9.2 Market Power and Marginal Revenue

Most firms have some sort of market power, even if they are not monopolists. We recognized this reality in Chapter 8 when we noted that truly perfectly competitive firms are rare—

337

FREAKONOMICS

Why Drug Dealers Want Peace, Not War

When it comes to gaining market power, monopolists have been extremely creative in the strategies they employ: lobbying governments for privileged access to markets, temporarily pricing below marginal cost to keep out rivals, and artificially creating entry barriers, just to name a few.

But murder?

Can you imagine the CEO of Anheuser-

The crack cocaine trade offers a modern example of the same phenomenon. Because crack is illegal, crack markets function without legal property rights or binding contracts. Violence becomes a means of enforcing contracts and establishing market power. And because these gangsters are already working illegally, the costs of murder aren’t nearly as high as in legal ventures. Researchers estimate that roughly one-

* Steven D. Levitt and Sudhir Alladi Venkatesh. “An Economic Analysis of a Drug-

Violence is one of the biggest costs of the illegal drug trade. Reducing this violence is one of the benefits touted by advocates of drug legalization. Simple economics suggests an alternative way to reduce the illegal drug trade and its effects. It is the high demand for drugs that makes drug sellers willing to take such extreme actions to establish market power. If the demand for illegal drugs were reduced, the ills associated with these markets would shrink, too. Several approaches along these lines have been tried—

What does it mean, practically speaking, for a firm to have market power? Suppose BMW increased production of all its vehicle models by 5 times. We would expect the greater quantity of BMWs supplied to cause a movement down and along the demand curve to a new quantity at a lower price. Conversely, if BMW cut its production to one-

In fact, because BMW doesn’t take its price as given, we could express the equivalent concept in terms of BMW choosing its price and letting the market determine the quantity it sells. That is, having market power means that if BMW sets a lower price for its cars, it will sell more of them, while if it raises prices, it will sell fewer. If a price-

338

Market Power and Monopoly

We made the argument that Apple was, effectively, a monopolist in the tablet computer market when it first introduced the iPad, but clearly we couldn’t say the same about BMW. It competes against several other automakers in every market in which it operates. Why, then, do we talk about its price-

oligopoly

Market structure in which a few competitors operate.

monopolistic competition

Market structure with a large number of firms selling differentiated products.

True monopolies are not the only types of firms that have downward-

While we deal more extensively with the nature of interactions between firms in oligopoly and monopolistically competitive markets in Chapter 11, in this chapter, we analyze how a firm in those kinds of markets chooses its production (or price) level if other firms won’t change their behaviors in response to its choices. Having made this assumption, as long as the firm’s demand curve slopes downward, our analysis is the same whether this demand curve can be moved around by a competitor’s actions (as in an oligopoly or monopolistically competitive market) or not (as in a monopoly). As a result, we sometimes interchange the terms “market power” and “monopoly power” even if the firm we are analyzing is not literally a monopolist. The point is that once the firm’s demand curve is determined, its decision-

Marginal Revenue

The key to understanding how a firm with market power acts is to realize that, because it faces a downward-

339

To see why these firms restrict output to keep their prices high, we need to remember the concept of a company’s marginal revenue, the additional revenue a firm earns from selling one more unit. At first, that just sounds like the price of the product. And as we saw in Chapter 8, for a firm with no market power, this is exactly the case; the price is the marginal revenue. If a hotdog vendor walking the stands at a football game (a “firm” that can reasonably be thought of as a price taker) sells another hotdog, his total revenue goes up by whatever price he sells the hotdog for. The price doesn’t depend on how many hotdogs he sells; he is a price taker. He could sell hundreds of hotdogs and it wouldn’t change the market price, so his marginal revenue is just market price P.

