The Spending Multiplier and Estimates of the Influence of Government Policy

An expansionary fiscal policy, like the American Recovery and Reinvestment Act, pushes the aggregate demand curve to the right. A contractionary fiscal policy, like Lyndon Johnson’s tax surcharge, pushes the aggregate demand curve to the left. For policy makers, however, knowing the direction of the shift isn’t enough: they need estimates of how much the aggregate demand curve will be shifted by a given policy. To get these estimates, they use the concept of the multiplier.

Multiplier Effects of Changes in Government Purchases

Suppose that a government decides to spend $50 billion to build bridges and roads. The government’s purchases of goods and services will directly increase total spending on final goods and services by $50 billion. But there will also be an indirect effect because the government’s purchases will start a chain reaction throughout the economy. The firms producing the goods and services purchased by the government will earn revenues that flow to households in the form of wages, profit, interest, and rent. This increase in disposable income will lead to a rise in consumer spending. The rise in consumer spending, in turn, will induce firms to increase output, leading to a further rise in disposable income, which will lead to another round of consumer spending increases, and so on.

In Module 16 we learned about the spending multiplier: the factor by which we multiply the amount of an autonomous change in aggregate spending to find the resulting change in real GDP. An increase in government purchases of goods and services is an example of an autonomous increase in aggregate spending. Any increase in government purchases of goods and services will lead to a series of additional purchases, resulting in an even larger final increase in real GDP. The initial change in spending, multiplied by the spending multiplier gives us the final change in real GDP.

Let’s consider a simple case that does not involve taxes or international trade. In this case, any change in GDP accrues entirely to households. Assume that the aggregate price level is fixed, so that any increase in nominal GDP is also a rise in real GDP, and that the interest rate is fixed. In that case, the spending multiplier is 1/(1 − MPC). Recall that MPC is the marginal propensity to consume, the fraction of an additional $1 in disposable income that is spent. For example, if the marginal propensity to consume is 0.5, the spending multiplier is 1/(1 − 0.5) = 1/0.5 = 2. Given a spending multiplier of 2, a $50 billion increase in government purchases of goods and services would increase real GDP by $100 billion. Of that $100 billion, $50 billion is the initial effect from the increase in G, and the remaining $50 billion is the subsequent effect of more production leading to more income which leads to more consumer spending, which leads to more production, and so on.

What happens if government purchases of goods and services are reduced instead? The math is exactly the same, except that there’s a minus sign in front: if government purchases of goods and services fall by $50 billion and the marginal propensity to consume is 0.5, real GDP falls by $100 billion. This is the result of less production leading to less income, which leads to less consumption, which leads to less production, and so on.

Multiplier Effects of Changes in Government Transfers and Taxes

Expansionary or contractionary fiscal policy need not take the form of changes in government purchases of goods and services. Governments can also change transfer payments or taxes. In general, however, a change in government transfers or taxes shifts the aggregate demand curve by less than an equal-

To see why, imagine that instead of spending $50 billion on building bridges, the government simply hands out $50 billion in the form of government transfers. In this case, there is no direct effect on aggregate demand as there was with government purchases of goods and services. Real GDP and income grow only because households spend some of that $50 billion—

Table 21.1 shows a hypothetical comparison of two expansionary fiscal policies assuming an MPC equal to 0.5 and a multiplier equal to 2: one in which the government directly purchases $50 billion in goods and services and one in which the government makes transfer payments instead, sending out $50 billion in checks to consumers. In each case, there is a first-

Table 21.1 Hypothetical Effects of a Fiscal Policy with a Multiplier of 2

| Effect on real GDP | $50 billion rise in government purchases of goods and services | $50 billion rise in government transfer payments |

| First round | $50 billion | $25 billion |

| Second round | $25 billion | $12.5 billion |

| Third round | $12.5 billion | $6.25 billion |

| • | • | • |

| • | • | • |

| • | • | • |

| Eventual effect | $100 billion | $50 billion |

However, the first-

A tax cut has an effect similar to the effect of a transfer. It increases disposable income, leading to a series of increases in consumer spending. But the overall effect is smaller than that of an equal-

The tax multiplier is the factor by which a change in tax collections changes real GDP.

The tax multiplier is the factor by which we multiply a change in tax collections to find the total change in real GDP. Recall that the spending multiplier is 1/(1−MPC). The tax multiplier has “MPC” in place of “1” in the numerator to reflect the initial spending decrease of MPC for each $1 of taxes collected. And the tax multiplier is negative because spending decreases when taxes increase, and spending increases when taxes decrease. This makes the tax multiplier:

−MPC/(1−MPC)

For example, if the MPC is 0.80, then the tax multiplier is −0.80/(1−0.80) = −4. So a $10 billion increase in taxes would cause a change in spending of −4 × $10 billion = −$40 billion.

