| Figure 29.7 | The Shor |

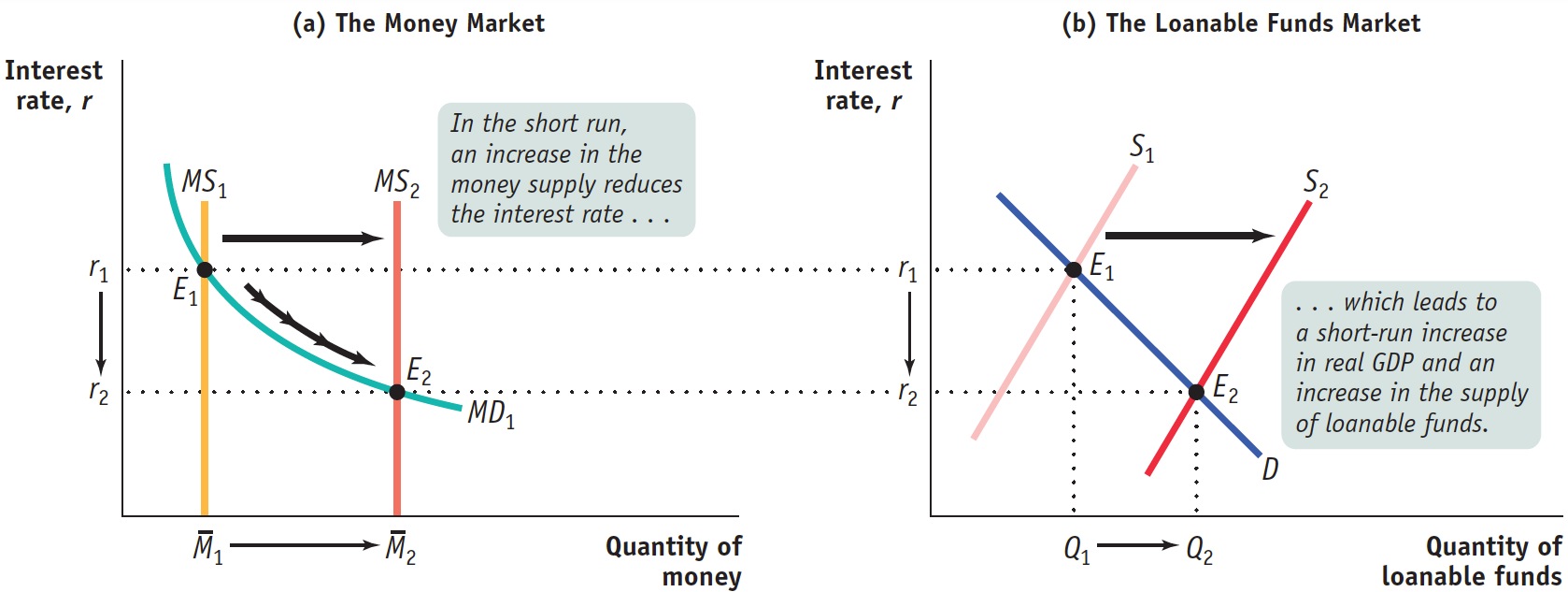

The Short- Run Determination of the Interest Rate Panel (a) shows the liquidity preference model of the interest rate: the equilibrium interest rate matches the money supply to the quantity of money demanded. In the short run, the interest rate is determined in the money market, where an increase in the money supply, from  1 to

1 to  2, pushes the equilibrium interest rate down, from r1 to r2. Panel (b) shows the loanable funds model of the interest rate. The fall in the interest rate in the money market leads, through the multiplier effect, to an increase in real GDP and savings; to a rightward shift of the supply curve of loanable funds, from S1 to S2; and to a fall in the interest rate, from r1 to r2. As a result, the new equilibrium interest rate in the loanable funds market matches the new equilibrium interest rate in the money market at r2.

2, pushes the equilibrium interest rate down, from r1 to r2. Panel (b) shows the loanable funds model of the interest rate. The fall in the interest rate in the money market leads, through the multiplier effect, to an increase in real GDP and savings; to a rightward shift of the supply curve of loanable funds, from S1 to S2; and to a fall in the interest rate, from r1 to r2. As a result, the new equilibrium interest rate in the loanable funds market matches the new equilibrium interest rate in the money market at r2.

1 to

1 to  2, pushes the equilibrium interest rate down, from r1 to r2. Panel (b) shows the loanable funds model of the interest rate. The fall in the interest rate in the money market leads, through the multiplier effect, to an increase in real GDP and savings; to a rightward shift of the supply curve of loanable funds, from S1 to S2; and to a fall in the interest rate, from r1 to r2. As a result, the new equilibrium interest rate in the loanable funds market matches the new equilibrium interest rate in the money market at r2.

2, pushes the equilibrium interest rate down, from r1 to r2. Panel (b) shows the loanable funds model of the interest rate. The fall in the interest rate in the money market leads, through the multiplier effect, to an increase in real GDP and savings; to a rightward shift of the supply curve of loanable funds, from S1 to S2; and to a fall in the interest rate, from r1 to r2. As a result, the new equilibrium interest rate in the loanable funds market matches the new equilibrium interest rate in the money market at r2.[Leave] [Close]