The Spending Multiplier: An Informal Introduction

The story of the boom and bust in Ft. Myers involves a sort of chain reaction in which an initial rise or fall in spending leads to changes in income, which lead to further changes in spending, and so on. Let’s examine that chain reaction more closely, this time thinking through the effects of changes in spending on the economy as a whole.

For the sake of this analysis, we’ll make the following four simplifying assumptions that we will have to reconsider in later modules:

We assume that producers are willing to supply additional output at a fixed price. That is, if consumers or businesses buying investment goods decide to spend an additional $1 billion, that will translate into the production of $1 billion worth of additional goods and services without driving up the overall level of prices. As a result, changes in overall spending translate into changes in aggregate output, as measured by real GDP. This assumption isn’t too unrealistic in the short run, but in this section we’ll learn that it needs to be changed when we think about the long-

run effects of changes in demand. We take the interest rate as given.

We assume that there is no government spending and no taxes.

We assume that exports and imports are zero.

Given these simplifying assumptions, consider what happens if there is a change in investment spending. Specifically, imagine that for some reason home builders decide to spend an extra $100 billion on home construction over the next year.

The direct effect of this increase in investment spending will be to increase income and the value of aggregate output by the same amount. That’s because each dollar spent on home construction translates into a dollar’s worth of income for construction workers, suppliers of building materials, electricians, and so on. If the process stopped there, the increase in residential investment spending would raise overall income by exactly $100 billion.

But the process doesn’t stop there. The increase in aggregate output leads to an increase in disposable income that flows to households in the form of profits and wages. The increase in households’ disposable income leads to a rise in consumer spending, which, in turn, induces firms to increase output yet again. This generates another rise in disposable income, which leads to another round of consumer spending increases, and so on. So there are multiple rounds of increases in aggregate output.

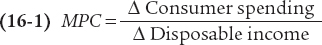

The marginal propensity to consume, or MPC, is the increase in consumer spending when disposable income rises by $1.

How large is the total effect on aggregate output if we sum the effect from all these rounds of spending increases? To answer this question, we need to introduce the concept of the marginal propensity to consume, or MPC: the increase in consumer spending when disposable income rises by $1. When consumer spending changes because of a rise or fall in disposable income, MPC is the change in consumer spending divided by the change in disposable income:

where the symbol Δ (delta) means “change in.” For example, if consumer spending goes up by $6 billion when disposable income goes up by $10 billion, MPC is $6 billion/$10 billion = 0.6.

The marginal propensity to save, or MPS, is the increase in household savings when disposable income rises by $1.

Because consumers normally spend part but not all of an additional dollar of disposable income, MPC is a number between 0 and 1. The additional disposable income that consumers don’t spend is saved; the marginal propensity to save, or MPS, is the fraction of b an additional $1 of disposable income that is saved. MPS is equal to 1 - MPC.

AP® Exam Tip

| formula: | ΔConsumer spending | . |

| ΔDisposable income |

| 1 | . |

| (1 - MPC) |

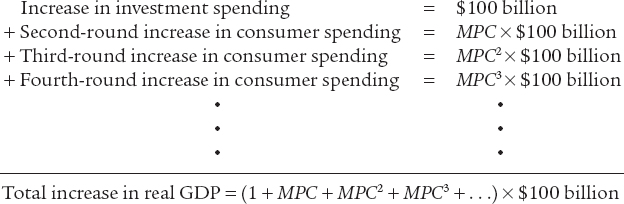

With the assumption of no taxes and no international trade, each $1 increase in spending raises both real GDP and disposable income by $1. So the $100 billion increase in investment spending initially raises real GDP by $100 billion. The corresponding $100 billion increase in disposable income leads to a second-

So the $100 billion increase in investment spending sets off a chain reaction in the economy. The net result of this chain reaction is that a $100 billion increase in investment spending leads to a change in real GDP that is a multiple of the size of that initial change in spending.

