Tackle the Test: Free-Response Questions

Question

Use the aggregate consumption function provided to answer the following questions:

What is the value of the marginal propensity to consume?

Suppose aggregate current disposable income is $4.0 trillion. Calculate the amount of aggregate consumer spending.

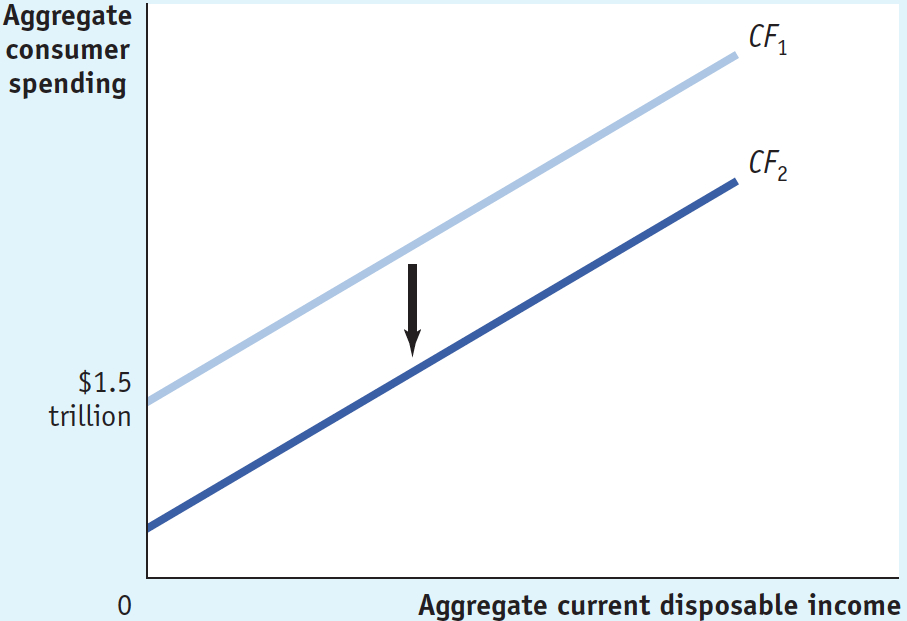

Draw a correctly labeled graph showing this aggregate consumption function.

What is the slope of this aggregate consumption function?

On your graph from part c, show what would happen if expected future income decreases.

Page 171Rubric for FRQ 1 (7 points)

1 point: 0.8

1 point: $4.7 trillion

1 point: Vertical axis labeled “Aggregate consumer spending” and horizontal axis labeled “Aggregate current disposable income”

1 point: Vertical intercept of $1.5 trillion

1 point: Upward-

sloping aggregate consumption function 1 point: 0.8

1 point: Aggregate consumption function shifts downward

Aggregate current disposable income

Aggregate current disposable incomeQuestion

List the three most important factors affecting planned investment spending. Explain how each is related to actual investment spending. (6 points)

Rubric for FRQ 2 (6 points)

1 point: The interest rate

1 point: The interest rate is the opportunity cost of investing. As the interest rate increases, investment spending decreases; as the interest rate decreases, investment spending increases.

1 point: Expected future real GDP

1 point: If a firm expects its sales to grow in the future, it will invest in expanded production capacity.

1 point: Production capacity

1 point: If a firm finds its existing production capacity insufficient for its future production needs, it will undertake investment spending to meet those needs; if it has more capacity than it needs, there is no need for investment spending.