Analyzing Our Scenario

Now let’s address the specific demands of our problem.

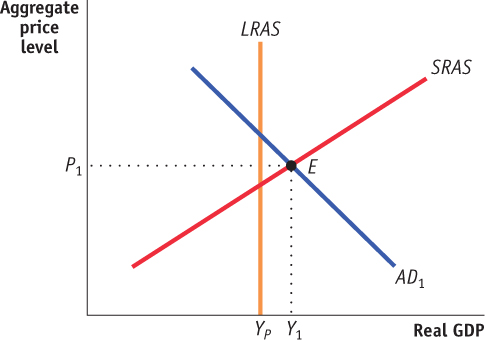

Draw a correctly labeled graph showing aggregate demand, short-

run aggregate supply, long- run aggregate supply, equilibrium output, and the aggregate price level.

Identify the open-

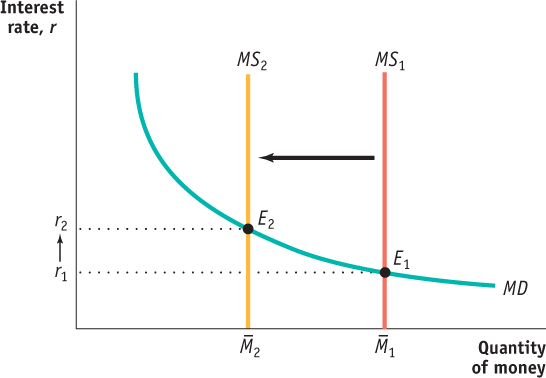

market operation the Fed would conduct.

The Fed would sell U.S. Treasury securities (bonds, bills, or notes).

Draw a correctly labeled graph of the money market to show the effect of the monetary policy on the nominal interest rate.

Page 450

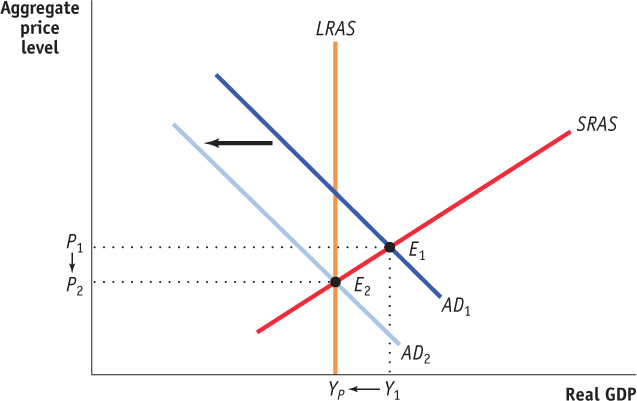

Show and explain how the Fed’s actions will affect equilibrium in the aggregate demand and supply graph you drew previously. Indicate the new aggregate price level on your graph.

A higher interest rate will lead to decreased investment and consumer spending, decreasing aggregate demand. The equilibrium price level and real GDP will fall.

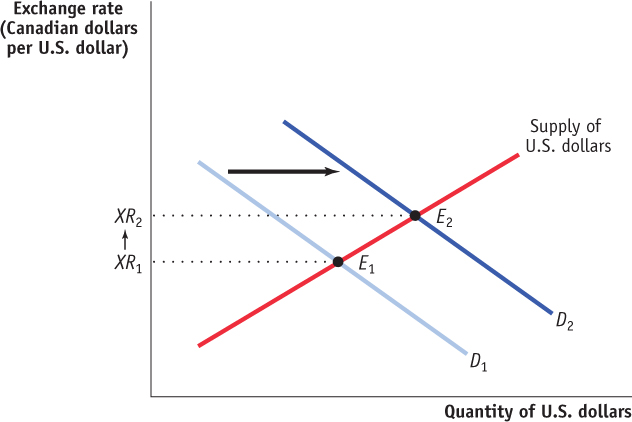

Draw a correctly labeled graph of the foreign exchange market for the U.S. dollar showing how the change in the aggregate price level you indicate on your graph above will affect the foreign exchange market.

The decrease in the U.S. price level will make U.S. exports relatively inexpensive for Canadians to purchase and lead to an increase in demand for U.S. dollars with which to purchase those exports.

What will happen to the U.S. dollar relative to the Canadian dollar?

The U.S. dollar will appreciate.

How will the Federal Reserve’s contractionary monetary policy affect the real interest rate in the United States in the long run? Explain.

There will be no effect on the real interest rate in the long run because, due to the neutrality of money, changes in the money supply do not affect real values in the long run.