But for a seller with market power, the concept of marginal revenue is more subtle. The extra revenue from selling another unit is no longer just the price. Yes, the firm can get the revenue from selling one more unit, but because the firm faces a downward-

An example will clarify the firm’s situation. Let’s suppose that the firm in this case is Durkee-

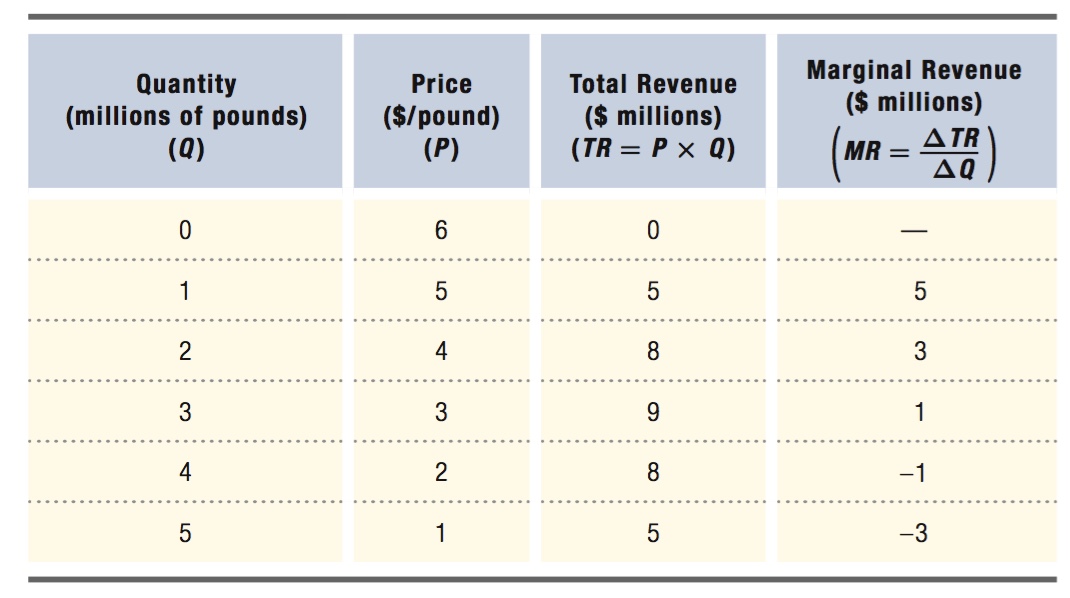

Table 9.1 shows how the quantity of Fluff produced this year varies with its price. As the quantity produced rises, the price falls because of the downward-

340

If Durkee-

As we discussed earlier, the lower marginal revenue reflects the fact that a firm with market power must reduce the price of its product when it produces more. Therefore, the marginal revenue isn’t just the price multiplied by the extra quantity, which would be ($4 per pound × 1 million pounds) = $4 million. It also subtracts the $1 million loss of revenue that occurs because the firm now sells the previous million units at a price that is $1 lower. Thus, the marginal revenue from producing 1 million more pounds of Fluff is $3 million: $4 million of revenue on the additional million pounds minus the $1 million lost from the price reduction on the initial million pounds sold.

If Durkee-

If the firm chooses to make still more Fluff, say, 4 million pounds, the market price drops further, to $2 per pound. Total revenue is now $8 million. That means in this case, Durkee-

Why Does the Price Have to Fall for Every Unit the Firm Sells? One thing about marginal revenue that can be confusing for students at first glance is why the seller has to lower the price on all of its sales if it decides to produce one more unit. For instance, in the Marshmallow Fluff example, why can’t Durkee-

There are two reasons why the price drop applies to all units sold. The first is that we are not thinking of the firm’s decision as being sequential. Durkee-

price discrimination

Pricing strategy in which firms with market power charge different prices to customers based on their willingness to pay.

The second reason why a price drop applies to all units sold is that we are assuming that, even within a particular time period, the market price has to be the same for all the units the firm sells. The firm can’t sell the first unit to a consumer who has a high willingness to pay and the second unit to a consumer with a slightly lower willingness to pay. This is probably a realistic assumption in many markets, including the market for marshmallow creme. Grocery stores don’t put multiple price tags on a given product. Imagine for a moment a scenario in which the price tag reads, “$5 if you really like Marshmallow Fluff, $4 if you like it but not quite as much, and $1 if you don’t really like Fluff but will buy it if it’s cheap.” In Chapter 10, we will look at situations where that sort of practice, called price discrimination, is possible.

