Creating a Budget

A budget will condition you to live within your means, put money into savings, and possibly invest down the road. Here are a few tips to help you get started.

Gather Income Information. To create an effective budget, you need to learn more about your income and your spending behaviors. First, determine how much money is coming in and when. Sources of income might include a job, your savings, gifts from relatives, student loans, scholarship dollars, or grants. List all your income sources, making note of how often you receive each type of income (weekly or monthly paychecks, quarterly loan disbursements, one-time gifts, etc.) and how much money you can expect each time. Knowing when your money is coming in will help you decide how to structure your budget. For example, if most of your income comes in on a monthly basis, you’ll want to create a monthly budget. If you are paid every other week, a biweekly budget might work better.

Gather Expense Information for Your College or University. Expenses will include tuition; residence hall fees if you live on campus; and the costs of books and course materials, lab fees, and membership fees for any organizations you might join. Some institutions offer a separate January or May term. Although your tuition for these one-month terms is generally covered in your overall tuition payment, you would have extra expenses if you wanted to travel to another location in the United States or abroad.

Gather Information about Living Expenses. First, get a “reality check.” How do you think that you are spending your money? To find out for sure where your money is going and when, track your spending for a few weeks—ideally at least a full month—in a notebook or in a table or spreadsheet. The kinds of expense categories you should consider will vary depending on your situation. If you are a traditional full-time student who lives with your parents or family members, your living expenses won’t be the same as students living in a campus residence hall or in an off-campus apartment. If you are a returning student who is holding down a job and has a family of your own to support, you will calculate your expenses differently. Whatever your situation, keeping track of your expenses and learning about your spending behaviors are important habits to develop. Consider which of the following expense categories are relevant to you:

Is This You?

Are you having serious problems managing your money? Were you counting on a source of income that isn’t going to be available after all? Do you need a budget but aren’t sure how to create one that will work for you? Are you using credit cards to buy things that you don’t really need? To stay in college and do your best academically, you have to learn to manage your money. That might mean seeking out loans or scholarships, destroying or hiding your credit cards until they are paid off, or seeking some financial counseling at your institution or through a community resource. This chapter will help you figure out what you need to do to stay on top of your financial situation so that it doesn’t derail your college plans.

- Rent

- Utilities (e.g., electricity, gas, water)

- Cell phone

- Cable/Internet

- Transportation (car payment, car insurance, car maintenance/repairs, gasoline, public transportation)

- Child care

- Groceries

- Medical expenses (prescriptions, doctor visits, hospital bills)

- Clothing

- Entertainment (dining out, hobbies, movies)

- Laundry

- Personal grooming (e.g., haircuts, toiletries)

- Miscellaneous (e.g., travel, organization dues)

Be sure to recognize which expenses are fixed and which are variable. A fixed expense is one that will cost you the same amount every time you pay it. For example, your rent is a fixed expense because you owe your landlord the same amount each month. A variable expense is one that may change. Your textbooks are a variable expense because the number and cost of them will be different each term.

Find Out How You Are Doing. Once you have a sense of how your total income compares to your total weekly or monthly expenses, you can get a clearer picture of your current financial situation.

Make Adjustments. Although your budget might never be perfect, you can strive to improve it. In what areas did you spend much more or much less than expected? Do you need to reallocate funds to better meet the needs of your current situation? Be realistic and thoughtful in how you spend your money, and use your budget to help meet your goals, such as planning for a trip or getting a new pair of jeans.

Whatever you do, don’t give up if your bottom line doesn’t end up the way that you expected it would. Budgeting is a lot like dieting; you might slip up and eat a pizza (or spend too much buying one), but all is not lost. If you stay focused and flexible, your budget can lead you to financial stability and independence.

IN THE MEDIA

|

|

In The Media

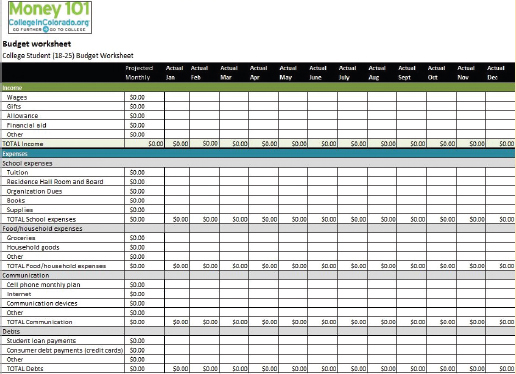

Various tools are available online to help you create a budget, such as easy-to-use spreadsheets or budget “wizards” that you can download for free. Built-in formulas do the math, making it easy to keep track of money that comes in and goes out. A quick Internet search yielded the following budgeting resources, among many others:

- www.educationcents.org/Calculators/Budget-Worksheets/Traditional-College-Student.aspx

- http://budget.cashcourse.org/

- www.vertex42.com/ExcelTemplates/college-budget.html

Web sites like educationcents.org are loaded with helpful resources in addition to budget tools and calculators (including ones for both traditional and returning college students). Resources include short courses on money management, spending, and paying for college; videos; articles; and a glossary to help you develop personal financial literacy.

For Reflection: Are you willing to commit to creating a budget? Do you already have a budget that works? Do you think that the costs at your institution are justified? Why or why not? Do you think that students who have all college costs paid by someone else are more or less motivated than those who work their way through college?