The multiplier for a change in transfers is the same as the tax multiplier, except the multiplier is positive, because when transfers increase, spending increases, and when transfers decrease, spending decreases. In our example above, the MPC was 0.5, so the multiplier was 0.5/(1−0.5) = 1. This explains why the $50 billion increase in transfers led to a $50 billion total increase in real GDP. If the MPC had been 0.75, the multiplier would have been 0.75/(1−0.75) = 3, and the $50 billion increase in transfers would have led to a 3 × $50 billion = $150 billion total increase in real GDP.

The balanced budget multiplier is the factor by which a change in both spending and taxes changes real GDP.

When a government collects taxes to cover its expenditures, it activates both the spending multiplier and the tax multiplier. The spending multiplier applies to the government spending and the tax multiplier applies to the equivalent taxes. By combining these multipliers, the balanced budget multiplier is the factor by which we multiply a change in both spending and taxes to find the total change in real GDP. We can find the balanced budget multiplier by adding the spending and tax multipliers together: 1/(1−MPC) + (−MPC)/(1−MPC) = (1−MPC)/(1−MPC) = 1. So each $1 of government spending funded with new tax collections increases aggregate spending by $1.

Lump-

While a balanced budget simplifies the multiplier story, the existence of taxes that depend on real GDP complicate it. In the real world, governments rarely impose lump-