341

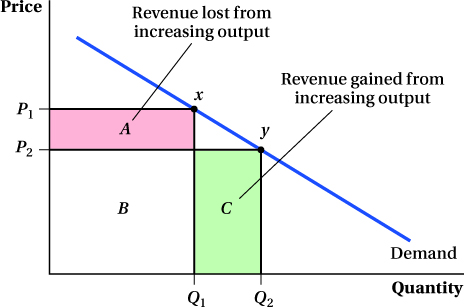

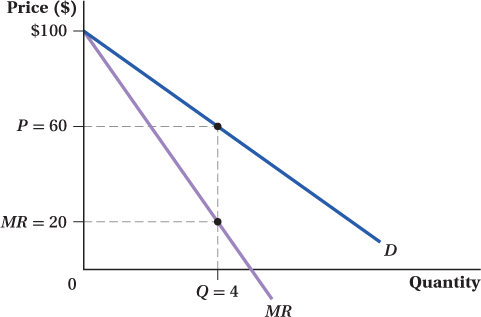

Marginal Revenue: A Graphical ApproachThe idea that marginal revenue is different from the price is easy to see in a graph like Figure 9.1. On the downward-

If the firm decides to produce more, say, by increasing output from Q1 to Q2, it will move to point y on the demand curve. The firm sells more units, but in doing so, the price falls to P2. The new total revenue is P2 × Q2 or the rectangle B + C. Therefore, the marginal revenue of this output increase is the new revenue minus the old revenue:

TR2 = P2 × Q2 = B + C

TR1 = P1 × Q1 = A + B

MR = TR2 – TR1

MR = (B + C) – (A + B) = C – A

The area C contains the extra revenue that comes from selling more goods at price P2, but this alone is not the marginal revenue of the extra output. We must also subtract area A, the revenue the firm loses because it now sells all units (not just the marginal unit) for the lower price P2 instead of P1. In fact, as we saw in the Fluff example, if the price-

Firms would like to engage in price discrimination if they could and sell different units at different prices, charging high willingness-

342

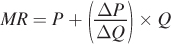

Marginal Revenue: A Mathematical Approach We can compute a formula for a firm’s marginal revenue using the logic we just discussed. As we saw, there are two effects when the firm sells an additional unit of output. Each of these will account for a component of the marginal revenue formula.

The first effect comes from the additional unit being sold at the market price P. In Figure 9.1, if we define Q2 – Q1 to be 1 unit, then this effect would be area C.

The second effect occurs because the additional unit drives down the market price for all the units the firm makes. To figure out how to express this component of marginal revenue, let’s first label the change in price ΔP (so that, had the additional unit not been sold, the price would have been P + ΔP). In Figure 9.1, we’re looking at the effect of a decrease in price, so ΔP < 0. Let’s also label the quantity before adding the incremental unit of output as Q and the incremental output as ΔQ. The second component of marginal revenue is therefore  the change in price caused by selling the additional unit of revenue times the quantity sold before adding the incremental unit. In Figure 9.1, this is area A. Note that because price falls as quantity rises—

the change in price caused by selling the additional unit of revenue times the quantity sold before adding the incremental unit. In Figure 9.1, this is area A. Note that because price falls as quantity rises—

Putting together these components, we have the formula for marginal revenue (MR) from producing an additional quantity (ΔQ) of output (notice that we add the two components together even though the second represents a loss in revenue because ΔP/ΔQ is already negative):

This negative second component means that marginal revenue will always be less than the market price. If we map this equation into Figure 9.1, the first term is the additional revenue from selling an additional unit at price P (area C) and the second is area A.

