Marginal Product of Labor and Marginal Rate of Technical Substitution

To begin solving the firm’s cost-

Before we jump into the producer’s cost-

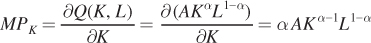

Consider first the concept of the marginal product of capital, or how much extra output is produced by using an additional unit of capital. Mathematically, the marginal product of capital is the partial derivative of the production function with respect to capital. It’s a partial derivative because we are holding the amount of labor constant. The marginal product of capital is

Similarly, the marginal product of labor is

240

Note that the marginal products above are positive whenever both capital and labor are greater than zero (any time output is greater than zero). In other words, the MPL and MPK of the Cobb–

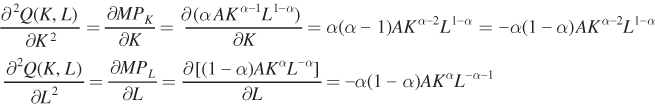

We also need to show that the assumptions about the diminishing marginal returns of capital and labor hold true; that is, the marginal products of capital and labor decrease as the amount of that input increases, all else equal. To see this, take the second partial derivative of the production function with respect to each input. In other words, we are taking a partial derivative of each of the marginal products with respect to its input:

As long as K and L are both greater than zero (i.e., as long as the firm is producing output), both of these second derivatives are negative so the marginal product of each input decreases as the firm uses more of the input. Thus, the Cobb-

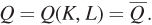

We also know from the chapter that the marginal rate of technical substitution and the marginal products of capital and labor are interrelated. In particular, the MRTS shows the change in labor necessary to keep output constant if the quantity of capital changes (or the change in capital necessary to keep output constant if the quantity of labor changes). The MRTS equals the ratio of the two marginal products. To show this is true using calculus, first recognize that each isoquant represents some fixed level of output, say  so that

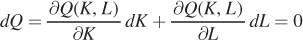

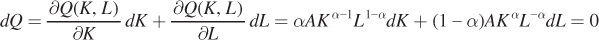

so that  Begin by totally differentiating the production function:

Begin by totally differentiating the production function:

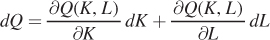

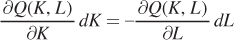

We know that dQ equals zero because the quantity is fixed at  :

:

so that

Now rearrange to get  on one side of the equation:

on one side of the equation:

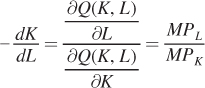

The left-

1 Recall that isoquants have negative slopes; therefore, the negative of the slope of the isoquant, the MRTS, is positive.

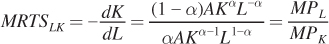

In particular, we differentiate the Cobb–

241

Again, rearrange to get  on one side of the equation:

on one side of the equation:

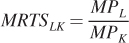

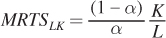

which simplifies to

Thus, we can see that the marginal rate of technical substitution equals the ratios of the marginal products for the Cobb–