Chapter 1Figure It Out 10.1

1.1 Screen 1 of 4

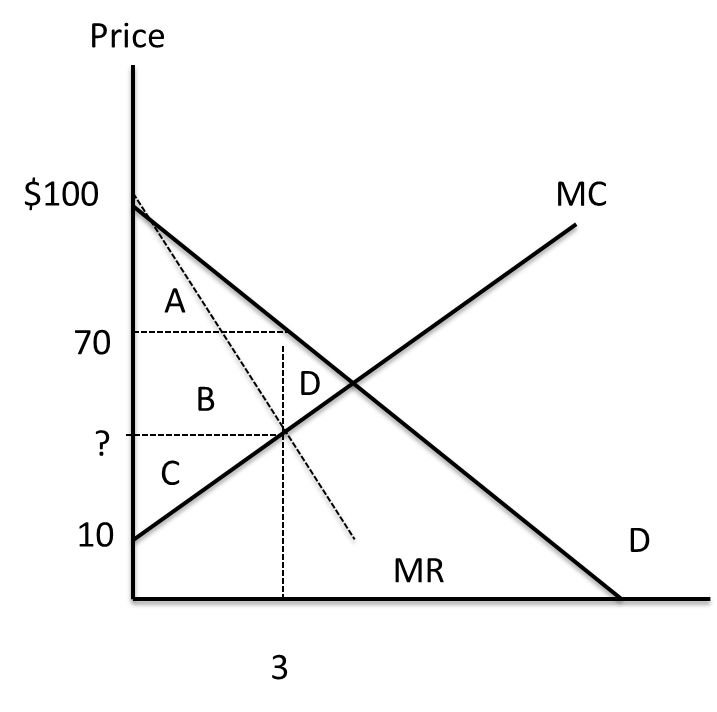

A firm with market power faces an inverse demand curve for its product of P = 100 – 10Q. Assume that the firm faces a marginal cost curve of MC = 10 + 10Q.

If the firm cannot price discriminate, what is the profit-maximizing level of output and price?

The profit-maximizing output is units.

The profit-maximizing price is $

- Chapters

- descriptions off, selected

- captions settings, opens captions settings dialog

- captions off, selected

This is a modal window.

Beginning of dialog window. Escape will cancel and close the window.

End of dialog window.

This is a modal window. This modal can be closed by pressing the Escape key or activating the close button.

This is a modal window.

1.2 Screen 2 of 4

The graph above represents a market in which one firm has market power. If the firm cannot price discriminate, how much consumer surplus will buyers receive? How much producer surplus will the firm receive? How much deadweight loss will the market power create?

Buyers will receive $ of consumer surplus.

The firm will receive $ of producer surplus.

The deadweight loss from market power is $

Producer surplus is the area below the price and above the supply curve, shown as areas B + C in the graph. To determine those areas, plug 3 units of output into the marginal cost function to find that MC = $40. So, area C is a triangle $30 tall and 3 units wide, for an area of 0.5 × $30 × 3, or $45. Area B is a rectangle $30 tall and 3 units wide, or $30 × 3 = $90. Therefore, areas B + C = $90 + $45 = $135.

The deadweight loss is surplus that would be created under perfect competition but not with a market in which a firm has market power. That area is shown as D in the graph. To find area D, find the perfectly competitive output level by equating marginal cost and demand: 10 + 10Q = 100 – 10Q, or Q = 4.5. So, area D is a triangle $30 tall and 1.5 units wide, for an area of 0.5 × $30 × 1.5, or $22.50. For further review see section “The Winners and Losers from Market Power”.

- Chapters

- descriptions off, selected

- captions settings, opens captions settings dialog

- captions off, selected

This is a modal window.

Beginning of dialog window. Escape will cancel and close the window.

End of dialog window.

This is a modal window. This modal can be closed by pressing the Escape key or activating the close button.

This is a modal window.

1.3 Screen 3 of 4

If the firm represented in the picture above has the ability to practice perfect price discrimination, what is the firm’s output?

The perfect price-discriminating firm’s profit maximizing output is

- Chapters

- descriptions off, selected

- captions settings, opens captions settings dialog

- captions off, selected

This is a modal window.

Beginning of dialog window. Escape will cancel and close the window.

End of dialog window.

This is a modal window. This modal can be closed by pressing the Escape key or activating the close button.

This is a modal window.

1.4 Screen 4 of 4

If the market above is monopolized by a firm practicing perfect price discrimination, what are the levels of consumer and producer surplus? What is the deadweight loss from market power?

Buyers will receive $ of consumer surplus.

The firm will receive $ of producer surplus.

The deadweight loss from market power is $

- Chapters

- descriptions off, selected

- captions settings, opens captions settings dialog

- captions off, selected

This is a modal window.

Beginning of dialog window. Escape will cancel and close the window.

End of dialog window.

This is a modal window. This modal can be closed by pressing the Escape key or activating the close button.

This is a modal window.