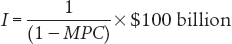

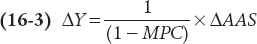

How large is this multiple? It’s a mathematical fact that an infinite series of the form 1 + x + x2 + x3 + . . ., where x is between 0 and 1, is equal to 1/(1 − x). So the total effect of a $100 billion increase in investment spending, I, taking into account all the subsequent increases in consumer spending (and assuming no taxes and no international trade), is given by:

(16-

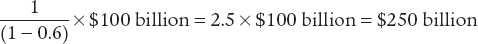

Let’s consider a numerical example in which MPC = 0.6: each $1 in additional disposable income causes a $0.60 rise in consumer spending. In that case, a $100 billion increase in investment spending raises real GDP by $100 billion in the first round. The second-

Notice that even though there can be a nearly endless number of rounds of expansion of real GDP, the total rise in real GDP is limited to $250 billion. The reason is that at each stage some of the rise in disposable income “leaks out” because it is saved, leaving less and less to be spent in the next round. How much of an additional dollar of disposable income is saved depends on MPS, the marginal propensity to save.

We’ve described the effects of a change in investment spending, but the same analysis can be applied to any other change in spending. The important thing is to distinguish between the initial change in aggregate spending, before real GDP rises, and the additional change in aggregate spending caused by the change in real GDP as the chain reaction unfolds. For example, suppose that a boom in housing prices makes consumers feel richer and that, as a result, they become willing to spend more at any given level of disposable income. This will lead to an initial rise in consumer spending, before real GDP rises. But it will also lead to second and later rounds of higher consumer spending as real GDP and disposable income rise.

An autonomous change in aggregate spending is an initial rise or fall in aggregate spending that is the cause, not the result, of a series of income and spending changes.

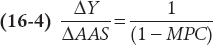

The spending multiplier is the ratio of the total change in real GDP caused by an autonomous change in aggregate spending to the size of that autonomous change. It indicates the total rise in real GDP that results from each $1 of an initial rise in spending.

An initial rise or fall in aggregate spending at a given level of real GDP is called an autonomous change in aggregate spending. It’s autonomous—

So the spending multiplier is:

Notice that the size of the spending multiplier depends on MPC. If the marginal propensity to consume is high, so is the spending multiplier. This is true because the size of MPC determines how large each round of expansion is compared with the previous round. To put it another way, the higher MPC is, the less disposable income “leaks out” into savings at each round of expansion.

The Spending Multiplier and the Great Depression

The Spending Multiplier and the Great Depression

The concept of the spending multiplier was originally devised by economists trying to understand the greatest economic disaster in history, the collapse of output and employment from 1929 to 1933, which began the Great Depression. Most economists believe that the slump from 1929 to 1933 was driven by a collapse in investment spending. But as the economy shrank, consumer spending also fell sharply, multiplying the effect on real GDP.

The table below shows what happened to investment spending, consumer spending, and GDP during those four terrible years. All data are in 2005 dollars for consistency with most of the other data in this section that are adjusted for inflation to 2005, the base year for the GDP deflator. What we see is that investment spending imploded, falling by more than 80%. But consumer spending also fell drastically and actually accounted for more of the fall in real GDP. (The total fall in real GDP was larger than the combined fall in consumer and investment spending, mainly because of technical accounting issues.)

Investment Spending, Consumer Spending, and Real GDP in the Great Depression (billions of 2005 dollars)

| 1929 | 1933 | Change | |

| Investment spending | $101.7 | $18.9 | −$82.8 |

| Consumer spending | 736.6 | 601.1 | −135.5 |

| Real GDP | 977.0 | 716.4 | −260.6 |

Source: Bureau of Economic Analysis.

The numbers in the table suggest that at the time of the Great Depression, the spending multiplier was around 3. Most current estimates put the size of the spending multiplier considerably lower—

In later modules we’ll use the concept of the spending multiplier to analyze the effects of fiscal and monetary policies. We’ll also see that the spending multiplier changes when we introduce various complications, including taxes and foreign trade. First, however, we need to look more deeply at what determines consumer spending.