Appendix Introduction

195

Chapter 5 Appendix

Chapter 5 Appendix: The Calculus of Income and Substitution Effects

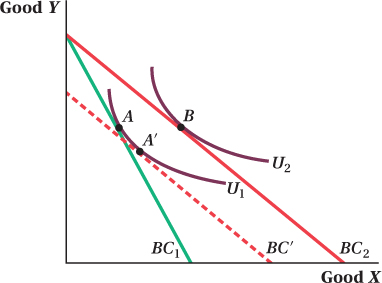

We saw in this chapter that a price change in one good influences a consumer’s consumption in two ways. The substitution effect is the change in a consumer’s optimal consumption bundle due to a change in the relative prices of the goods, holding his utility constant. The income effect is the change in a consumer’s optimal consumption bundle due to the change in his purchasing power. In the chapter, we solved for these two effects using a figure like the one below where good X is shown on the horizontal axis and good Y on the vertical axis. The consumer’s original consumption bundle is A. Consumption bundle B is the optimal bundle after a decrease in the price of X, holding the price of Y constant. Finally, bundle A′ shows what the consumer would buy if the price of X decreased but utility stayed the same as at bundle A (i.e., on indifference curve U1). Graphically, the substitution effect is the change from bundle A to bundle A′, the income effect is the change from A′ to B, and the total effect is the sum of these two effects or the change from A to B.

The graphical approach to decomposing the income and substitution effects can be a little messy. You have to keep track of multiple budget constraints, indifference curves, and their respective shifts. The calculus links the effects we observed in the graph to the techniques we learned for solving the consumer’s problem in the Chapter 4 Appendix. Solving for these effects is a two-

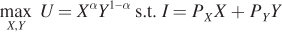

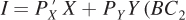

Let’s start with a consumer with budget constraint I = PXX + PYY (BC1 in the graph) and a standard Cobb–

196

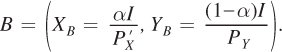

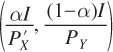

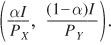

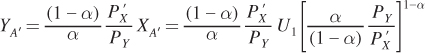

In the Chapter 4 Appendix, we derived the solution to this particular utility-

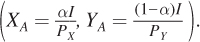

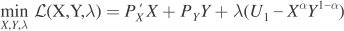

Now suppose that the price of good X, PX, decreases to PX′.The consumer has the same utility function as before, but because of the price change, his budget constraint rotates outward to  on the graph). Once again, we rely on utility maximization to solve for the optimal bundle:

on the graph). Once again, we rely on utility maximization to solve for the optimal bundle:

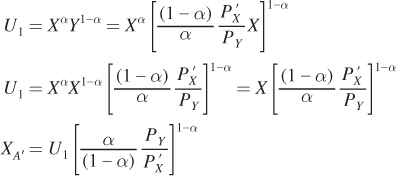

Because we already know the generic solution to this problem, we can plug in the new price of X to find the new optimal bundle  This gives us the total effect of the price change on the consumer’s consumption bundle—

This gives us the total effect of the price change on the consumer’s consumption bundle— and his original consumption bundle

and his original consumption bundle  Note that in this instance the change in the price of X does not affect the quantity of Y the consumer purchases. That the demand for each good is independent of changes in the price of the other good is a quirk of the Cobb–

Note that in this instance the change in the price of X does not affect the quantity of Y the consumer purchases. That the demand for each good is independent of changes in the price of the other good is a quirk of the Cobb–

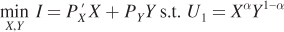

The solution to the utility-

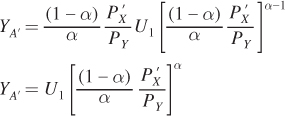

What is the substitution effect? It is the effect of the change in the relative price of two goods on the quantities demanded given the consumer’s original level of utility. How can we solve for this effect? It’s easy! When we know the consumer’s original level of utility and the goods’ prices, as we do here, expenditure minimization tells us the answer to the problem. Take the consumer’s original level of utility U1 as the constraint and set up the consumer’s expenditure-

as a Lagrangian:

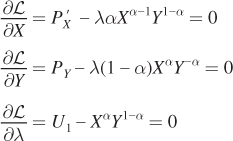

Write out the first-

Solve for Y using the first two conditions:

197

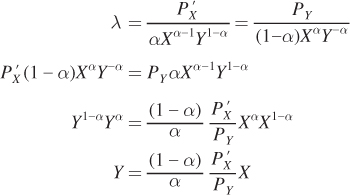

Plug this expression for Y as a function of X into the constraint to solve for bundle A′:

Then plug this optimal value of X into the expression for Y as a function of X from above:

