14.4 Evaluating Risky Investments

We now understand how to analyze investment choices using net present value analysis, and we have developed a sense of how the interest rate used in NPV analysis is determined. There is one important component of these decisions we’ve ignored until now: risk. What if things don’t work out as we expect them to? In real life, firms and consumers face a lot of uncertainty when making investment decisions. Sometimes investments flop. In this section, we discuss the ways to analyze NPVs while taking uncertainty into account, including situations in which investors have the option of waiting to gather more information before deciding to invest.

NPV with Uncertainty: Expected Value

The basic way to incorporate risk into NPV investment analysis is to compute NPV as an expected value, that is, by weighting each payoff by the probability that it happens. Any risky payout can be described as a combination of two things: the different payouts that could possibly happen, and the probability of each possible outcome occurring.

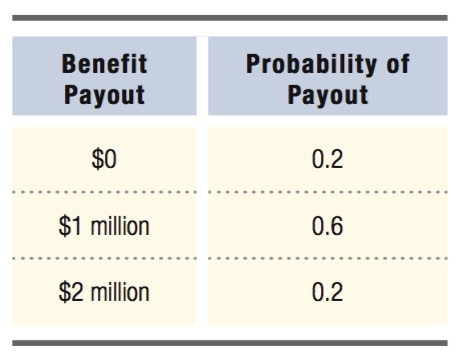

Consider an example of a risky investment that will pay an uncertain benefit in one year. Table 14.4 shows the possible benefits along with the probabilities of their occurrence. Looking at these possible outcomes, we see that the investment could perform poorly and earn no return with a small probability (0.2, or 20%), do very well and deliver a $2 million payout with a small probability (0.2), or, most likely, yield a modest $1 million payout with higher probability (0.6).6

expected value

The probability-

We use the concept of expected value to evaluate the situation. The expected value of any uncertain outcome is the sum of the product of each possible outcome/payment and the probability of that outcome/payment. (Equivalently, it is the probability-

Expected value = (p1 × M1) + (p2 × M2) + . . . + (pN × MN)

where p1, p2, . . . pN are, respectively, the probabilities of payments 1, 2, and so on, and M1, M2, . . . MN are the payments themselves. So, in our example investment above, the expected benefit payout is

Expected benefit payout = (0.2 × $0) + (0.6 × $1 million) + (0.2 × $2 million)

= $0 + $0.6 million + $0.4 million

= $1 million

For payment flows that are guaranteed—

556

Using expected value, then, all of the NPV calculations hold up exactly the same way as before, but you just need to multiply outcomes by their probabilities.

Risk and the Option Value of Waiting

option value of waiting

The value created if an investor can postpone his investment decision until the uncertainty about an investment’s returns is wholly or partially resolved.

Evaluating an investment using expected value provides a natural way to incorporate risk into the NPV calculation. One way risk can influence decisions is by creating an incentive to postpone investments and gather more information. This incentive, known as the option value of waiting, arises if waiting will resolve some of the uncertainty about the investment before deciding whether to go forward with the investment. (The name refers to the fact that an investor’s option to postpone an investment decision is conceptually related to financial options—

Let’s use an example to see how this operates. It’s 2016 and you want to get a new, high-

Let’s apply some numbers to see how this uncertainty affects the NPV and the option value of buying a television. Suppose the interest rate is 5%, 4K TVs cost $1,350, and HD 3D TVs cost $1,200. Furthermore, each type of television gives its owner $150 per year of value forever if his or her favorite shows are broadcast in that format and $0 if not (i.e., if the TV’s format has lost the standards war).

