Tackle the Test: Free-Response Questions

Question

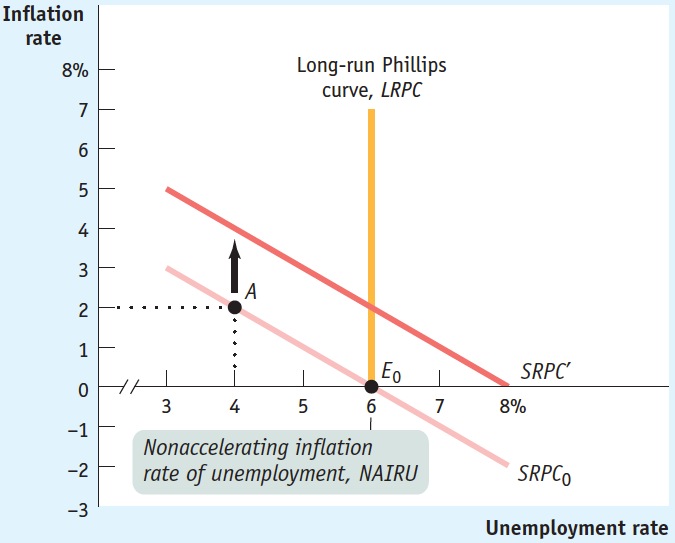

Draw a correctly labeled graph showing a short-

run Phillips curve with an expected inflation rate of 0% and the corresponding long- run Phillips curve. On your graph, label the nonaccelerating inflation rate of unemployment.

On your graph, show what happens in the long run if the government decides to decrease the unemployment rate below the nonaccelerating inflation rate of unemployment. Explain.

Rubric for FRQ 1 (8 points)

1 point: Vertical axis labeled “Inflation rate”

1 point: Horizontal axis labeled “Unemployment rate”

1 point: Downward-

sloping curve labeled “SRPC0” 1 point: Vertical curve labeled “LRPC”

1 point: SRPC0 crosses horizontal axis where it crosses LRPC

1 point: NAIRU is labeled where SRPC0 crosses LRPC and horizontal axis

1 point: New SRPC is labeled, for example as “SRPC',” and shown above the original SRPC0

1 point: When the unemployment rate moves below the NAIRU, it creates inflation and moves the economy to a point such as A. This leads to positive inflationary expectations, which shift the SRPC up as shown by SRPC'.

Question

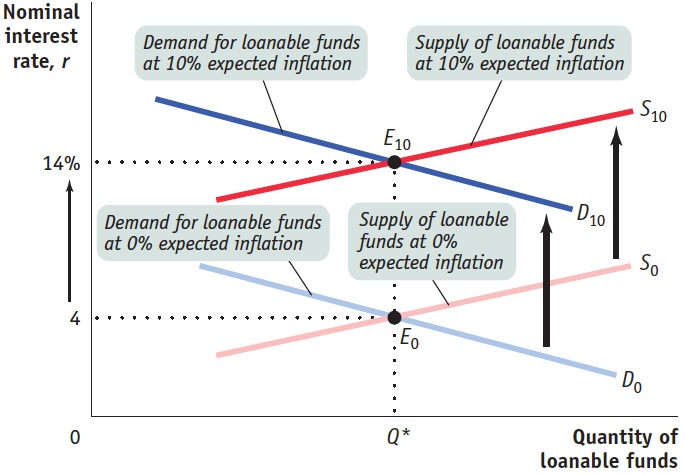

Consider the accompanying figure.

What is the nominal interest rate if expected inflation is 0%?

What would the nominal interest rate be if the expected inflation rate were −2%? Explain.

What would the nominal interest rate be if the expected inflation rate were −6%? Explain.

What would a negative nominal interest rate mean for lenders? How much lending would take place at a negative nominal interest rate? Explain.

What effect does a nominal interest rate of zero have on monetary policy? What is this situation called? (6 points)

Rubric for FRQ 2 (6 points)

1 point: 4%

1 point: In this scenario, the nominal interest rate is 4% plus the expected inflation rate, which makes it: 2% because 4% − 2% = 2%

1 point: 0% because although 4% − 6% = − 2%, nominal interest rates can’t go below zero

1 point: Lenders would effectively have to pay people to borrow their money because what the lenders received back would be less than what they lent out. No lending would take place. It is better to hold cash and get 0% interest than to pay people to borrow money.

1 point: Conventional monetary policy (decreasing interest rates) can’t happen if the nominal interest rate is already zero.

1 point: This is called the zero bound OR a liquidity trap.