To simplify, invert the third term and combine like terms:

Solving the consumer’s expenditure-

8 One way to check our answer to bundle A′ is to take the new prices, income, and utility function, and solve for the bundle using utility maximization. As we saw in the Chapter 4 Appendix, this approach will yield the same answer.

figure it out 5A.1

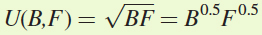

A sample problem will make breaking down the total effect of a price change into the substitution and income effects even clearer. Let’s return to Figure It Out 4.4, which featured Antonio, a consumer who purchases burgers and fries. Antonio has a utility function  and income of $20. Initially, the prices of burgers and fries are $5 and $2, respectively.

and income of $20. Initially, the prices of burgers and fries are $5 and $2, respectively.

What is Antonio’s optimal consumption bundle and utility at the original prices?

The price of burgers increases to $10 per burger, and the price of fries stays constant at $2. What does Antonio consume at the optimum at these new prices? Decompose this change into the total, substitution, and income effects.

Solution:

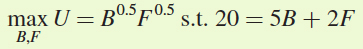

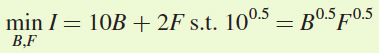

We solved this question in the Chapter 4 Appendix, but the answer will be crucial to solving for the total, substitution, and income effects in part (b). When a burger costs $5 and fries cost $2, Antonio’s original constrained optimization problem is

We found that Antonio consumes 2 burgers and 5 orders of fries, and his utility for this bundle is B0.5F0.5 = 20.550.5 = 100.5.

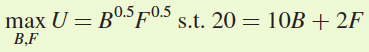

When the price of hamburgers doubles to $10 each, Antonio faces a new budget constraint: 20 = 10B + 2F. Antonio’s new utility-

maximization problem is

198

Therefore, we should write his constrained optimization problem as a Lagrangian and solve for his new optimal bundle at the higher burger price:

We use the first two conditions to solve for λ and then solve for F as a function of B:

λ = 0.05B–0.5F0.5 = 0.25B0.5F–0.5

F0.5F0.5 = 20(0.25)B0.5B0.5

F = 5B

and substitute this value for F into the budget constraint:

20 = 10B + 2F

20 = 10B + 2(5B)

20 = 20B

B* = 1 burger

F* = 5B = 5(1) = 5 orders of fries

In response to the increase in the price of burgers from $5 to $10, then, Antonio decreases his consumption of burgers and leaves his consumption of fries unchanged. Therefore, the total effect of the price change is that Antonio’s consumption of burgers declines by 1 and his consumption of fries remains the same at 5.

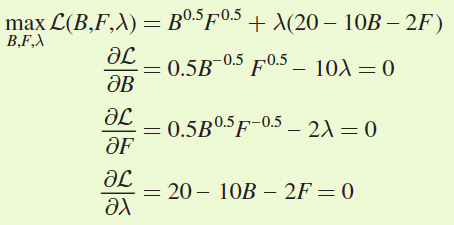

Next, we use expenditure minimization to find the substitution and income effects. Remember that we want to find out how many burgers and fries Antonio will consume if the price of burgers is $10 but his utility is the same as his utility when burgers cost $5. His third constrained optimization problem is

We could solve using the Lagrangian as we did above, but instead let’s use what we know about the solution to the consumer’s optimization problem and set the marginal rate of substitution of burgers for fries equal to the ratio of their prices and solve for F as a function of B:

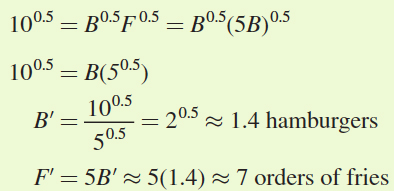

Now plug this value for F into the consumer’s utility constraint:

Antonio’s expenditure-

While this bundle gives Antonio the same level of utility as the original bundle, he would have to spend about $8 more to buy it [his original expenditure was $20; his new one is $10(1.4) + $2(7) = $28]. Remember, however, that Antonio doesn’t actually purchase this $28 combination of burgers and fries. It’s just a step on the way to his final consumption bundle (1 hamburger, 5 orders of fries) that we got from the utility-

In the end, the price change only changes Antonio’s consumption of hamburgers: The total effect on his consumption bundle is 1 fewer burger (1 – 2 burgers = –1 burger), which is the sum of the substitution effect (–0.6 burgers) and the income effect (–0.4 burgers). On the other hand, the total effect on his consumption of fries is zero because the substitution effect (2 more orders of fries) and the income effect (2 fewer orders of fries) exactly offset one another.

199

Let’s review what we’ve learned about decomposing the total effect of a price change into the substitution and income effects. To find the original bundle, we solve the utility-