Check Your Understanding

Question

Use a diagram of the loanable funds market to illustrate the effect of the following events on the equilibrium interest rate and quantity of loanable funds.

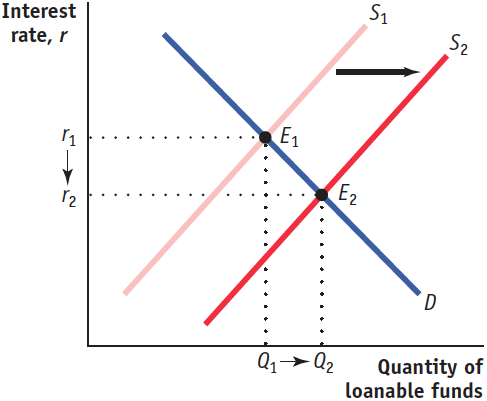

An economy is opened to international movements of capital, and a capital inflow occurs.

As capital flows into the economy, the supply of loanable funds increases. This is illustrated by the shift of the supply curve from S1 to S2 in the accompanying diagram. As the equilibrium moves from E1 to E2, the equilibrium interest rate falls from r1 to r2, and the equilibrium quantity of loanable funds increases from Q1 to Q2.

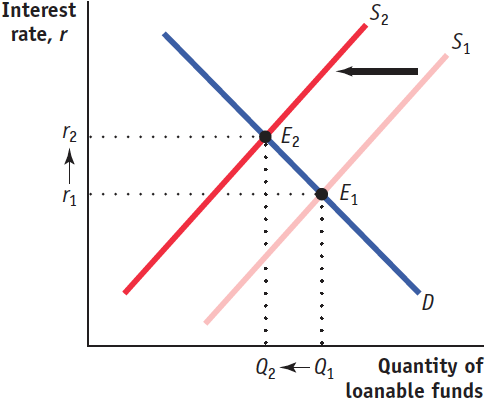

Retired people generally save less than working people at any interest rate. The proportion of retired people in the population goes up.

Savings fall due to the higher proportion of retired people, and the supply of loanable funds decreases. This is illustrated by the leftward shift of the supply curve from S1 to S2 in the accompanying diagram. The equilibrium moves from E1 to E2, the equilibrium interest rate rises from r1 to r2, and the equilibrium quantity of loanable funds falls from Q1 to Q2.

Question

Explain what is wrong with the following statement: “Savings and investment spending may not be equal in the economy as a whole in equilibrium because when the interest rate rises, households will want to save more money than businesses will want to invest.”

We know from the loanable funds market that as the interest rate rises, households want to save more and consume less. But at the same time, an increase in the interest rate lowers the number of investment spending projects with returns at least as high as the interest rate. The statement “Households will want to save more money than businesses will want to invest” cannot represent an equilibrium in the loanable funds market because it says that the quantity of loanable funds offered exceeds the quantity of loanable funds demanded. If that were to occur, the interest rate would fall to make the quantity of loanable funds offered equal to the quantity of loanable funds demanded.Question

Suppose that expected inflation rises from 3% to 6%.

How will the real interest rate be affected by this change?

The real interest rate will not change. According to the Fisher effect, an increase in expected inflation drives up the nominal interest rate, leaving the real interest rate unchanged.How will the nominal interest rate be affected by this change?

The nominal interest rate will rise by 3%. Each additional percentage point of expected inflation drives up the nominal interest rate by 1 percentage point.What will happen to the equilibrium quantity of loanable funds?

As long as inflation is expected, it does not affect the equilibrium quantity of loanable funds. Both the supply and demand curves for loanable funds are pushed upward, leaving the equilibrium quantity of loanable funds unchanged.