Financial Health

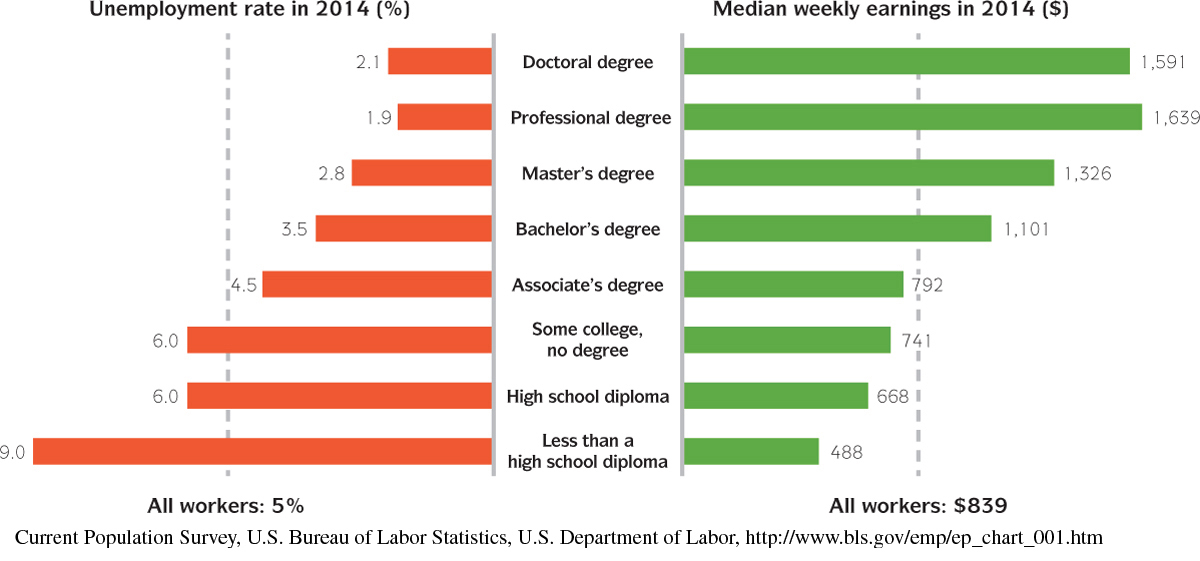

If you’re like most students, one big reason you’re in college is to graduate, get a job, and make enough money to pay your bills and plan for the future. When you earn a college degree, you make a tremendous investment in yourself and your future financial health. As Figure 12.2 shows, people with an associate’s degree earn, on average, $124 more per week than those with only a high school diploma, and those with a bachelor’s degree earn $433 more per week. That translates into roughly $6,400 to $22,500 of additional income each year for the rest of your life, depending on the degree you get. Imagine what you and your family could do with that added income! Plus, as Figure 12.2 also shows, people with a degree are less likely to be unemployed.

As important as it is to your financial future to get a degree, you will likely face at least a few financial challenges while you work toward your goals. In fact, in a recent survey, seven out of ten Americans identified money as a significant stressor in their lives.13 As a college student, you may be worrying right now about how you’ll pay next term’s tuition, pay for child care next week, or whittle down your student loan and credit card debt. But if these and other financial worries keep you up at night, you can take steps to take control of your finances — starting with creating a budget.

Create a Budget

A budget is a critical survival tool for your financial health. It is your financial plan: It documents your income and expenses over specific time periods (such as a week, month, or year). Creating and sticking to a budget lets you take control of your money, live within your means, and achieve your financial goals. To create a budget, follow these steps.

Budget: A plan that documents income and expenses for a specific period of time.

CONNECT

TO MY EXPERIENCES

When you were growing up, how did your family manage the household’s income? Was there a budget for monthly income and expenses? If so, how useful was the budget? If not, what were the consequences? Write one page about what your early experiences taught you about budgeting.

Step 1: Gather Information. For one month, collect your bank statements, loan and scholarship information, pay stubs, and any regular bills. Track all of your spending over the course of the month, and keep all of your receipts in one place, such as a desk drawer. If you spend $2 on a cup of coffee and don’t get a receipt, jot down “$2 coffee” and the date on a piece of paper and save it. You’ll need all this information to build your budget.

