Monetary Policy and Aggregate Demand

AP® Exam Tip

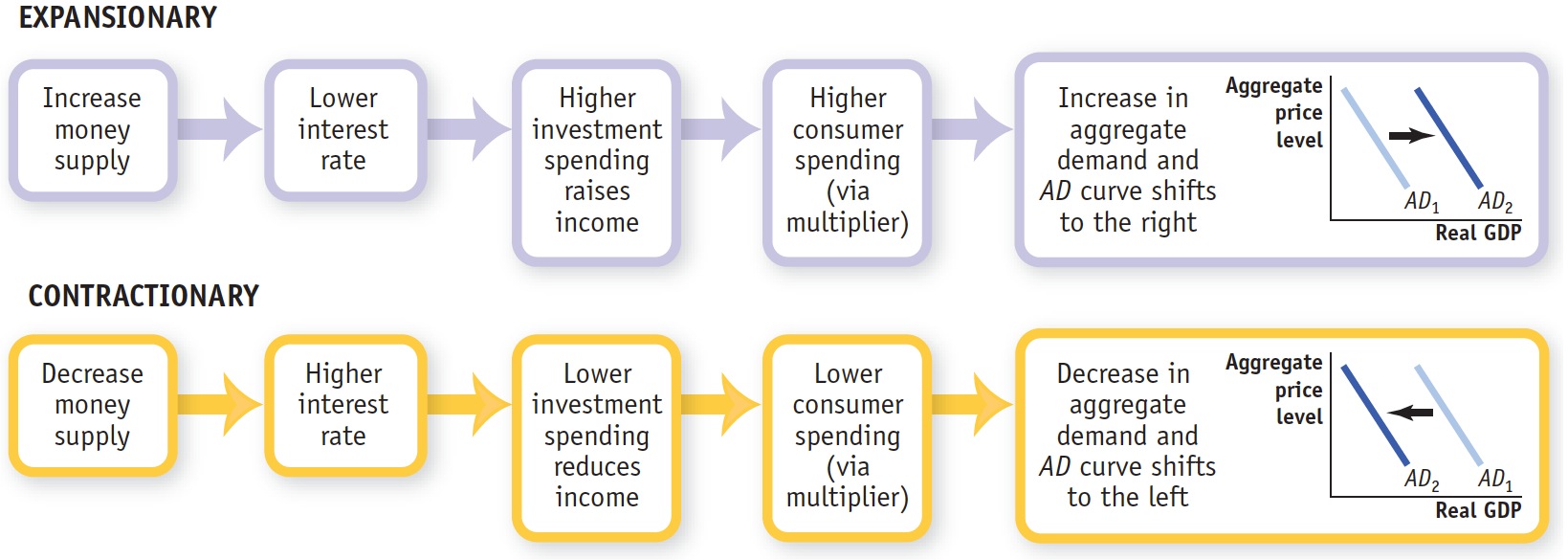

Remember that the aggregate demand curve shifts in the same direction as the money supply curve when the Fed conducts monetary policy.

We have seen how fiscal policy can be used to stabilize the economy. Now we will see how monetary policy—

Expansionary and Contractionary Monetary Policy

Previously we said that monetary policy shifts the aggregate demand curve. We can now explain how that works: through the effect of monetary policy on the interest rate.

Expansionary monetary policy is monetary policy that increases aggregate demand.

Figure 31.3 illustrates the process. Suppose that the Federal Reserve wants to reduce interest rates, so it expands the money supply. As we’ve seen, this leads to a lower interest rate. A lower interest rate, in turn, will lead to more investment spending, which will lead to higher real GDP, which will lead to higher consumer spending, and so on through the multiplier process. So the total quantity of goods and services demanded at any given aggregate price level rises when the quantity of money increases, and the AD curve shifts to the right. Monetary policy that shifts the AD curve to the right, as illustrated in the top portion of Figure 31.3, is known as expansionary monetary policy.

| Figure 31.3 | Expansionary and Contractionary Monetary Policy |

Contractionary monetary policy is monetary policy that reduces aggregate demand.

Suppose, alternatively, that the Federal Reserve contracts the money supply. This leads to a higher interest rate. The higher interest rate leads to lower investment spending, which leads to lower real GDP, which leads to lower consumer spending, and so on. So the total quantity of goods and services demanded falls when the money supply is reduced, and the AD curve shifts to the left. Monetary policy that shifts the AD curve to the left, as illustrated in the lower portion of Figure 31.3, is called contractionary monetary policy.