The Modern Consensus

The 1970s and the first half of the 1980s were a stormy period for the U.S. economy (and for other major economies, too). There was a severe recession in 1974–

After about 1985, however, the economy settled down. The recession of 1990–

Unfortunately, the Great Moderation was followed by the Great Recession, the severe and persistent slump that followed the 2008 financial crisis. We’ll talk shortly about the policy disputes caused by the Great Recession. First, however, let’s examine the apparent consensus that emerged during the Great Moderation. It combines a belief in monetary policy as the main tool of stabilization, with skepticism toward the use of fiscal policy, and an acknowledgement of the policy constraints imposed by the natural rate of unemployment and the political business cycle.

To understand the modern consensus, where it came from, and what still remains in dispute, we’ll look at how macroeconomists have changed their answers to five key questions about macroeconomic policy. The five questions, and the answers given by macroeconomists over the past 70 years, are summarized in Table 36.1. (In the table, new classical economics is subsumed under classical economics, and new Keynesian economics is subsumed under the modern consensus.) Notice that classical macroeconomics said no to each question; basically, classical macroeconomists didn’t think macroeconomic policy could accomplish very much. But let’s go through the questions one by one.

Table 36.1 Five Key Questions About Macroeconomic Policy

| Classical macroeconomics | Keynesian macroeconomics | Monetarism | Modern consensus | |

| Is expansionary monetary policy helpful in fighting recessions? | No | Not very | Yes | Yes, except in special circumstances |

| Is expansionary fiscal policy effective in fighting recessions? | No | Yes | No | Yes |

| Can monetary and/or fiscal policy reduce unemployment in the long run? | No | Yes | No | No |

| Should fiscal policy be used in a discretionary way? | No | Yes | No | No, except in special circumstances |

| Should monetary policy be used in a discretionary way? | No | Yes | No | Still in dispute |

Is Expansionary Monetary Policy Helpful in Fighting Recessions?

As we’ve seen, classical macroeconomists generally believed that expansionary monetary policy was ineffective or even harmful in fighting recessions. In the early years of Keynesian economics, macroeconomists weren’t against monetary expansion during recessions, but they tended to believe that it was of doubtful effectiveness. Milton Friedman and his followers convinced economists that monetary policy was effective after all.

Nearly all macroeconomists now agree that monetary policy can be used to shift the aggregate demand curve and to reduce economic instability. The classical view that changes in the money supply affect only aggregate prices, not aggregate output, has few supporters today. The view once held by some Keynesian economists—

Is Expansionary Fiscal Policy Effective in Fighting Recessions?

Classical macroeconomists were, if anything, even more opposed to fiscal expansion than to monetary expansion. Keynesian economists, on the other hand, gave fiscal policy a central role in fighting recessions. Monetarists argued that fiscal policy was ineffective as long as the money supply was held constant. But that strong view has become relatively rare.

Most macroeconomists now agree that fiscal policy, like monetary policy, can shift the aggregate demand curve. Most macroeconomists also agree that the government should not seek to balance the budget regardless of the state of the economy: they agree that the role of the budget as an automatic stabilizer helps keep the economy on an even keel.

Can Monetary and/or Fiscal Policy Reduce Unemployment in the Long Run?

Classical macroeconomists didn’t believe the government could do anything about unemployment. Some Keynesian economists moved to the opposite extreme, arguing that expansionary policies could be used to achieve a permanently low unemployment rate, perhaps at the cost of some inflation. Monetarists believed that unemployment could not be kept below the natural rate.

Almost all macroeconomists now accept the natural rate hypothesis and agree on the limitations of monetary and fiscal policy. They believe that effective monetary and fiscal policy can limit the size of fluctuations of the actual unemployment rate around the natural rate but can’t keep unemployment below the natural rate.

Should Fiscal Policy Be Used in a Discretionary Way?

As we’ve already seen, views about the effectiveness of fiscal policy have gone back and forth, from rejection by classical macroeconomists, to a positive view by Keynesian economists, to a negative view once again by monetarists. Today, most macroeconomists believe that tax cuts and spending increases are at least somewhat effective in increasing aggregate demand. However, discretionary fiscal policy is subject to the various types of lags discussed in Module 20. All too often, policies intended to fight a slump affect aggregate demand after the economy has turned around, and end up intensifying a boom.

As a result, the macroeconomic consensus gives monetary policy the lead role in economic stabilization. Discretionary fiscal policy plays the leading role only in special circumstances when monetary policy is ineffective and fiscal policy is likely to take effect before the economy has recovered. For example, many macroeconomists favored the use of discretionary fiscal policy in 2008–

Should Monetary Policy Be Used in a Discretionary Way?

Classical macroeconomists didn’t think that monetary policy should be used to fight recessions; Keynesian economists didn’t oppose discretionary monetary policy, but they were skeptical about its effectiveness. Monetarists argued that discretionary monetary policy was doing more harm than good. Where are we today? This remains an area of dispute. Today there is a broad consensus among macroeconomists on these points:

Monetary policy should play the main role in stabilization policy.

