13.7 Imperfectly Competitive Factor Markets: Monopoly in Factor Supply

We covered markets with monopoly power extensively in Chapter 9 and 10. The concepts we explored there apply equally to factor markets in which sellers have market power. Consider, for example, the world’s best tax accountant who helps companies use loopholes to reduce their tax burden. If that accountant has market power (maybe because he knows tricks other accountants don’t), then he will restrict sales relative to a competitive market because he knows that he drives down the price of his service by selling too much of it. He may also try to price-

Labor Markets and Unions

533

Perhaps the most studied holders of market power in factor markets are labor unions. Unions coordinate the labor supply actions of their members so that these workers act together as a monopoly seller of labor. In this way, unions are like cartels, coordinating their members’ market behavior to arrive at an outcome that is jointly better for all members. Unions face the same cartel stability issues that we discussed in Chapter 9: problems with free-

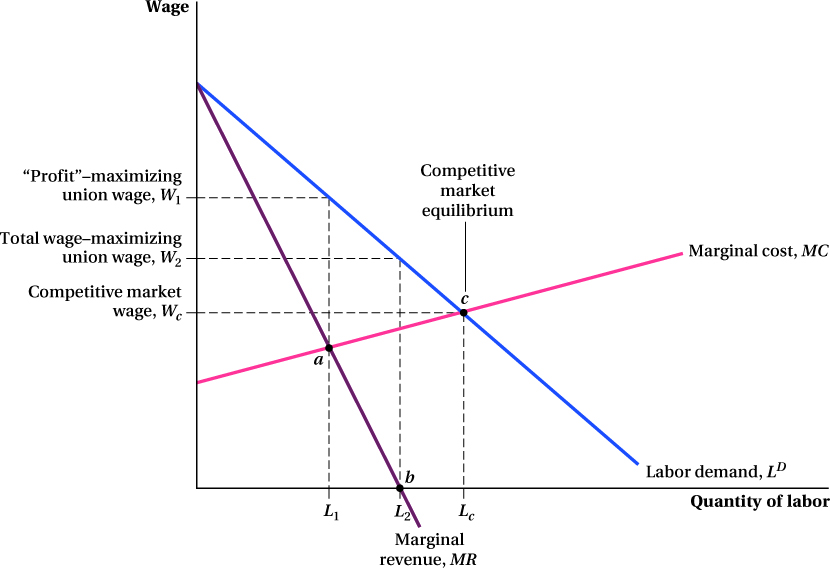

The analysis of a union’s effect on a labor market is similar to the standard monopoly model with which we’re already familiar. The union faces a demand for its product, the labor of its members. This is LD in Figure 13.12. The union’s coordinating role gives it market power, so the demand curve for its members’ labor is downward-

Everything to this point is exactly as it was in our earlier monopoly models. What might be a bit unusual for a union relative to other sellers with market power, though, is the objective it is trying to maximize with its supply choices. We know a profit-

This analysis may describe some unions’ labor supply decisions. However, some economists believe such an objective may not describe many unions’ goals. In part, this is because it is difficult for unions to measure their members’ opportunity costs of working. While a firm with market power probably has a good idea about its marginal costs of production so it can know when it is maximizing profit, a union can’t really measure this analog to its marginal cost. Instead, economists often believe that unions instead maximize the total earnings of their members—

Total wage earnings are maximized when the union’s marginal revenue (its marginal wage earnings when it adds another member) equals zero. This is when MR = 0, because at that point supplying any additional labor would reduce revenue (total earnings). This occurs at point b in Figure 13.12. If unions seek this objective, their quantity of labor supplied will be L2 and the wage W2. This higher labor quantity and lower wage result in a smaller “profit” than L1 and the wage W1 (as we know it must, because profit is maximized only when MR = MC). However, the MR = 0 objective results in a larger total amount of wage payments to the union’s members; that is, (L2 × W2) > (L1 × W1).

534

Regardless of whether it seeks to maximize its members’ “profit” or total wage payments from their labor supply, the union will supply a lower quantity of labor at a higher wage than would be obtained in a competitive market. A competitive market equilibrium would be at point c, the intersection of the labor demand and labor supply (here, MC) curves. At this point, the competitive market wage is Wc and quantity of labor is Lc. The wage premium the union earns its members by coordinating their labor supply decisions is the difference between Wc and, depending on the union’s objective, W1 or W2. As noted, however, this wage premium comes with a restriction in employment relative to that in a competitive labor market.

Application: Longshore Workers’ Wage Premium

About 5 million people in the United States work in the transportation and warehousing sector. The firms that operate in this sector, including trucking companies, railroads, airlines, overseas and inland shippers, pipelines, parcel services, and the U.S. Postal Service, all have as their primary task moving people and goods from where they are to where they need to be. This sector plays a crucial role in our dynamic, globalized, and just-

535

Workers in this sector are paid well if not extravagantly for their efforts. In 2014 the average wage across all occupational categories in the sector was $22.00 an hour. Average annual earnings were $45,760. Both of these numbers are very close to the overall average wage and annual earnings among U.S. private sector businesses that year.3

There’s a group of workers in this sector who do considerably better than this, however. The longshore workers (those who load and unload cargo at seaports), who are members of the International Longshore and Warehouse Union (ILWU) and work at one of the 29 largest ports on the U.S. West Coast, have average annual earnings that tip into six figures. About half make more than $100,000 a year, and around 15% make over $150,000. Pay starts at $25.71 an hour ($53,477 per year if full-

How does this group of workers command pay that is more than twice as high of that for other employees in the sector? One possible explanation is that they are more experienced or skilled, on average, and the higher pay reflects the fact that their human capital makes them more productive. This is likely part of the story. Many longshore workers are skilled in trades that are very valuable; a crane operator who is careless or unskilled is both destructive and dangerous. But the monopoly power of the ILWU is probably also an important factor.

All unions seek monopoly power, as we’ve noted, but features of the market environment in which the ILWU works have made it a particularly powerful seller. For one, an explosion of shipping through West Coast ports has greatly increased the demand for longshore workers. West Coast container traffic rose sixfold over the past 35 years as global trade expanded and Asian countries became manufacturing powerhouses. Every year, goods worth about $400 billion come in through the ports of Los Angeles and Long Beach alone. Second, there aren’t many substitutes for a port. When goods are on a ship, they need to be taken off and sent inland, and there’s really only one way to do that. You can’t move a port to a lower-

Not that everything always works smoothly between the ILWU and firms that hire its members. Strikes and slowdowns pop up from time to time, often around contract renegotiation periods. During a slowdown in the winter of 2015, President Obama sent the secretary of labor to try to mediate a solution so that the backlog of goods stacking up and sitting on ships in harbors could be moved along. ILWU members approved a five-