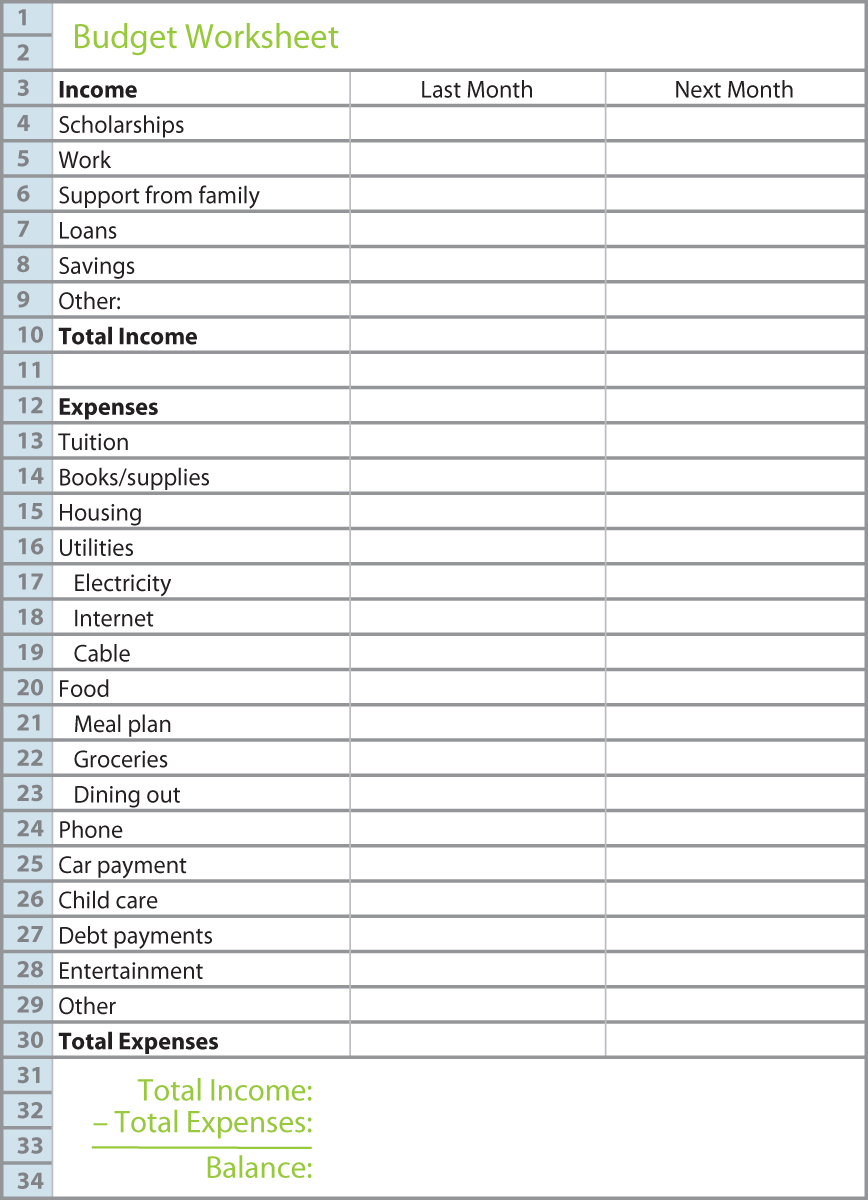

Step 2: Record Your Income and Expenses. Using a form or spreadsheet like the one in Figure 12.3, enter into the “Last Month” column all the income and expense information you gathered for the previous month (in step 1). Then subtract your total expenses from your total income to obtain your balance for the past month. If your income was greater than your expenses (a financially healthy situation), your balance will be positive. If you spent more than you made (a financially unhealthy situation), your balance will be negative. Once you see where your money’s coming from — and more important, where it’s going and if you’re spending more than you make — you can decide whether you need to manage your money more effectively.

Step 3: Use Your Insights to Make Changes. If you discover that you aren’t managing your money as effectively as you’d like (perhaps you’re spending more than you bring in), you can create a new budget reflecting the changes you need to make. For example, you might take a part-time job to earn more, or cut back on unnecessary spending. Return to your budget, and record your expected income and expenses in the “Next Month” column.

Step 4: Track Your Results and Refine Your Budget Further. At the end of the next month, see how closely your actual income and expenses match what you budgeted for the month. Use any differences to further tweak your budget to bring your actual earning and spending in line with your goals. The sections that follow provide ideas you can try.

DISCUSSION: Ask students what they think of when they hear the word budget. This can be an intimidating subject and can evoke negative connotations. Next, ask students to come up with ideas for how to think about budgets in a positive light. Ask students: How are budgets beneficial? What happens when you don’t have a budget?

Reduce Your Spending

If you usually spend more than you make or you just want to save some money, try reducing your spending. You may find some easy ways to do this. For example, if Callista wants to cut her spending by $100 a month, she can brew her own coffee each morning instead of buying coffee on the road, and she can eliminate one night out each week. Other solutions may require more sacrifice. If Callista’s goal is to graduate with less than $5,000 in debt, she may have to take fewer classes per term so that she can work more hours and pay more tuition up-front.

