Check Your Understanding

Question

Draw a diagram, similar to Figure 43.1, representing the foreign exchange situation of China when it kept the exchange rate fixed at a target rate of $0.121 per yuan and the market equilibrium rate was higher than the target rate. Then show with a diagram how each of the following policy changes might eliminate the disequilibrium in the market.

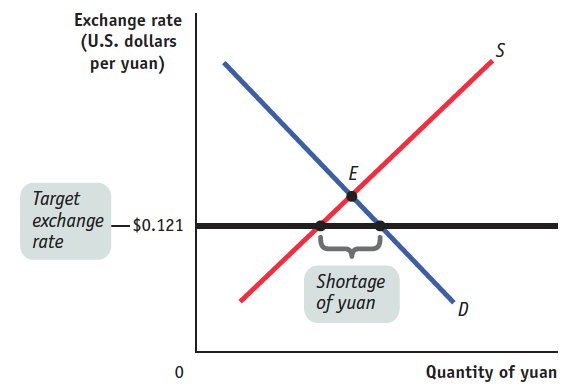

The accompanying diagram shows the supply of and demand for the yuan, with the U.S. dollar price of the yuan on the vertical axis. In 2005, prior to the revaluation, the exchange rate was pegged at 8.28 yuan per U.S. dollar or, equivalently, 0.121 U.S. dollars per yuan ($0.121). At the target exchange rate of $0.121, the quantity of yuan demanded exceeded the quantity of yuan supplied, creating the shortage depicted in the diagram. Without any intervention by the Chinese government, the U.S. dollar price of the yuan would be bid up, causing an appreciation of the yuan. The Chinese government, however, intervened to prevent this appreciation.

allowing the exchange rate to float more freely

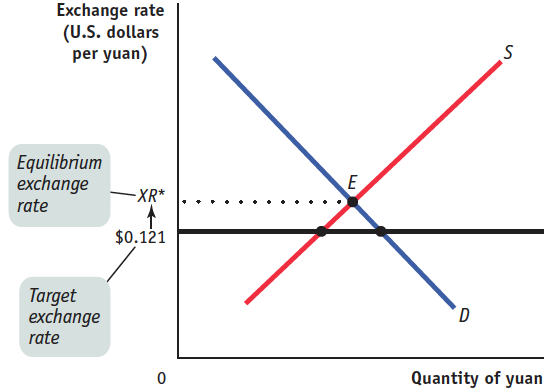

If the exchange rate were allowed to float more freely, the U.S. dollar price of the exchange rate would move toward the equilibrium exchange rate (labeled XR * in the diagram below). This would occur as a result of the shortage, when buyers of the yuan would bid up its U.S. dollar price. As the exchange rate increased, the quantity of yuan demanded would fall and the quantity of yuan supplied would increase. If the exchange rate were allowed to increase to XR *, the disequilibrium would be entirely eliminated.

placing restrictions on foreigners who want to invest in China

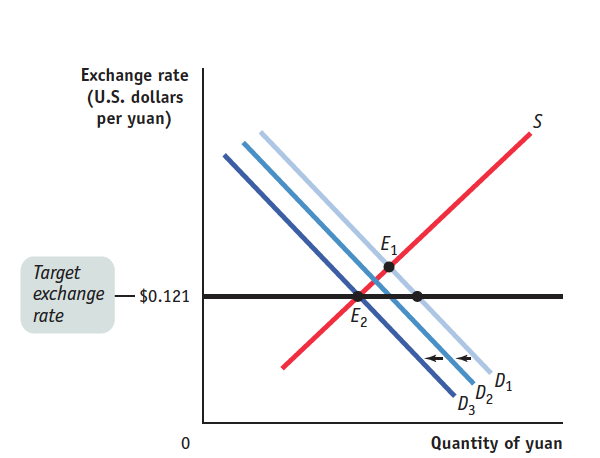

Placing restrictions on foreigners who want to invest in China would reduce the demand for the yuan, causing the demand curve to shift in the accompanying diagram from D1 to something like D2. This would cause a reduction in the shortage of the yuan. If demand fell to D3, the disequilibrium would be completely eliminated.

removing restrictions on Chinese who want to invest abroad

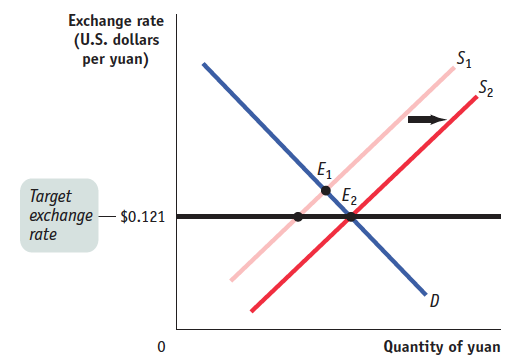

Removing restrictions on Chinese who wish to invest abroad would cause an increase in the supply of the yuan and a rightward shift of the supply curve. This increase in supply would reduce the size of the shortage. If, for example, supply increased from S1 to S2, the disequilibrium would be eliminated completely, as shown in the accompanying diagram.

imposing taxes on Chinese exports, such as clothing

Imposing a tax on exports (Chinese goods sold to foreigners) would raise the price of these goods and decrease the amount of Chinese goods purchased. This would also decrease the demand for yuan with which to purchase those goods. The graphical analysis here is the same as that found in the figure accompanying part b.

Question

In the late 1980s, Canadian economists argued that the high interest rate policies of the Bank of Canada weren’t just causing high unemployment—

they were also making it hard for Canadian manufacturers to compete with U.S. manufacturers. Explain this complaint, using our analysis of how monetary policy works under floating exchange rates. The high Canadian interest rates caused an increase in capital inflows to Canada. To obtain assets that yielded a relatively high interest rate in Canada, investors first had to obtain Canadian dollars. The increase in the demand for the Canadian dollar caused the Canadian dollar to appreciate. This appreciation of the Canadian currency raised the price of Canadian goods to foreigners (measured in terms of the foreign currency). This made it more difficult for Canadian firms to compete in other markets.