Given this information, the value of a 4K television in the first year is –$1,350 + $150 = –$1,200. For every year following that, a 4K TV offers a $150 benefit if that is the format that channels are broadcast in. Using the formula we discussed above, the total PDV of this infinite stream of $150 benefits is $150/0.05 = $3,000. The Hyper-

Finally, suppose analysts believe that 4K has a 75% chance of winning the standards war and Hyper-

Now we have everything we need to compute the net present value (NPV) of buying each television in 2016. If you purchase a 4K TV, the first year’s payouts include the price you pay for the television ($1,350) and the $150 benefit you receive from it for that year. After that, starting in 2017, there is a 75% chance 4K will win the standards war and you will receive a $150 annual benefit forever (PDV = $3,000). On the other hand, there is a 25% chance Hyper-

4K NPV2016 = (–$1,350 + $150) + 0.75 × ($3,000/1.05) + 0.25 × ($0/1.05)

= –$1,200 + 0.75 × $2,857.14 + 0.25 × $0

= –$1,200 + $2,142.86 + $0 = $942.86

557

Notice that this NPV calculation is an expected value—

We calculate the NPV of buying the Hyper-

Hyper-

= –$1,050 + 0.25 × $2,857.14 + 0.75 × $0

= –$1,050 + $714.29 + $0 = –$335.71

The NPV of buying the Hyper-

So, we see that the NPV of buying the 4K is $942.86, while the NPV of buying the Hyper-

But, what if you could wait a year before deciding whether to buy? You could find out which platform wins the standards war and then buy that one, sure that you’ll have a supply of programs available (and the $3,000 of benefit they give you) in the future. To find the value of waiting, we need to compute the NPV of that plan in 2016. Why 2016, even though following through with the plan means you wouldn’t actually buy anything until 2017? Because we need to compare the NPVs of this wait-

This wait-

NPVw2017 = 0.75 × (–$1,200/1.05) + 0.75 × ($3,000/1.052) + 0.25 × (–$1,050/1.05) + 0.25 × ($3,000/1.052)

= 0.75 × (–$1,142.86) + 0.75 × ($2,721.09) + 0.25 × (–$1,000.00) + 0.25 × ($2,721.09)

= –$857.15 + $2,040.82 – $250.00 + $680.27 = $1,613.94

Here, in the 75% chance 4K TV wins the standards war, you buy that type of machine. It delivers a net benefit of –$1,200 in 2017 (its $1,350 cost plus its $150 benefit) and gives you a $150 per year benefit forever after (PDV = $3,000). From the perspective of 2016, however, the first of these payment flows occur one year in the future and therefore must be discounted by 1.05, and the second payment occurs in two years and must be discounted by 1.052. If Hyper-

So, while the NPV of buying the 4K TV in 2016 was positive ($942.86), waiting one more year before buying yields an even higher NPV ($1,613.94). Where does this extra value come from? Waiting eliminates the chance that you buy a standards-

558

Option values of waiting arise in many real-

figure it out 14.3

Alex is a house flipper: He buys old houses that appear to be bargains, rehabs them, and then puts them back on the market for resale. Alex recently discovered a lovely Victorian home that he is considering for rehab. There is a 0.2 probability that Alex will lose 10% on the deal, a 0.7 probability that he will gain 8% on the deal, and a 0.1 probability that he will gain 20%.

Calculate Alex’s expected return from the project.

Suppose that, in a different neighborhood, there is a bungalow selling for the same price. Alex estimates that there is a 0.3 probability that he will gain 3%, a 0.5 probability that he will gain 5.8%, and a 0.2 probability that he will gain 9%. Calculate Alex’s expected return from this project.

Assume that Alex has only enough money to flip one house. If he bases his decision solely on expected return, is it clear which project Alex will prefer? If not, is there an additional factor that might tip the balance?

Solution:

Remember that Expected value = (p1 × M1) + (p2 × M2) + (p3 × M3). Substituting the numbers for the Victorian, we find

Expected return = (0.2 × –10) + (0.7 × 8) + (0.1 × 20) = –2 + 5.6 + 2 = 5.6%

Substituting the numbers for the bungalow, we find

Expected return = (0.3 × 3) + (0.5 × 5.8) + (0.2 × 9) = 0.9 + 2.9 + 1.8 = 5.6%

The expected return for the two investments is the same. If this is the only basis of comparison, neither the Victorian nor the bungalow is obviously superior. However, there is no chance he will lose money on the bungalow, while he faces a 0.2 probability of experiencing a 10% loss on the Victorian. Some investors (perhaps including Alex) may be willing to give up a small chance at a higher return if they know that the worst outcome is less costly, as is the case with the bungalow. This preference is characteristic of risk aversion, which we discuss more below.

559