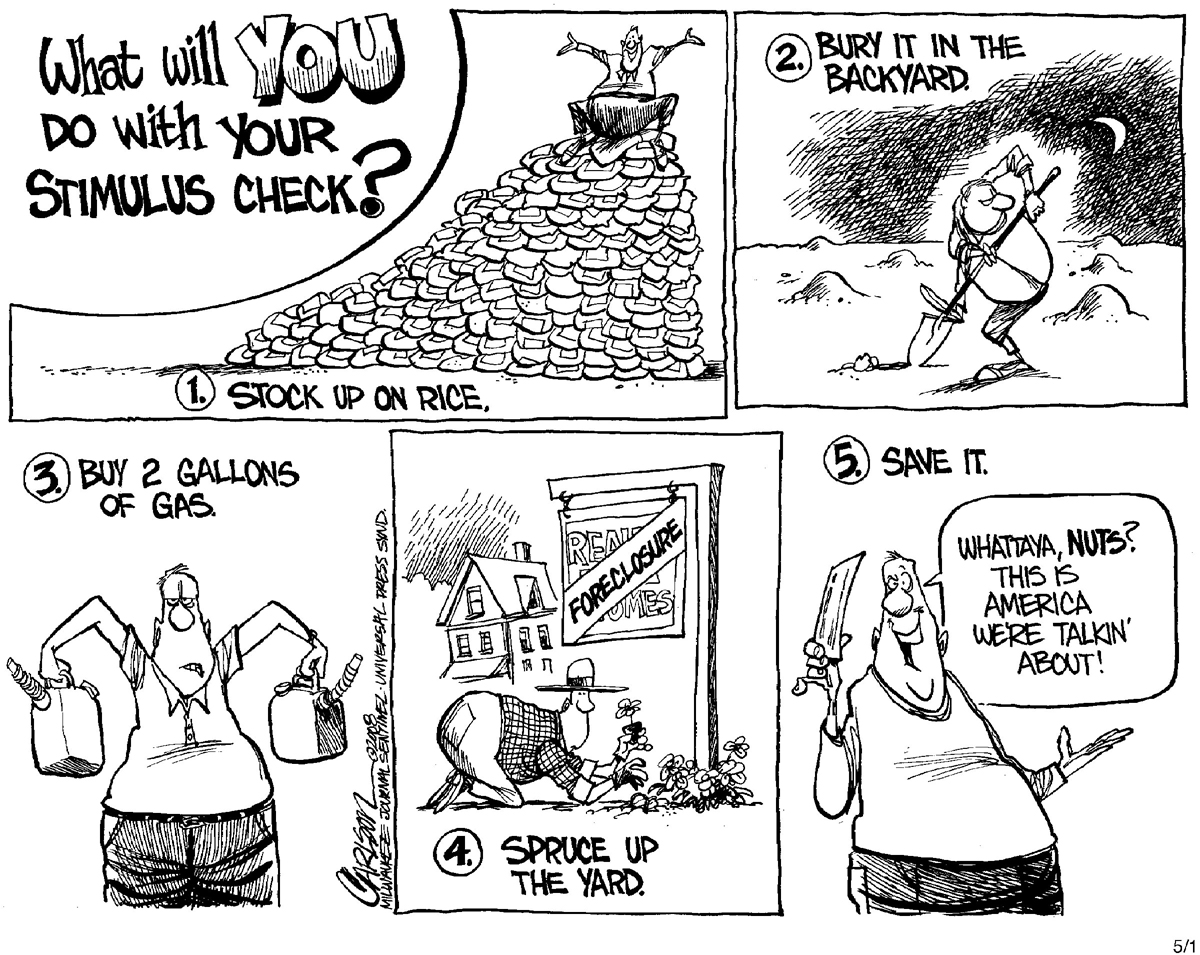

In practice, economists often argue that who among the population gets tax cuts or increases in government transfers also matters. For example, compare the effects of an increase in unemployment benefits with a cut in taxes on profits distributed to shareholders as dividends. Consumer surveys suggest that the average unemployed worker will spend a higher share of any increase in his or her disposable income than would the average recipient of dividend income. That is, people who are unemployed tend to have a higher MPC than people who own a lot of stocks, because the latter tend to be wealthier and tend to save more of any increase in disposable income. If that’s true, a dollar spent on unemployment benefits increases aggregate demand more than a dollar’s worth of dividend tax cuts. Such arguments played an important role in the final provisions of the 2008 stimulus package.

How Taxes Affect the Multiplier

Government taxes capture some part of the increase in real GDP that occurs in each round of the multiplier process, since most government taxes depend positively on real GDP. As a result, disposable income increases by considerably less than $1 for each $1 spent once we include taxes in the model.

AP® Exam Tip

Simplify your calculations! The tax multiplier is always 1 less than the spending multiplier, and the opposite sign. When taxes and government spending both increase or decrease by the same amount, the net change in real GDP is simply the change in government spending. That is, the balanced budget multiplier is simply 1.

The increase in government tax revenue when real GDP rises isn’t the result of a deliberate decision or action by the government. It’s a consequence of the way the tax laws are written, which causes most sources of government revenue to increase automatically when real GDP goes up. For example, income tax receipts increase when real GDP rises because the amount each individual owes in taxes depends positively on his or her income, and households’ taxable income rises when real GDP rises. Sales tax receipts increase when real GDP rises because people with more income spend more on goods and services. And corporate profit tax receipts increase when real GDP rises because profits increase when the economy expands.

The effect of these automatic increases in tax revenue is to reduce the size of the spending and tax multipliers. Remember, the multipliers are the result of a chain reaction in which higher real GDP leads to higher disposable income, which leads to higher consumer spending, which leads to further increases in real GDP. The fact that the government siphons off some of any increase in real GDP means that at each stage of this process, the increase in consumer spending is smaller than it would be if taxes weren’t part of the picture. As a result, these multipliers become smaller.

Automatic stabilizers are government spending and taxation rules that cause fiscal policy to be automatically expansionary when the economy contracts and automatically contractionary when the economy expands.

Many macroeconomists believe it’s a good thing that taxes reduce the multipliers in real life. Most, though not all, recessions are the result of negative demand shocks. The same mechanism that causes tax revenue to increase when the economy expands causes it to decrease when the economy contracts. Since tax receipts decrease when real GDP falls, the effects of these negative demand shocks are smaller than they would be if there were no taxes. The decrease in tax revenue reduces the adverse effect of the initial fall in aggregate demand. The automatic decrease in government tax revenue generated by a fall in real GDP—

The rules that govern tax collection aren’t the only automatic stabilizers, although they are the most important ones. Some types of government transfers also play a stabilizing role. For example, more people receive unemployment insurance when the economy is depressed than when it is booming. The same is true of Medicaid and food stamps. So transfer payments tend to rise when the economy is contracting and fall when the economy is expanding. Like changes in tax revenue, these automatic changes in transfers tend to reduce the size of the multipliers because the total change in disposable income that results from a given rise or fall in real GDP is smaller.

Discretionary fiscal policy is fiscal policy that is the result of deliberate actions by policy makers rather than rules.

As in the case of government tax revenue, many macroeconomists believe that it’s a good thing that government transfers reduce the spending and tax multipliers. Expansionary and contractionary fiscal policies that are the result of automatic stabilizers are widely considered helpful to macroeconomic stabilization, because they blunt the extremes of the business cycle. But what about fiscal policy that isn’t the result of automatic stabilizers? Discretionary fiscal policy is fiscal policy that is the direct result of deliberate actions by policy makers rather than automatic adjustment. For example, during a recession, the government may pass legislation that cuts taxes and increases government spending in order to stimulate the economy. In general, mainly due to problems with time lags as discussed in Module 10, economists tend to support the use of discretionary fiscal policy only in special circumstances, such as during an especially severe recession.

