Tackle the Test: Free-Response Questions

Question

Assume the central bank increases the quantity of money by 25%, even though the economy is initially in both short-

run and long- run macroeconomic equilibrium. Describe the effects, in the short run and in the long run (giving numbers where possible), on the following: aggregate output

the aggregate price level

the real value of the money supply (its purchasing power for goods and services)

the interest rate

Rubric for FRQ 1 (8 points)

1 point: Aggregate output rises in the short run.

1 point: Aggregate output falls back to potential output in the long run.

1 point: The aggregate price level rises in the short run (by less than 25%).

1 point: The aggregate price level rises by 25% in the long run.

1 point: The real value of the money supply increases in the short run.

1 point: The real value of the money supply does not change (relative to its original value) in the long run.

1 point: The interest rate falls in the short run.

1 point: The interest rate rises back to its original level in the long run.

Question

Draw a correctly labeled graph of aggregate demand and aggregate supply showing an economy in long-

run macroeconomic equilibrium. On your graph, show what happens in the short run if the central bank increases the money supply to pay off a government deficit. Explain.

On your graph, show what will happen in the long run. Explain.(6 points)

Rubric for FRQ 2 (6 points)

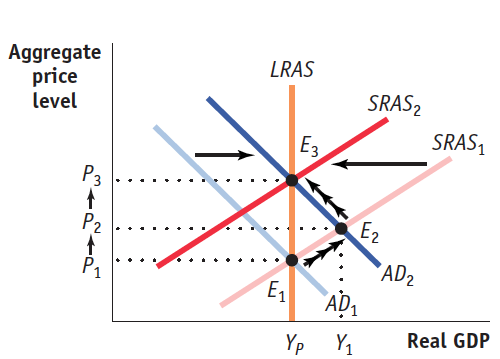

1 point: Graph with “Price level” or “Aggregate price level” on the vertical axis, “Real GDP” on the horizontal axis, a downward-sloping aggregate demand curve, and an upward-sloping aggregate supply curve

1 point: A vertical long-run aggregate supply curve and equilibrium of aggregate demand and short-run aggregate supply at a point on the longrun aggregate supply curve

1 point: Rightward shift of the aggregate demand curve

1 point: The higher money supply leads to a lower interest rate, which increases investment spending (and consumer spending) and, in turn, aggregate demand. Thus, the aggregate demand curve shifts to the right, creating a new equilibrium price level and real GDP.

1 point: Leftward shift of the short-run aggregate supply curve

1 point: The higher price level and production beyond potential output cause wages to rise over time, shifting short-run aggregate supply to the left. This brings the equilibrium level of real GDP back to potential output, but at a higher price level than before.