A Structure for Macroeconomic Analysis

In our study of macroeconomics we have seen questions about the macroeconomy take many different forms. No matter what the specific question, most macroeconomic problems have the following components:

A starting point. To analyze any situation, you have to know where to start.

A pivotal event. This might be a change in the economy or a policy response to the initial situation.

Initial effects of the event. An event will generally have some initial, short-

run effects. Secondary and long-

run effects of the event. After the short-run effects run their course, there are typically secondary effects and the economy will move toward its long- run equilibrium.

For example, you might be asked to consider the following scenario and answer the associated questions.

Assume the U.S. economy is currently operating at an aggregate output level above potential output. Draw a correctly labeled graph showing aggregate demand, short-

Now assume that the Federal Reserve conducts contractionary monetary policy. Identify the open-

Show and explain how the Fed’s actions will affect equilibrium in the aggregate demand and supply graph you drew previously. Indicate the new aggregate price level on your graph.

Assume Canada is the largest trading partner of the United States. Draw a correctly labeled graph of the foreign exchange market for the U.S. dollar showing how the change in the aggregate price level you indicate on your graph above will affect the foreign exchange market. What will happen to the value of the U.S. dollar relative to the Canadian dollar?

How will the Federal Reserve’s contractionary monetary policy affect the real interest rate in the United States in the long run? Explain.

Taken as a whole, this scenario and the associated questions can seem overwhelming. Let’s start by breaking down our analysis into four components.

The starting point

Assume the U.S. economy is currently operating at an aggregate output level above potential output.

The pivotal event

Now assume that the Federal Reserve conducts contractionary monetary policy.

Initial effects of the event

Show and explain how the Fed’s actions will affect equilibrium.

Secondary and long-

run effects of the event Assume Canada is the largest trading partner of the United States. What will happen to the value of the U.S. dollar relative to the Canadian dollar?

How will the Federal Reserve’s contractionary monetary policy affect the real interest rate in the United States in the long run? Explain.

Now we are ready to look at each of the steps and untangle this scenario.

The Starting Point

Assume the U.S. economy is currently operating at an aggregate output level above potential output. Draw a correctly labeled graph showing aggregate demand, short-

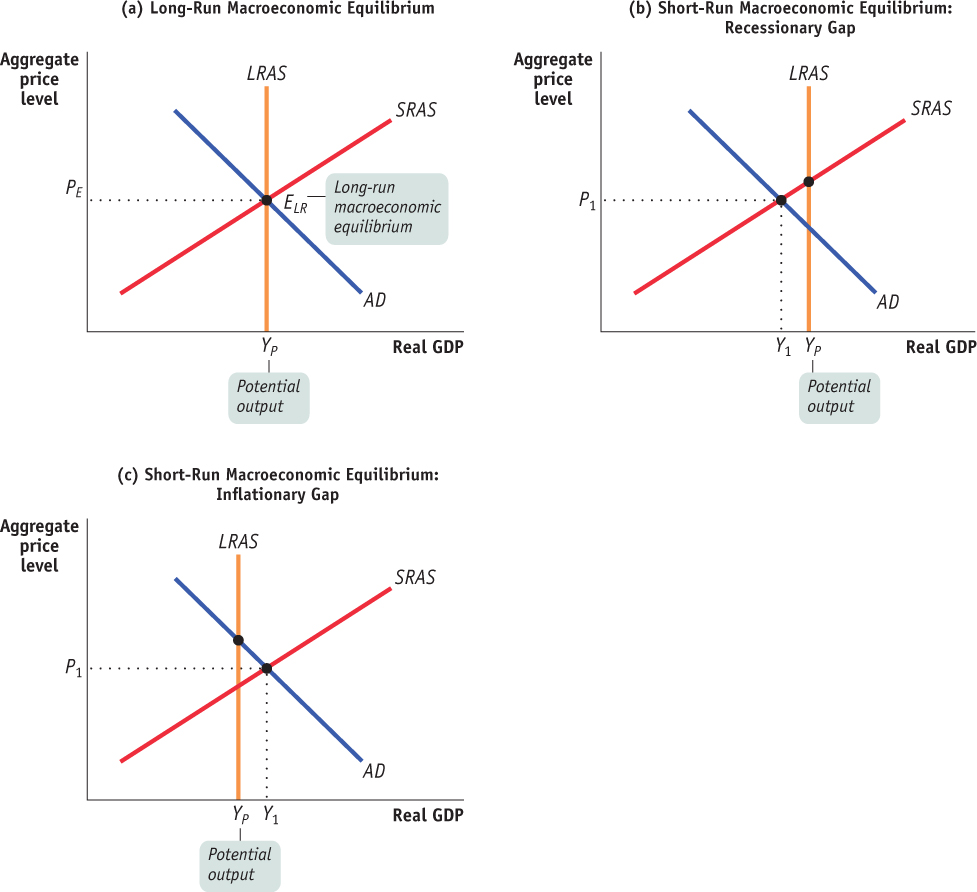

To analyze a situation, you have to know where to start. You will most often use the aggregate demand–

| Figure 45.1 | Analysis Starting Points |

The Pivotal Event

Now assume that the Federal Reserve conducts contractionary monetary policy.

It is the events in a scenario that make it interesting. Perhaps a country goes into or recovers from a recession, inflation catches consumers off guard or becomes expected, consumers or businesses become more or less confident, holdings of money or wealth change, trading partners prosper or falter, or oil prices plummet or spike. The event can also be expansionary or contractionary monetary or fiscal policy. With the infinite number of possible changes in policy, politics, the economy, and markets around the world, don’t expect to analyze a familiar scenario on the exam.

