Check Your Understanding

Question

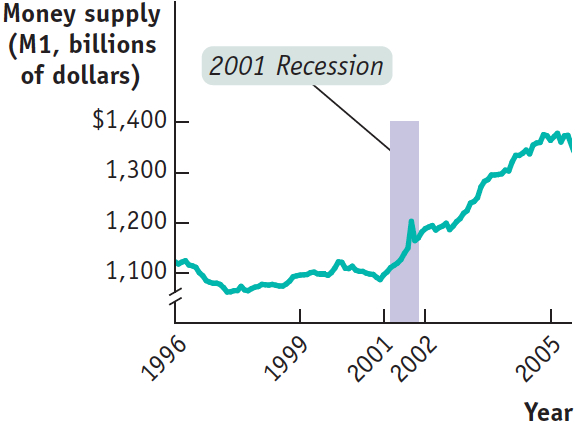

The figure below shows the behavior of M1 before, during, and after the 2001 recession. What would a classical economist have said about the Fed’s policy?

Question

What would the figure in Question 1 have looked like if the Fed had been following a monetarist policy since 1996?

Monetarists argue that central banks should implement policy so that the money supply grows at some constant rate. Had the Fed pursued a monetarist policy during this period, we would have observed movements in M1 that would have shown a fixed rate of growth. Therefore, we would not have observed any of the reductions in M1 that are observed in the figure, nor would we have observed the acceleration in the rate of growth of M1 that occurred in 2001.Question

Now look at Figure 35.3, which shows the path of the velocity of money. What problems do you think the United States would have had since 1996 if the Fed had followed a monetarist policy?

As in Problem 2, a monetarist policy would have resulted in a constant rate of growth in M1. Between 1996 and 2000, the velocity of M1 rose steadily. After 2000, the velocity leveled off a bit and then rose again. Given a constant rate of money growth, these increases in the velocity of M1 would have been expansionary, causing increases in aggregate demand and the aggregate price level, other things being equal.Question

In addition to praising aggressive monetary policy, the 2004 Economic Report of the President says that “tax cuts can boost economic activity by raising after-

tax income and enhancing incentives to work, save, and invest.” Which part of the report is a Keynesian statement and which part is not? Explain your answer. The advocacy of fiscal policy (here in the form of tax cuts) to boost economic activity is Keynesian because Keynes promoted fiscal policy as a useful tool to dampen fluctuations in the business cycle. The praise of aggressive monetary policy is not Keynesian because Keynes worried that a liquidity trap would thwart the ability of monetary policy to change interest rates and influence investment spending.Question

In early 2001, as it became clear that the United States was experiencing a recession, the Fed stated that it would fight the recession with an aggressive monetary policy. By 2004, most observers concluded that this aggressive monetary expansion should be given credit for ending the recession.

What would rational expectations theorists say about this conclusion?

a. Rational expectations theorists would argue that only unexpected changes in money supply would have any short-run effect on economic activity. They would also argue that expected changes in the money supply would affect only the aggregate price level, with no short-run effect of aggregate output. Thus, such theorists would give credit to the Fed for limiting the severity of the 2001 recession only if the Fed’s monetary policy had been more aggressive than individuals expected during this period.What would real business cycle theorists say?

Real business cycle theorists would argue that the Fed’s policy had no effect on ending the 2001 recession because they believe that fluctuations in aggregate output are caused largely by changes in total factor productivity.