ACTIVITY: Have students write down some warning signs that would tell them that they’re having financial difficulties (such as having to choose which bills to pay this month or being unable to afford a birthday present for a friend). Next, ask students to write down two or three methods they would be willing to employ to reduce spending. Encourage students to keep these warning signs and techniques in mind as a “contingency plan.”

WRITING PROMPT: Have students respond to the following: Many popular blogs promote the idea that living with less actually gives you more freedom. Do you agree? Why or why not?

To make it easier to reduce your spending, distinguish between your must-haves (needs) and nice-to-haves (wants). For instance, Jerome needs a car to get from work to class, but he wants to keep his new SUV, which comes with a monthly payment he can barely afford. As tempting as it is to keep that SUV, Jerome could boost his financial health by trading it in for a car that doesn’t break his budget.

Being honest with yourself about your needs and wants and cutting your expenses can be hard, but here are some ideas that can help.

If you live on campus, change to a less expensive meal plan. If you live off campus, shop smart by using coupons and buying products on sale.

Drop your cable plan.

Find a cheaper Internet service.

Explore housing options. Is it cheaper to live on campus? Would you save money by selling your house and renting? Can you find a roommate to share expenses?

Cancel your gym membership and use campus facilities or exercise outdoors.

Go an extra two weeks between haircuts.

Explore options at your school for taking more classes each term. Full-time students can often take one or two more classes each term without paying more, which adds up to substantial savings. But take care that you don’t get overloaded: Talk with your adviser and family about how to make this work.

Get a Job to Boost Your Income

Working is a fact of life for most college students. According to the National Center for Education Statistics, four out of ten full-time students and seven out of ten part-time students work while attending college.14 Working has important advantages. You make money, gain valuable experience, build your skills, apply what you’re learning in class to the real world, and build your résumé.

However, there are potential risks associated with working, and it’s good to be mindful of these as you schedule your time. Students who work more than fifteen hours a week and those who work off campus are more likely to have lower grades and leave school before graduating.15 If you have a stressful job and work long hours, you might also have trouble putting enough time into your studies.

If you’re balancing work and school effectively now, continue taking good care of yourself so that you don’t get overwhelmed. If doing both is becoming problematic, consider taking fewer classes or getting more financial aid. You can talk about possible solutions with an adviser, your family, and your school’s financial aid office.

Navigate Financial Aid

It’s no secret that college is expensive and that financial aid is a lifesaver for students who couldn’t otherwise afford to go. According to the U.S. Department of Education, about two-thirds of all undergraduate students receive financial aid,16 in forms such as public or private loans, grants, scholarships, or work-study programs.

ACTIVITY: Invite a financial aid counselor from your campus to give a short presentation on financial aid. Have students prepare three questions in advance to ask during the presentation.

ACTIVITY: In class, explore the FAFSA Web site so that students are more familiar with the process.

Many sources of aid are available, but learning about and applying for aid can be stressful. A good place to start is with the basics: how to apply for aid, what types of aid exist, and how to keep your aid once you receive it.

FAFSA. If you’re currently receiving financial aid, then you’ve already completed a form called the Free Application for Federal Student Aid (FAFSA). If you haven’t yet applied for financial aid, start with the FAFSA. This tool assesses your (or your family’s) financial situation and calculates how much the federal government believes you can afford to pay for college — which determines how much aid you qualify for. To learn more about the FAFSA, go to www.fafsa.ed.gov or visit your college’s financial aid office.

Grants. One common type of financial aid is a grant, which is money provided by the government or your college that you’re not expected to repay. The federal government gives grants based on financial need (such as Pell Grants) as well as military service (such as Iraq and Afghanistan Service Grants). Your state government might provide grants to in-state residents who earned a strong high school GPA or those who graduated in the top half of their class and attend a two- or four-year college in the state. Your college may also provide grants based on financial need or past accomplishments.

CONNECT

TO MY RESOURCES

If you’ve taken out student loans, it’s not too early to craft a strategy for repaying them. Visit the financial aid office and ask about (1) your expected total debt upon graduation, (2) the average debt of graduates at your school and the percentage of students who can’t repay their loans, and (3) options for reducing your loans.

Scholarships. As with grants, you don’t have to repay scholarships. Scholarships come from different sources and are awarded for different reasons, such as financial need, talents or accomplishments, membership in a cultural or religious group, or a student’s area of study (for example, education or health science). Your high school or college may award scholarships, or you can earn them through your community, private organizations or businesses, and sometimes even your employer. Web-based services can help you find scholarships, but be sure to start with secure sites that don’t charge a fee.