While it’s impossible to foresee all of the scenarios you might encounter, we can group the determinants of change into a reasonably small set of major factors that influence macroeconomic models. Table 45.1 matches major factors with the curves they affect. With these influences in mind, it is relatively easy to proceed through a problem by identifying how the given events affect these factors. Most hypothetical scenarios involve changes in just one or two major factors. Although the real world is more complex, it is largely the same factors that change—

Table 45.1Major Factors that Shift Curves in Each Model

| Aggregate Demand and Aggregate Supply | ||

| Aggregate Demand Curve | Short- |

Long- |

| Expectations | Commodity prices | Productivity |

| Wealth | Nominal wages | Physical capital |

| Size of existing capital stock | Productivity | Human capital |

| Fiscal and monetary policy | Business taxes | Technology |

| Net exports | Quantity of resources | |

| Interest rates | ||

| Investment spending | ||

| Supply and Demand | ||

| Demand Curve | Supply Curve | |

| Income | Input prices | |

| Prices of substitutes and complements | Prices of substitutes and complements in production | |

| Tastes | Technology | |

| Consumer expectations | Producer expectations | |

| Number of consumers | Number of producers | |

| Loanable Funds Market | ||

| Demand Curve | Supply Curve | |

| Investment opportunities | Private saving behavior | |

| Government borrowing | Capital inflows | |

| Money Market | ||

| Demand Curve | Supply Curve | |

| Aggregate price level | Set by the Federal Reserve | |

| Real GDP | ||

| Technology (related to money market) | ||

| Institutions (related to money market) | ||

| Foreign Exchange Market | ||

| Demand | Supply | |

| Foreigners’ purchases of domestic | Domestic residents’ purchases of foreign | |

| Goods | Goods | |

| Services | Services | |

| Assets | Assets | |

| Note: It is the real exchange rate (adjusted for international differences in aggregate price levels) that affects imports and exports. | ||

Note: It is the real exchange rate (adjusted for international differences in aggregate price levels) that affects imports and exports.

As shown in Table 45.1, many curves are shifted by changes in only two or three major factors. Even for the aggregate demand curve, which has the largest number of associated factors, you can simplify the task further by asking yourself, “Does the event influence consumer spending, investment spending, government spending, or net exports?” If so, aggregate demand shifts. A shift of the long-

In the supply and demand model there are five major factors that shift the demand curve and five major factors that shift the supply curve. Most examples using this model will represent a change in one of these ten factors. The loanable funds market, money market, and foreign exchange market have their own clearly identified factors that affect supply or demand. With this information you can link specific events to relevant factors in the models to see what changes will occur. Remember that having correctly labeled axes on your graphs is crucial to a correct analysis.

Often, as in our scenario, the event is a policy response to an undesirable starting point such as a recessionary or inflationary gap. Expansionary policy is used to combat a recession, and contractionary policy is used to combat inflationary pressures. To begin analyzing a policy response, you need to fully understand how the Federal Reserve can implement each type of monetary policy (e.g., increase or decrease the money supply) and how that policy eventually affects the economy. You also need to understand how the government can implement expansionary or contractionary fiscal policy by raising or lowering taxes or government spending.

The Initial Effect of the Event

Show and explain how the Fed’s actions will affect equilibrium.

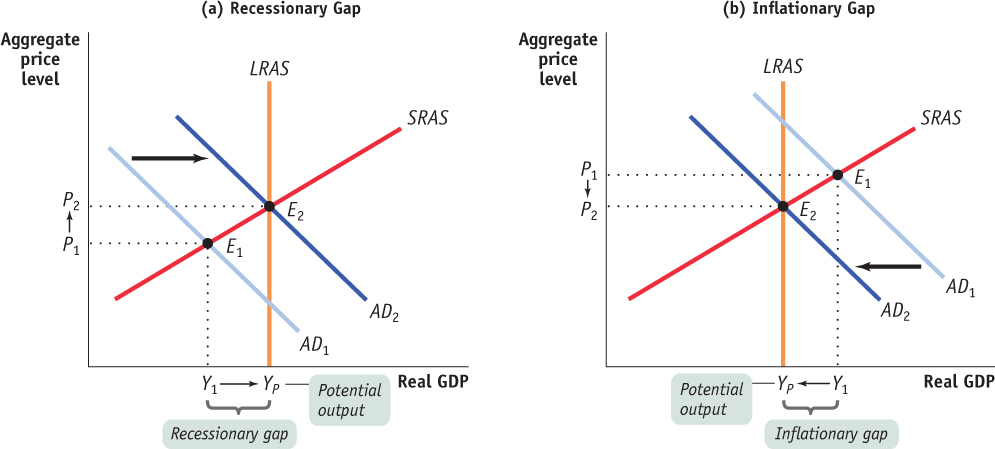

We have seen that events will create short-

| Figure 45.2 | Monetary and Fiscal Policy Close Output Gaps |

Secondary and Long-Run Effects of the Event

Assume Canada is the largest trading partner of the United States. What will happen to the value of the U.S. dollar relative to the Canadian dollar?

How will the Federal Reserve’s contractionary monetary policy affect the real interest rate in the United States in the long run? Explain.

Secondary Effects In addition to the initial, short-

We have seen that negative or positive demand shocks (including those created by inappropriate monetary or fiscal policy) move the economy away from long-

If the short-

Long-

We know that in the long run, monetary policy affects only the aggregate price level, not real GDP. Because money is neutral, changes in the money supply have no effect on the real economy. The aggregate price level and nominal values will be affected by the same proportion, leaving real values (including the real interest rate as mentioned in our scenario) unchanged.