Chapter Introduction

281

Chapter 7 Appendix

Chapter 7 Appendix: The Calculus of a Firm’s Cost Structure

We saw in this chapter that firms face a multitude of costs—

Let’s return to the firm with the Cobb–

TC = RK + WL

This formula specifies the firm’s total costs when the firm produces a specific quantity and thus knows its cost- , and the firm’s production function is

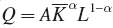

, and the firm’s production function is  . Its demand for labor in the short run is then determined by how much capital the firm has. Finding the short-

. Its demand for labor in the short run is then determined by how much capital the firm has. Finding the short-

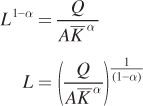

Plugging this short- ) into the total cost equation, the firm faces short-

) into the total cost equation, the firm faces short-

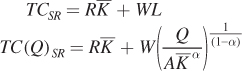

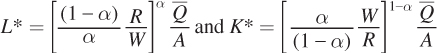

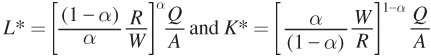

In the long run, the firm chooses the optimal amount of capital and labor, so its long- , the firm demands

, the firm demands  . At any level of Q, then, the firm demands

. At any level of Q, then, the firm demands  , where Q is variable and not a fixed quantity.

, where Q is variable and not a fixed quantity.

282

These are the firm’s long-

TCLR = RK + WL

Notice that total cost increases as output and the prices of inputs increase, but that total cost decreases as total factor productivity A increases.

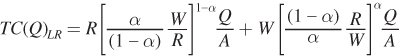

We can now also find the firm’s generalized marginal cost curve by taking the derivative of the total cost curve with respect to quantity Q. But be careful before you do this! We have to again consider whether the firm is operating in the short run or the long run. In the short run, the cost of capital is a fixed cost and will not show up in the firm’s marginal cost curve. Short-

As we would expect, marginal costs increase with output in the short run. Why? Because in the short run capital is fixed. The firm can only increase output by using more and more labor. However, the diminishing marginal product of labor means that each additional unit of labor is less productive and that the firm has to use increasingly more labor to produce an additional unit of output. As a result, the marginal cost of producing this extra unit of output increases as short-

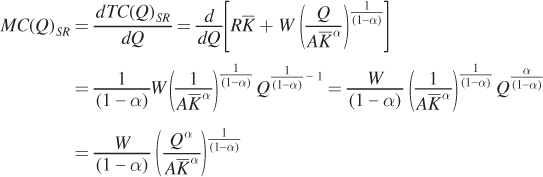

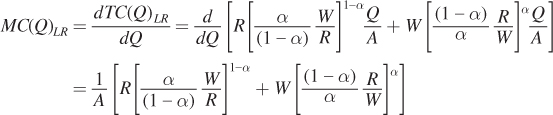

In the long run, the firm can change both inputs, and its marginal cost curve reflects the firm’s capital and labor demands. To get long-

Notice that this expression for marginal cost consists only of constants (A, α, W, and R). So, long-

283

figure it out 7A.1

Let’s revisit Figure It Out 7.4. Steve and Sons Solar Panels has a production function of Q = 4KL and faces a wage rate of $8 per hour and a rental rate of capital of $10 per hour. Assume that, in the short run, capital is fixed at  .

.

Derive the short-

run total cost curve for the firm. What is the short- run total cost of producing Q = 200 units? Derive expressions for the firm’s short-

run average total cost, average fixed cost, average variable cost, and marginal cost. Derive the long-

run total cost curve for the firm. What is the long- run total cost of producing Q = 200 units? Derive expressions for the firm’s long-

run average total cost and marginal cost.

Solution:

To get the short-

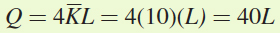

run total cost function, we need to first find L as a function of Q. The short- run production function can be found by substituting  into the production function:

into the production function:

Therefore, the firm’s short-

run demand for labor is L = 0.025Q

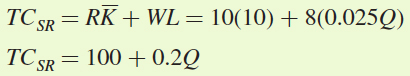

Now plug

and L into the total cost function:

and L into the total cost function:

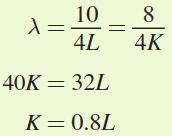

This is the equation for the short-

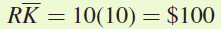

run total cost curve with fixed cost FC equal to 100 and variable cost VC equal to 0.2Q. Notice that the fixed cost is just the total cost of capital,  . The short-

. The short-run total cost of producing 200 units of output is TCSR = 100 + 0.2(200) = $140

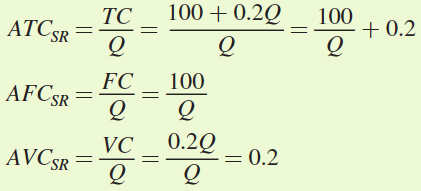

Average costs are a firm’s costs divided by the quantity produced. Hence, the average total cost, average fixed cost, and average variable cost measures for this total cost function are

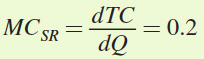

Marginal cost is the derivative of total cost with respect to quantity, or

Marginal cost for Steve and Sons is constant and equal to average variable cost in the short run because the marginal product of labor is constant when capital is fixed.

284

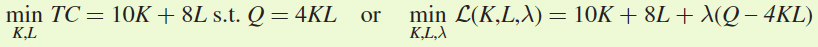

In the long run, Steve and Sons solves its cost-

minimization problem:

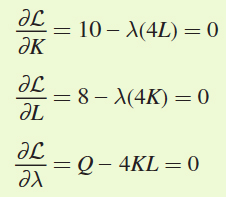

The first-

order conditions are

To find the optimal levels of labor and capital, we need to set the first two conditions equal to solve for K as a function of L:

To find the firm’s long-

run labor demand, we plug this expression for K as a function of L into the production function and solve for L: Q = 4KL = 4(0.8L)L = 3.2L2

L2 = 0.31Q

L = 0.56Q0.5

To find the firm’s long-

run demand for capital, we simply plug the labor demand into our expression for K as a function of L: K = 0.8L = 0.8(0.56Q0.5)

= 0.45Q0.5

The firm’s long-

run total cost function can be derived by plugging the firm’s long- run input demands L and K into the long- run total cost function: TCLR = RK + WL = 10(0.45Q0.5) + 8(0.56Q0.5)

= 8.98Q0.5

Therefore, the cost for producing 200 units of output in the long run is

TCLR = 8.98(200)0.5 ≈ $127

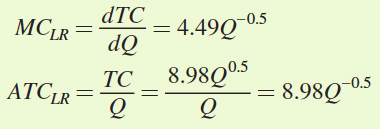

We can also find the long-

run marginal and average total costs for this firm:

Notice that marginal cost in this case decreases as output increases. Furthermore, MC < ATC for all levels of output. This is because Steve and Sons’ production function, Q = 4KL, exhibits increasing returns to scale at all levels of output.

285