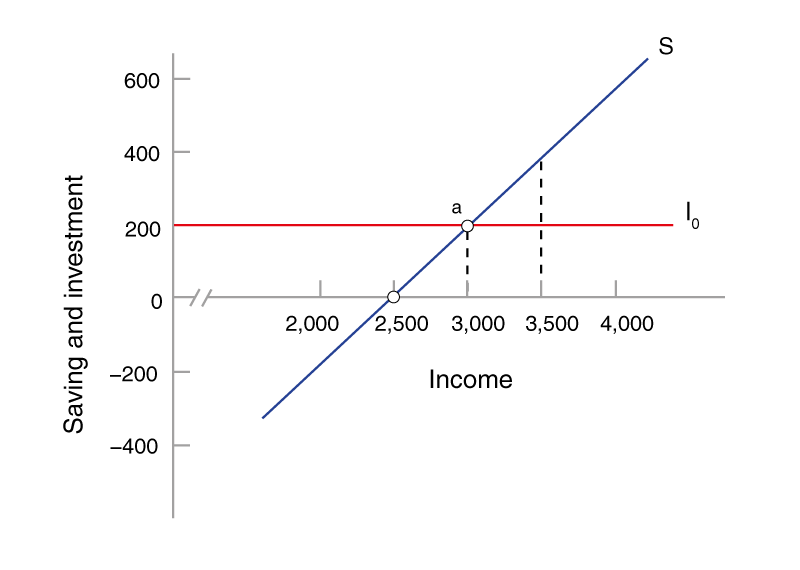

Use the figure below to answer the following questions.

The numerical value of the MPC is .

The numerical value of the multiplier is .

Correct! MPS is calculated as the change in saving divided by the change in income. We see in the graph that as income rises by $500, saving rises by $200. Since this is a straight line, the slope is constant; it doesn’t matter which two points on the S line are used to calculate MPS. $200 divided by $500 is 0.4.

MPS is the proportion of additional income that is saved (not consumed), while MPC is the portion of additional income that is consumed. We can calculate MPC as 1-MPS. Here,

MPC = 1 – 0.4 = 0.6. In other words, $300 of each additional $500 income, or 60 percent, is consumed rather than saved.

The multiplier is calculated as 1/MPS. Here, 1÷0.4 = 2.5. Similarly, the multiplier can also be calculated as 1÷(1 – MPC) = 1÷(1 – 0.6) = 1÷0.4 = 2.5.

MPS is the proportion of additional income that is saved (not consumed), while MPC is the portion of additional income that is consumed. We can calculate MPC as 1-MPS. Here,

MPC = 1 – 0.4 = 0.6. In other words, $300 of each additional $500 income, or 60 percent, is consumed rather than saved.

The multiplier is calculated as 1/MPS. Here, 1÷0.4 = 2.5. Similarly, the multiplier can also be calculated as 1÷(1 – MPC) = 1÷(1 – 0.6) = 1÷0.4 = 2.5.

Incorrect! MPS is calculated as the change in saving divided by the change in income. We see in the graph that as income rises by $500, saving rises by $200. Since this is a straight line, the slope is constant; it doesn’t matter which two points on the S line are used to calculate MPS. $200 divided by $500 is 0.4.

MPS is the proportion of additional income that is saved (not consumed), while MPC is the portion of additional income that is consumed. We can calculate MPC as 1-MPS. Here,

MPC = 1 – 0.4 = 0.6. In other words, $300 of each additional $500 income, or 60 percent, is consumed rather than saved.

The multiplier is calculated as 1/MPS. Here, 1÷0.4 = 2.5. Similarly, the multiplier can also be calculated as 1÷(1 – MPC) = 1÷(1 – 0.6) = 1÷0.4 = 2.5.

MPS is the proportion of additional income that is saved (not consumed), while MPC is the portion of additional income that is consumed. We can calculate MPC as 1-MPS. Here,

MPC = 1 – 0.4 = 0.6. In other words, $300 of each additional $500 income, or 60 percent, is consumed rather than saved.

