The Profit-Maximizing Condition

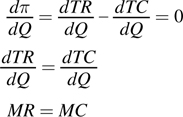

Let’s begin by solving for the profit-

372

What does this first-

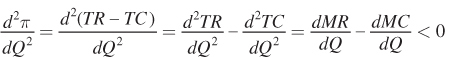

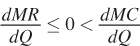

We do need to check one more condition before considering this result conclusive. Producing where MR = MC doesn’t guarantee that the firm is maximizing its profit. It only guarantees that the profit function is at one extreme or another—

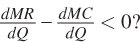

When will  This condition holds when

This condition holds when

or when the change in marginal cost exceeds the change in marginal revenue. We have seen that marginal cost generally increases with output, while marginal revenue either is constant (for a price taker like the firms we saw in Chapter 8) or decreases as the quantity produced rises (for firms with market power, as we observed in Chapter 9). Therefore, this second-

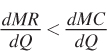

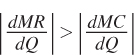

The firm has to be careful about assuming this, however. If marginal cost is declining (which can be true of a firm with increasing returns to scale over the range that it is producing), we need to confirm that marginal revenue is decreasing at a faster rate than marginal cost:

If this condition does not hold for a firm experiencing increasing returns to scale, the firm is not maximizing its profit. In this context, the firm could increase its profit by producing more output because the decrease in total cost from the additional output would be greater than the decrease in total revenue.