The central bank should be independent, insulated from political pressures, in order to avoid a political business cycle.

Discretionary fiscal policy should be used sparingly, both because of policy lags and because of the risks of a political business cycle.

However, the Great Moderation was upended by events that posed very difficult questions—

Crisis and Aftermath

The Great Recession shattered any sense among macroeconomists that they had entered a permanent era of agreement over key policy questions. Given the nature of the slump, however, this should have come as no surprise. Why? Because the severity of the slump arguably made the policies that seemed to work during the Great Moderation inadequate.

During the Great Moderation, there had been broad agreement that the job of stabilizing the economy was best carried out by having the Federal Reserve and its counterparts abroad raise or lower interest rates as the economic situation warranted. But what should be done if the economy is deeply depressed, while the interest rates the Fed normally controls are already close to zero and can go no lower (that is, when the economy is in a liquidity trap)? Some economists called for aggressive discretionary fiscal policy and/or unconventional monetary policies that might achieve results despite the zero lower bound. Others strongly opposed these measures, arguing either that they would be ineffective or that they would produce undesirable side effects.

The Debate over Fiscal Policy In 2009, a number of governments, including that of the United States, responded with expansionary fiscal policy, or “stimulus,” generally taking the form of a mix of temporary spending measures and temporary tax cuts. From the start, however, these efforts were highly controversial.

Supply-Side Economics

Supply-Side Economics

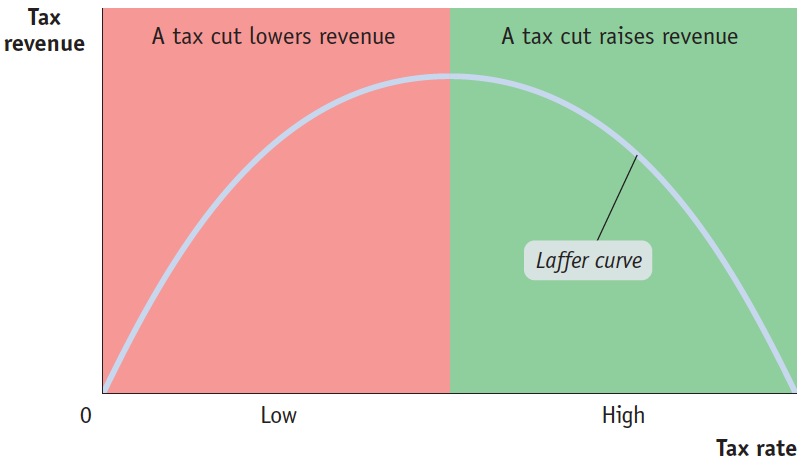

During the 1970s, a group of economic writers began propounding a view of economic policy that came to be known as “supply-

In the 1970s, supply-

Because supply-

The main reason for this dismissal is lack of evidence. Almost all economists agree that tax cuts increase incentives to work and invest, but attempts to estimate these incentive effects indicate that at current U.S. tax levels they aren’t nearly strong enough to support the strong claims made by supply-

Supporters of fiscal stimulus offered three main arguments for breaking with the normal presumption against discretionary fiscal policy:

They argued that discretionary fiscal expansion was needed because the usual tool for stabilizing the economy, monetary policy, could no longer be used now that interest rates were near zero.

They argued that one normal concern about expansionary fiscal policy—

that deficit spending would drive up interest rates, crowding out private investment spending— was unlikely to be a problem in a depressed economy. Again, this was because interest rates were close to zero and likely to stay there as long as the economy was depressed. Finally, they argued that another concern about discretionary fiscal policy—

that it might take a long time to get going— was less of a concern than usual given the likelihood that the economy would be depressed for an extended period. These arguments generally won the day in early 2009.

However, opponents of fiscal stimulus raised two main objections:

They argued that households and firms would see any rise in government spending as a sign that tax burdens were likely to rise in the future, leading to a fall in private spending that would undo any positive effect. This is known as the Ricardian equivalence argument.

- Page 357

They also warned that spending programs might undermine investors’ faith in the government’s ability to repay its debts, leading to an increase in long-

term interest rates despite increases in the money supply.

In fact, by 2010 a number of economists were arguing that the best way to boost the economy was actually to cut government spending, which they argued would increase private-

Critics of fiscal stimulus pointed out that the U.S. stimulus had failed to deliver a convincing fall in unemployment; stimulus advocates, however, had warned from the start that this was likely to happen because the stimulus was too small compared with the depth of the slump. Meanwhile, austerity programs in Britain and elsewhere had also failed to deliver an economic turnaround and, in fact, had seemed to deepen the slump. Supporters of these programs, however, argued that they were nonetheless necessary to head off a potential collapse of confidence.

One thing that was clear, however, was that those who had predicted a sharp rise in U.S. interest rates due to budget deficits, leading to conventional crowding out, had been wrong: by the fall of 2011, U.S. long-