Looking more closely at this formula reveals how the shape of the demand curve facing a firm affects its marginal revenue. The change in price corresponding to a change in quantity, ΔP/ΔQ, is a measure of how steep the demand curve is. When the demand curve is really steep, price falls a lot in response to an increase in output. ΔP/ΔQ is a large negative number in this case. This will drive down MR and can even make it negative. On the other hand, when the demand curve is flatter, price is not very sensitive to quantity increases. In this case, because ΔP/ΔQ is fairly small in magnitude, the first (positive) component P of marginal revenue plays a larger relative role, keeping marginal revenue from falling too much as output rises. In the special case of perfectly flat demand curves, ΔP/ΔQ is zero, and therefore marginal revenue equals the market price of the good. We know from Chapter 8 that when a firm’s marginal revenue equals price, the firm is a price taker: Whatever quantity it sells will be sold at the market price P. This is an important insight that we return to below: Perfect competition is just the special case in which the firm’s demand curve is perfectly elastic, so MR = P.

This connection between the slope of the demand curve and the level of a firm’s marginal revenue is important in understanding how firms with market power choose the output levels that maximize their profits. We study this profit-

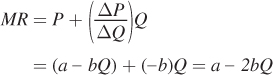

We can apply the marginal revenue formula to any demand curve. For nonlinear demand curves, the slope ΔP/ΔQ is the slope of a line tangent to the demand curve at quantity Q. But the formula is especially easy for linear demand curves, because ΔP/ΔQ is constant. For any linear (inverse) demand curve of the form P = a – bQ, where a (the vertical intercept of the demand curve) and b are constants, ΔP/ΔQ = –b. The inverse demand curve itself relates P (the other component of marginal revenue) to Q, so if we also plug P = a – bQ and ΔP/ΔQ = –b into the MR formula above, we arrive at an expression for the marginal revenue of any linear demand curve:

343

This formula shows that marginal revenue varies with the firm’s output. This is true in this specific case of a linear demand curve, but it’s important to recognize that it holds more generally. (The only exception to this outcome is for a perfectly competitive firm, for which marginal revenue is constant and equal to the market price for any production quantity.) Here, the marginal revenue curve looks a lot like the inverse demand curve. It has the same vertical intercept as the inverse demand curve, which is equal to a. (To see this, just plug Q = 0 into the demand and marginal revenue curves.) It also slopes down: A higher Q leads to lower marginal revenue. The only difference between the marginal revenue and demand curves is that the former is twice as steep: bQ in the inverse demand curve has been replaced with 2bQ. The formula for MR doesn’t just look like an inverse demand curve; it is conceptually similar, too. Just as the inverse demand curve shows how the price changes with production levels, the marginal revenue formula shows how marginal revenue changes with production levels. Further connecting the two curves is the fact that both the market price and marginal revenue are measured in the same units—

An example of a demand curve and its marginal revenue curve is shown in Figure 9.2.3 The demand curve in the figure is P = 100 – 10Q and therefore the marginal revenue curve is MR = 100 – 20Q. If Q = 4, as shown, then the demand curve implies P = $60 and MR = $20.

344

figure it out 9.1

Suppose the demand curve is Q = 12.5 – 0.25P.

What is the marginal revenue curve that corresponds to this demand curve?

Calculate marginal revenue when Q = 6. Calculate marginal revenue when Q = 7.

Solution:

First, we need to solve for the inverse demand curve by rearranging the demand function so that price is on the left side by itself:

Q = 12.5 – 0.25P

0.25P = 12.5 – Q

P = 50 – 4Q

Thus, we know that the inverse demand curve is P = 50 – 4Q, with a = 50 and b = 4. Because MR = a – 2bQ, we know that MR = 50 – 8Q.

We can plug these values into our MR equation to solve for marginal revenue:

When Q = 6, MR = 50 – 8(6) = 50 – 48 = 2

When Q = 7, MR = 50 – 8(7) = 50 – 56 = –6

Note that, as we discussed above, MR falls as Q rises and can even become negative.

See the problem worked out using calculus

See the problem worked out using calculus