The multiplier is calculated as 1/MPS. Here, 1÷0.4 = 2.5. Similarly, the multiplier can also be calculated as 1÷(1 – MPC) = 1÷(1 – 0.6) = 1÷0.4 = 2.5.

Correct! To reach the full employment level of spending, policymakers need only to spend part of the needed amount and let the multiplier effect provide the rest. Here, point a represents $3000 income, so an additional $1000 income is needed to reach the $4000 full employment level. With a multiplier of 2.5, only $400 additional spending is required since $400 x 2.5 = $1000. This amount can also be calculated by dividing the desired change in total income by the multiplier, or $1000 ÷ 2.5 = $400.

Incorrect! To reach the full employment level of spending, policymakers need only to spend part of the needed amount and let the multiplier effect provide the rest. Here, point a represents $3000 income, so an additional $1000 income is needed to reach the $4000 full employment level. With a multiplier of 2.5, only $400 additional spending is required since $400 x 2.5 = $1000. This amount can also be calculated by dividing the desired change in total income by the multiplier, or $1000 ÷ 2.5 = $400.

Correct! When taxpayers are provided a decrease in taxes, some of that is saved, and therefore does not work through the economy. To calculate the amount of the tax decrease required to achieve a specific increase in total spending, first divide the desired change in total income by the multiplier. This results in the required change in total spending. In this case, total income needs to increase by $1,000, and in Part b above it was calculated that an increase in total spending of $400 is required. Dividing this by the MPC yields the required tax change, or $4000.6 = $666.67

To recap, a tax decrease of $666.67 would result in $400 (= $666.67 x 0.6) additional consumer spending. Since the multiplier is 2.5, this $400 additional consumption spending would have a multiplied impact on the economy of $1,000.

Alternatively, the formula for the tax multiplier is MPC x multiplier = MPC x 1MPS = or 0.6 x 2.5 = 1.5. Since equilibrium income needs to increase by $1,000, the tax decrease is calculated by dividing this change in income by the tax multiplier. In this case, $1,000 ÷ 1.5 = $667, which is the required tax decrease.

To recap, a tax decrease of $666.67 would result in $400 (= $666.67 x 0.6) additional consumer spending. Since the multiplier is 2.5, this $400 additional consumption spending would have a multiplied impact on the economy of $1,000.

Alternatively, the formula for the tax multiplier is MPC x multiplier = MPC x 1MPS = or 0.6 x 2.5 = 1.5. Since equilibrium income needs to increase by $1,000, the tax decrease is calculated by dividing this change in income by the tax multiplier. In this case, $1,000 ÷ 1.5 = $667, which is the required tax decrease.

Incorrect! When taxpayers are provided a decrease in taxes, some of that is saved, and therefore does not work through the economy. To calculate the amount of the tax decrease required to achieve a specific increase in total spending, first divide the desired change in total income by the multiplier. This results in the required change in total spending. In this case, total income needs to increase by $1,000, and in Part b above it was calculated that an increase in total spending of $400 is required. Dividing this by the MPC yields the required tax change, or $4000.6 = $666.67

To recap, a tax decrease of $666.67 would result in $400 (= $666.67 x 0.6) additional consumer spending. Since the multiplier is 2.5, this $400 additional consumption spending would have a multiplied impact on the economy of $1,000.

Alternatively, the formula for the tax multiplier is MPC x multiplier = MPC x 1MPS = or 0.6 x 2.5 = 1.5. Since equilibrium income needs to increase by $1,000, the tax decrease is calculated by dividing this change in income by the tax multiplier. In this case, $1,000 ÷ 1.5 = $667, which is the required tax decrease.

To recap, a tax decrease of $666.67 would result in $400 (= $666.67 x 0.6) additional consumer spending. Since the multiplier is 2.5, this $400 additional consumption spending would have a multiplied impact on the economy of $1,000.

Alternatively, the formula for the tax multiplier is MPC x multiplier = MPC x 1MPS = or 0.6 x 2.5 = 1.5. Since equilibrium income needs to increase by $1,000, the tax decrease is calculated by dividing this change in income by the tax multiplier. In this case, $1,000 ÷ 1.5 = $667, which is the required tax decrease.