11.3 Oligopoly with Identical Goods: Bertrand Competition

Model Assumptions Bertrand Competition with Identical Goods

Firms sell identical products.

The firms compete by choosing the price at which they sell their products.

The firms set their prices simultaneously.

Bertrand competition

Oligopoly model in which each firm chooses the price of its product.

In the previous section, we learned that the collusion/cartel model of oligopoly in which firms behave like a monopoly is unlikely to hold in reality. If firms don’t (or can’t) cooperate to act as a single monopolist would, we need a model in which they compete directly against one another. The first such model is as simple as it gets: Firms sell the same product, and consumers compare prices and buy the product with the lowest price. Economists call this structure Bertrand competition, after Joseph Bertrand, the nineteenth-

Setting Up the Bertrand Model

To set up this model, let’s suppose there is a market with only two companies in it. They sell the same product and have the same marginal cost. For example, suppose there are only two stores in a city, a Walmart and a Target, and these stores are located next to each other. They both sell Sony PS4s. Each firm’s marginal cost is $150 per console. This includes the wholesale price the firm has to pay Sony as well as miscellaneous selling costs such as stocking the consoles on shelves, checking customers out, and so on.

433

We need one further assumption: Consumers don’t view either store differently in terms of service, atmosphere, and the like. If consumers did value these things separately from the video games, then in a way the products would no longer be identical and we would need to model the firms’ behavior using the model of differentiated products discussed later in the chapter.

With only two companies in a market, it might seem as if there would be a lot of market power and high markups over cost. But suppose the customers in this market have a simple demand rule: Buy the PS4 from the store that sells it at the lowest price. If both stores charge the same price, consumers flip a coin to determine where they buy. This rule means, in effect, that the store charging the lowest price will get all the demand for PS4s in the market. If both stores charge the same price, each store gets half of the demand.

Suppose the total demand in the market is for Q consoles. Let’s denote Walmart’s price as PW and Target’s price as PT. The two stores then face the following demand curves:

Demand for PS4s at Walmart:

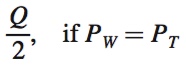

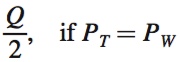

Q, if PW < PT

0, if PW > PT

Demand for PS4s at Target:

Q, if PT < PW

0, if PT > PW

Each store chooses its price to maximize its profit, realizing that it will sell the number of units according to the demand curves above. We’ve assumed the total number of consoles sold, Q, doesn’t depend on the price charged. The price only affects which store people buy from. (We could alternatively have allowed Q to depend on the lowest price charged; all of the key results discussed below would remain the same.)

Nash Equilibrium of a Bertrand Oligopoly

Remember that in a Nash equilibrium, each firm is doing the best it can given whatever the other firm is doing. So to find the equilibrium of this Bertrand model, let’s first think about Target’s best response to Walmart’s actions. (We could do this in the other order if we wanted.) If Target believes Walmart will charge a price PW for PS4s, Target will sell nothing if it sets its price above PW, so we can probably rule that out as a profit-

As an example, suppose Q = 1,000 and Target thinks Walmart will charge PW = $175. If Target also charges PT = $175, it will sell 500 PS4s at a profit of $25 each (the $175 price minus the $150 marginal cost). That’s a total profit of $12,500. But if Target charges $174.99, it will sell 1,000 PS4s at a profit of $24.99 each. This is a profit of $24,990—

434

Of course, things are the same from Walmart’s perspective: It has the same incentive to undercut whatever price it thinks Target will choose. If it believes Target is going to charge PT = $174.99 for a PS4, Walmart could price its consoles at $174.98 and gain back the entire market. But then Target would have the incentive to undercut this expected price, and so on.

This incentive for undercutting would only stop once the price each store expects the other to charge falls to the level of the stores’ marginal costs ($150). At that point, cutting prices further would let a store gain the entire market, but that store would be selling every PS4 at a loss (try to make that up on increased volume!).

The equilibrium of this Bertrand oligopoly occurs when each store charges a price equal to its marginal cost—

In the identical-

The Bertrand model of oligopoly shows you that even with a small number of firms, competition can still be extremely intense. In fact, the market outcome of Bertrand competition with identical goods is the same as that in a perfectly competitive market: Price equals marginal cost. This super-

This example had only two firms, but the result would be the same if there were more. The intuition is the same: Every firm’s price-