Tackle the Test: Free-Response Questions

Question

Consider the information provided below for the hypothetical country of Zeta.

Tax revenues = $2,000

Government purchases of goods and services = $1,500

Government transfers = $1,000

Real GDP = $20,000

Potential output = $18,000

Is the budget balance in Zeta positive or negative? What is the amount of the budget balance?

Zeta is currently in what phase of the business cycle? Explain.

Is Zeta implementing the appropriate fiscal policy given the current state of the economy? Explain.

How does Zeta’s cyclically adjusted budget deficit compare with its actual budget deficit? Explain.

Rubric for FRQ 1 (8 points)

1 point: Negative

1 point: −$500

1 point: Expansion

1 point: Real GDP > potential output

1 point: No

1 point: Zeta is running a budget deficit during an expansion.

1 point: It is larger.

1 point: Because if real GDP equaled potential output, tax revenues would be lower and government transfers would be higher.

Question

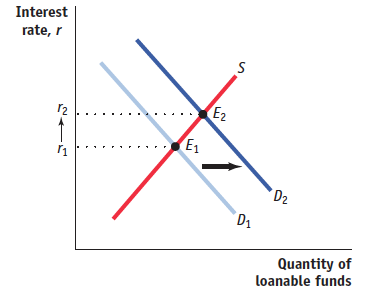

In Module 29 you learned about the market for loanable funds, which is intimately related to our current topic of budget deficits. Use a correctly labeled graph of the market for loanable funds to illustrate the effect of a persistent budget deficit. Identify and explain the effect persistent budget deficits can have on private investment. (6 points)

Rubric for FRQ 2 (6 points)

1 point: Graph labeled “Interest rate” on the vertical axis, “Quantity of loanable funds” on the horizontal axis, and a downward-sloping demand curve

1 point: Upward-sloping supply curve

1 point: Rightward shift of demand curve

1 point: Increase in the equilibrium interest rate shown on graph

1 point: This effect is called “crowding out.”

1 point: Persistent budget deficits increase the demand for loanable funds, thereby increasing interest rates and decreasing private investment.