Student Loans. Many students take out a loan to help pay for college. However, if you borrow large amounts and choose a low-paying career or don’t ever graduate, you could have trouble paying what you owe. So before you sign up for a loan, understand the pros and cons of borrowing that money. Research the different types of loans available to you, and talk with your adviser to make sure you’re taking all the courses required for graduation. Spending an extra year, or even an extra term, in college may mean more loans. Visit the career center to learn how much you can expect to earn if you graduate with your intended degree. Will your future income be enough that you can repay your loans and still afford to eat? And remember: Whenever you borrow money, you have to pay interest on the loan. Often, the faster you pay off the loan, the less interest you’ll end up paying in the long run, which can save you big bucks.

Here are some common loans available to students.

Direct subsidized loans. The federal government provides these loans. They usually have a lower interest rate than other types of loans, and interest doesn’t accrue (get added to the loan) while you’re in school. Students qualify for these loans based on financial need.

Direct unsubsidized loans. These government-provided loans tend to have higher interest rates than subsidized loans, and interest accrues while you’re in school. All college students are eligible for unsubsidized loans, regardless of financial need.

Direct PLUS loans. PLUS is a federal loan program that lets parents borrow money for the college expenses of a dependent student. PLUS loans have a higher interest rate and charge more fees than other federal loans.

Private loans. These loans are issued by institutions such as banks, credit unions, or colleges. Compared to federal loans, they often have higher interest rates and fewer repayment options.

FURTHER READING: For some helpful tips on how to repay loans and some additional resources, refer to the article “6 Ways for New Grads to Tackle Their Student Loans,” written by Liz Weston (Time.com, October 27, 2014).

CONNECT

TO MY CAREER

Are you currently working? If so, you can build valuable skills, even if your current job isn’t in your future career field. List three skills you’ll need in your future career, or a career that interests you, that you can develop in your current job. How will you build these skills?

Work-Study Programs. If you receive a work-study award, you can apply for an on-campus job that’s been set aside for someone with financial need. Positions fill up quickly, and placement isn’t guaranteed, so talk with someone in the financial aid office if you want to explore what’s available. Sure, the work-study job you get may not be perfect or exciting — you may find yourself making copies or delivering mail. Still, every job offers learning opportunities, and some work-study jobs can even give you experience in your field of study. For instance, if you want to be a journalist, a work-study job that involves helping your journalism professor write a book could teach you a lot about your dream profession.

Keeping Your Financial Aid. After all the time and energy you put into applying for and securing financial aid, take the following steps to keep it — or even increase it.

Fulfill requirements. Understand and fulfill all the requirements for keeping your financial aid. For example, if your GPA falls below a certain level or if you drop a class and become a part-time student (which colleges and funding sources define differently), you may lose your aid.

If your financial situation changes, see if you qualify for more aid. For instance, if you or a primary wage earner in your family loses a job, talk with your school’s financial aid office about what has changed and how that affects your aid eligibility.

Keep looking for aid. You may qualify for different scholarships as you progress through college. For instance, a donor may have established a scholarship for junior and senior engineering students who want to go into public service. Regularly research emerging opportunities like these.

Apply for financial aid each year. Be sure to complete the FAFSA and any other required applications on time so that you can keep your aid every year.

Control Your Credit Cards — So They Don’t Control You

When you buy something with a credit card, you’re taking out a short-term loan from the credit card company and promising that you’ll pay for the purchase later. Like student loans, credit cards come with interest rates. You have to pay that interest if you don’t pay off your credit card balance in full every month. But credit card interest rates can be shockingly high — as much as 20 percent or more.

To grasp how this high level of interest can affect your financial health, meet Jason. He has a $3,000 balance on his credit card, which charges 18 percent interest. If he makes only the minimum payment of $75 each month (and doesn’t spend any more on the card), he’ll end up paying a total of $6,923.08 over more than eighteen years!

If you have a credit card, look at one of your statements. Credit card companies are required to tell you how much you’ll pay in the long run if you make only the minimum monthly payment on your balance. Once you start racking up big credit card debt, it’s very hard to whittle it back down, so keep that number in the forefront of your mind. It could motivate you to whip out that “plastic” less often — and maybe even cut up your card and throw it away.

WRITING PROMPT: In a one- to two-page reflection paper, ask students to examine their use of credit cards. How do they feel about buying with credit cards? Have they ever been unable to pay their bill? What strategies could they use to decrease the amount of their credit card spending?

If you’re going to use credit cards, try these tactics for keeping your debt under control.

Use only one card. If you have several cards, pay off and close all of them except one.

Pay off the entire amount every month — on time.

Consider getting a debit card. This functions like a credit card when you make purchases, but it’s tied to your checking account and withdraws money that you already have.

Check your credit report for errors. Each year, you can get a free copy of your credit report from each of the three credit-reporting agencies (Equifax, TransUnion, and Experian). To get your reports, go to www.annualcreditreport.com.