10.1 The Basics of Pricing Strategy

pricing strategy

A firm’s method of pricing its product based on market characteristics.

price discrimination

The practice of charging different prices to different customers for the same product.

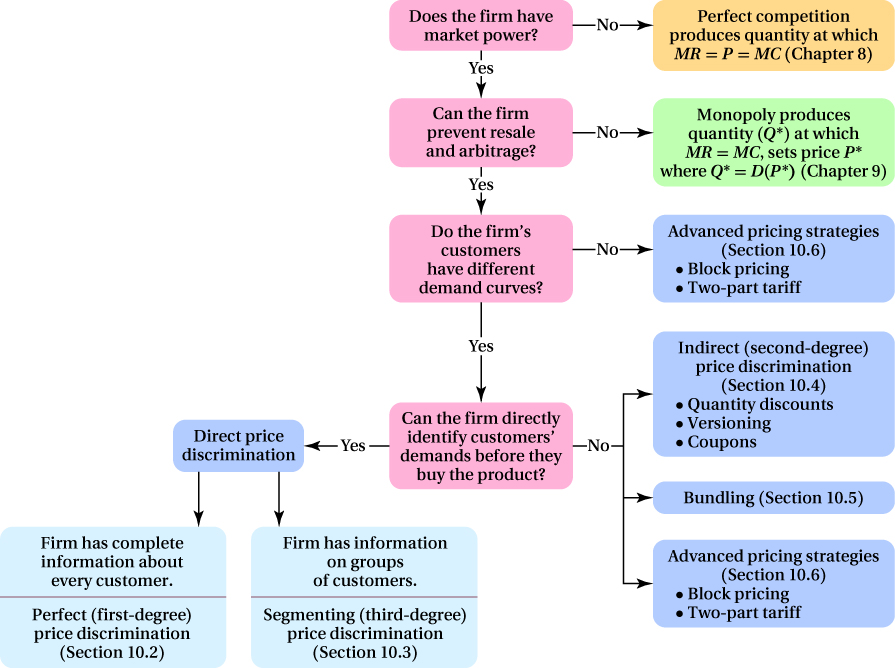

A pricing strategy is a firm’s plan for setting the price of its product given the market conditions it faces and its desire to maximize profit. The pricing strategy for a perfectly competitive firm is that it charges the equilibrium market price for its product and earns no economic profit. The pricing strategy for firms with market power is more complex. A firm with monopoly power that charges one price to all its customers sets the market price according to the quantity of output it chooses to produce to maximize its profit. (Remember that firms operating in markets with barriers to entry can earn economic profits even in the long run.) Some firms with market power, however, can charge different prices to different customers for the same product using a pricing strategy called price discrimination. If a firm with market power can price-

378

It is important to understand that price discrimination is not necessarily the same phenomenon as the existence of different prices for different goods. Price differences can occur across similar products even in a competitive market if the marginal costs of producing the products are different. For example, if the marginal cost of washing SUVs at the car wash is higher than that of washing Mini Coopers because SUVs are bigger, car washes might charge more to wash SUVs. Price discrimination is something different. It implies the use of market power to charge higher prices for the same product to those consumers who are willing to pay more for it. Price variations due to price discrimination do not reflect differences in marginal costs; they exist only because a firm with market power has the ability to charge different prices for the same product.

There are several pricing strategies a company with market power can use depending on its circumstances. These range from direct price discrimination to indirect price discrimination to bundling to two-

When Can a Firm Pursue a Pricing Strategy?

All firms—

Requirement 1: The firm must have market power. A company must have market power to price-

arbitrage

The practice of reselling a product at a price higher than its original selling price.

Requirement 2: The firm must prevent resale and arbitrage. To take advantage of advanced pricing strategies, a firm must be able to prevent its customers from reselling its product among themselves. Otherwise, the customers able to buy the product at a low price could purchase a large number and resell them to other customers who would otherwise have had to buy the product from the firm at a higher price. The practice of taking advantage of price differences for a product by buying at a lower price and reselling at a higher price is called arbitrage.

The ability to engage in arbitrage makes all customers better off. The low-

If a firm meets the two requirements above, it can attempt to implement more profitable pricing strategies than can a single-

Strategies for Customers with Different Demands The first pricing strategies we look at involve price discrimination. For price discrimination to be an option, a firm needs to have different types of customers with different price sensitivities of demand. The exact kind of price discrimination the firm should use depends on the kind of information the firm has.

379

Can a firm identify its customers’ demands before they buy? If a firm can directly identify different customers or groups of customers (as can a store that requires students to show IDs when making purchases), it can practice direct price discrimination and charge different prices to each customer or group of customers. If the firm has complete, detailed information about each customer’s own demand curve before she buys the product, it can practice perfect price discrimination (or as it’s sometimes called, first-

degree price discrimination ) and charge every customer a different price. If information about its customers is less detailed, a firm may be able to discriminate by customer group, as in segmenting (also called third-degree price discrimination ).Can a firm identify its customers’ differing demands only after they make a purchase? If a firm cannot identify different types of consumers before they make their purchases, it can try indirect (second-

degree) price discrimination , which involves offering different pricing packages and then identifying the customer’s type from the pricing package she chooses. These pricing packages can take the form of quantity discounts, different versions of the product at different prices, or coupons. Under the right conditions, firms can also make a pricing package by bundling together different products. In addition, firms can also pursue advanced pricing strategies such as block pricing and two-part tariffs.

380

Do a Firm’s Customers Have the Same Demand Curves? There is still another set of pricing strategies that a firm can use even if its consumers have the same demand curves. These strategies involve offering different unit prices to the same customer for different quantities purchased or charging lump-

We explore all these strategies in the remainder of this chapter. To help clarify a firm’s decision, each pricing strategy section has a When to Use It feature that explains what a firm needs to know about its market and customers to use a given pricing strategy most effectively. By using the best strategy, the firm can extract the most producer surplus from the market.