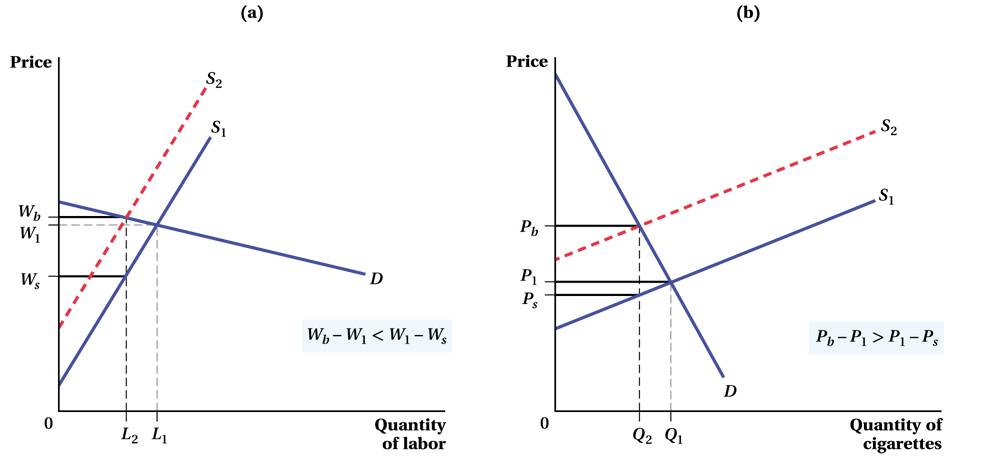

Figure 3.14 Tax Incidence and Elasticities

(a) In a labor market where demand is elastic and supply inelastic, we begin with supply curve S1, demand D, and equilibrium price and quantity (W1, L1). The implementation of the tax, Wb – Ws, shifts the supply curve inward from S1 to S2 and decreases the equilibrium quantity of labor from L1 to L2. Because laborers in this market are not very sensitive to price and employers are, the effect of the tax on the wages laborers receive is much larger than its effect on the wage employers pay, Wb – W1 < W1 – Ws.(b) In the market for cigarettes where demand is inelastic and supply elastic, we begin with supply curve S1, demand D, and equilibrium price and quantity (P1, Q1). The implementation of the tax, Pb – Ps, shifts the supply curve inward from S1 to S2 and decreases the equilibrium quantity of cigarettes from Q1 to Q2. Because smokers in this market are not very sensitive to price and cigarette companies are, the effect of the tax on the price consumers pay is much larger than its effect on the price companies receive, Pb – P1 > P1 – Ps.