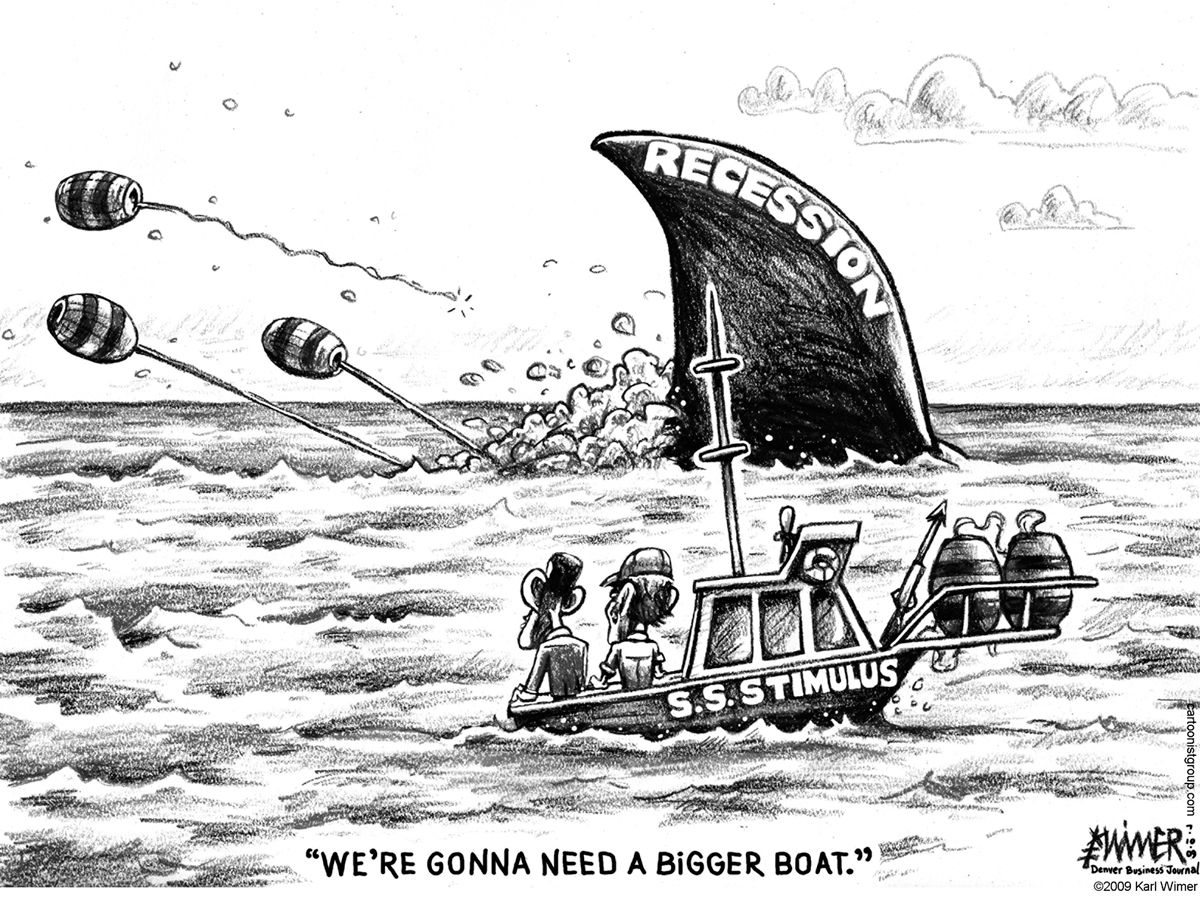

About That Stimulus Package . . .

About That Stimulus Package . . .

In early 2008, there was broad bipartisan agreement that the U.S. economy needed a fiscal stimulus. However, there was sharp partisan disagreement about what form that stimulus should take. The eventual bill was a compromise that left both sides unhappy and arguably made the stimulus less effective than it could have been.

Initially, there was little support for an increase in government purchases of goods and services—

The eventual compromise gave most taxpayers a flat $600 rebate, $1,200 for married couples. Very highincome taxpayers were not entitled to a rebate; low earners who didn’t make enough to pay income taxes, but did pay other taxes, received $300. In effect, the plan was a combination of tax cuts for most Americans and transfer payments to Americans with low incomes.

How well designed was the stimulus plan? Many economists believed that only a fraction of the rebate checks would actually be spent, so that the eventual multiplier would be fairly low. White House economists appeared to agree: they estimated that the stimulus would raise employment by half a million jobs above what it would have been otherwise, the same number offered by independent economists who believed that the multiplier on the plan would be around 0.75. Some economists were critical, arguing that Congress should have insisted on a plan that yielded more “bang for the buck.”

Both Democratic and Republican economists working for Congress defended the plan, arguing that the perfect is the enemy of the good—

Despite controversies over specifics, the general consensus about active stabilization policy is apparent: when at first you don’t succeed, try, try again.