The Price Elasticity of Supply

In the wake of the flu vaccine shortfall of 2004, attempts by vaccine distributors to drive up the price of vaccines would have been much less effective if a higher price had induced a large increase in the output of flu vaccines by flu vaccine manufacturers other than Chiron. In fact, if the rise in price had precipitated a significant increase in flu vaccine production, the price would have been pushed back down. But that didn’t happen because, as we mentioned earlier, it would have been far too costly and technically difficult to produce more vaccine for the 2004–

Measuring the Price Elasticity of Supply

The price elasticity of supply is a measure of the responsiveness of the quantity of a good supplied to the price of that good. It is the ratio of the percent change in the quantity supplied to the percent change in the price as we move along the supply curve.

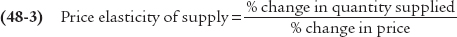

The price elasticity of supply is defined the same way as the price elasticity of demand (although there is no minus sign to be eliminated here):

The only difference is that here we consider movements along the supply curve rather than movements along the demand curve.

Suppose that the price of tomatoes rises by 10%. If the quantity of tomatoes supplied also increases by 10% in response, the price elasticity of supply of tomatoes is 1 (10%/10%) and supply is unit-

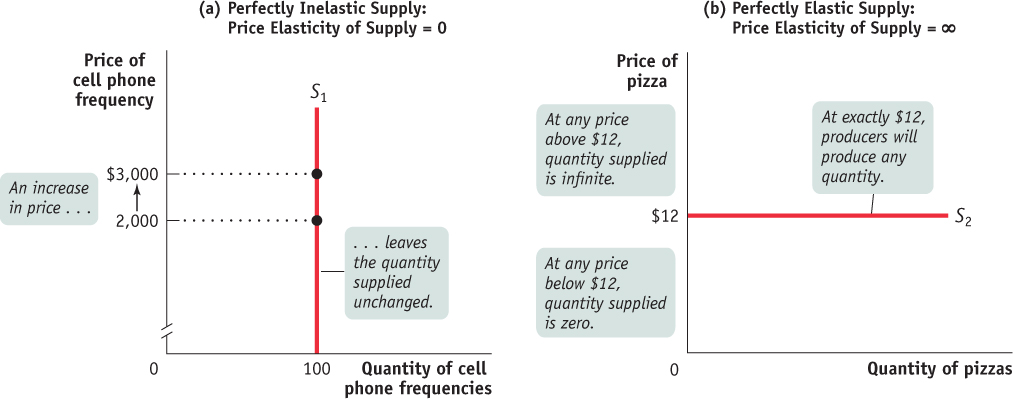

There is perfectly inelastic supply when the price elasticity of supply is zero, so that changes in the price of the good have no effect on the quantity supplied. A perfectly inelastic supply curve is a vertical line.

As in the case of demand, the extreme values of the price elasticity of supply have a simple graphical representation. Panel (a) of Figure 48.1 shows the supply of cell phone frequencies, the portion of the radio spectrum that is suitable for sending and receiving cell phone signals. Governments own the right to sell the use of this part of the radio spectrum to cell phone operators inside their borders. But governments can’t increase or decrease the number of cell phone frequencies they have to offer—

| Figure 48.1 | Two Extreme Cases of Price Elasticity of Supply |

There is perfectly elastic supply if the quantity supplied is zero below some price and infinite above that price. A perfectly elastic supply curve is a horizontal line.

Panel (b) shows the supply curve for pizza. We suppose that it costs $12 to produce a pizza, including all opportunity costs. At any price below $12, it would be unprofitable to produce pizza and all the pizza parlors would go out of business. At a price of $12 or more, there are many producers who could operate pizza parlors. The ingredients—

As our cell phone frequencies and pizza examples suggest, real-

What Factors Determine the Price Elasticity of Supply?

Our examples tell us the main determinant of the price elasticity of supply: the availability of inputs. In addition, as with the price elasticity of demand, time may also play a role in the price elasticity of supply. Here we briefly summarize the two factors.

The Availability of Inputs The price elasticity of supply tends to be large when inputs are readily available and can be shifted into and out of production at a relatively low cost. It tends to be small when inputs are available only in a more-

AP® Exam Tip

Time gives firms a chance to adjust their size and find new sources of inputs. So the more time, the more ability to respond to price changes and the greater the elasticity of supply.

Time The price elasticity of supply tends to grow larger as producers have more time to respond to a price change. This means that the long-

The price elasticity of pizza supply is very high because the inputs needed to make more pizza are readily available. The price elasticity of cell phone frequencies is zero because an essential input—

Many industries are like pizza and have large price elasticities of supply: they can be readily expanded because they don’t require any special or unique resources. On the other hand, the price elasticity of supply is usually substantially less than perfectly elastic for goods that involve limited natural resources: minerals like gold or copper, agricultural products like coffee that flourish only on certain types of land, and renewable resources like ocean fish that can be exploited only up to a point without destroying the resource.

Given enough time, producers are often able to significantly change the amount they produce in response to a price change, even when production involves a limited natural resource. For example, consider again the effects of a surge in flu vaccine prices, but this time focus on the supply response. If the price were to rise to $90 per vaccination and stay there for a number of years, there would almost certainly be a substantial increase in flu vaccine production. Producers such as Chiron would eventually respond by increasing the size of their manufacturing plants, hiring more lab technicians, and so on. But significantly enlarging the capacity of a biotech manufacturing lab takes several years, not weeks or months or even a single year.

For this reason, economists often make a distinction between the short-