Check Your Understanding

Question

Using the tables in Check Your Understanding Questions 1 and 2 in Module 49, find the equilibrium price and quantity in the market for cheese-

stuffed jalapeño peppers. What is the total surplus in the equilibrium in this market, and how much of it does each consumer and producer receive? The quantity demanded equals the quantity supplied at a price of $0.50, the equilibrium price. At that price, a total quantity of 5 peppers will be bought and sold. Casey will buy 3 peppers and receive a consumer surplus of $0.40 on his first, $0.20 on his second, and $0.00 on his third pepper. Josey will buy 2 peppers and receive a consumer surplus of $0.30 on her first and $0.10 on her second pepper. Total consumer surplus is therefore $1.00. Cara will supply 3 peppers and receive a producer surplus of $0.40 on her first, $0.40 on her second, and $0.10 on her third pepper. Jamie will supply 2 peppers and receive a producer surplus of $0.20 on his first and $0.00 on his second pepper. Total producer surplus is therefore $1.10. Total surplus in this market is thus $1.00 + $1.10 = $2.10.Question

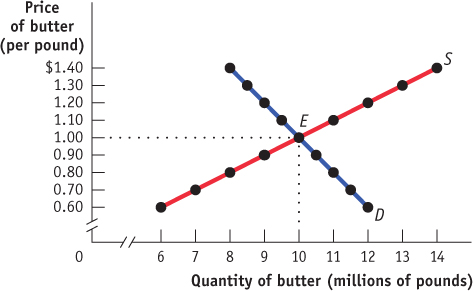

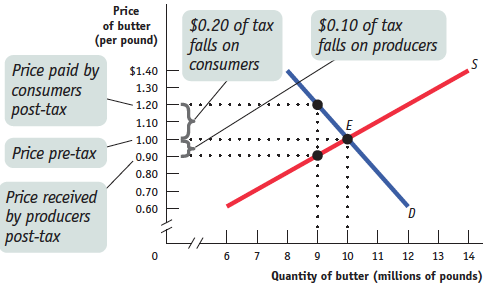

Consider the market for butter, shown in the accompanying figure. The government imposes an excise tax of $0.30 per pound of butter. What is the price paid by consumers post-

tax? What is the price received by producers post- tax? What is the quantity of butter sold? How is the incidence of the tax allocated between consumers and producers? Show this on the figure.  The following figure shows that, after the introduction of the excise tax, the price paid by consumers rises to $1.20; the price received by producers falls to $0.90. Consumers bear $0.20 of the $0.30 tax per pound of butter; producers bear $0.10 of the tax. The tax drives a wedge of $0.30 between the price paid by consumers and the price received by producers. As a result, the quantity of butter sold is now 9 million pounds.

The following figure shows that, after the introduction of the excise tax, the price paid by consumers rises to $1.20; the price received by producers falls to $0.90. Consumers bear $0.20 of the $0.30 tax per pound of butter; producers bear $0.10 of the tax. The tax drives a wedge of $0.30 between the price paid by consumers and the price received by producers. As a result, the quantity of butter sold is now 9 million pounds.

Question

The accompanying table shows five consumers’ willingness to pay for one can of diet soda each as well as five producers’ costs of selling one can of diet soda each. Each consumer buys at most one can of soda; each producer sells at most one can of soda. The government asks your advice about the effects of an excise tax of $0.40 per can of diet soda. Assume that there are no administrative costs from the tax.

Consumer Willingness to Pay Producer Cost Ana $0.70 Zhang $0.10 Bernice 0.60 Yves 0.20 Chizuko 0.50 Xavier 0.30 Dagmar 0.40 Walter 0.40 Ella 0.30 Vern 0.50 Without the excise tax, what is the equilibrium price and the equilibrium quantity of soda?

a. Without the excise tax, Zhang, Yves, Xavier, and Walter sell, and Ana, Bernice, Chizuko, and Dagmar buy 1 can of soda each, at $0.40 per can. Thus, the quantity bought and sold is 4.The excise tax raises the price paid by consumers post-

tax to $0.60 and lowers the price received by producers post- tax to $0.20. With the excise tax, what is the quantity of soda sold? With the excise tax, Zhang and Yves sell, and Ana and Bernice buy 1 can of soda each. So, the quantity sold is 2.Without the excise tax, how much individual consumer surplus does each of the consumers gain? How much individual consumer surplus does each consumer gain with the tax? How much total consumer surplus is lost as a result of the tax?

Without the excise tax, Ana’s individual consumer surplus is $0.70 − $0.40 = $0.30, Bernice’s is $0.60 − $0.40 = $0.20, Chizuko’s is $0.50 − $0.40 = $0.10, and Dagmar’s is $0.40 − $0.40 = $0.00. Total consumer surplus is $0.30 + $0.20 + $0.10 + $0.00 = $0.60. With the tax, Ana’s individual consumer surplus is $0.70 − $0.60 = $0.10 and Bernice’s is $0.60 − $0.60 = $0.00. Total consumer surplus post-tax is $0.10 + $0.00 = $0.10. Thus, the total consumer surplus lost because of the tax is $0.60 − $0.10 = $0.50.Without the excise tax, how much individual producer surplus does each of the producers gain? How much individual producer surplus does each producer gain with the tax? How much total producer surplus is lost as a result of the tax?

Without the excise tax, Zhang’s individual producer surplus is $0.40 − $0.10 = $0.30, Yves’s is $0.40 − $0.20 = $0.20, Xavier’s is $0.40 − $0.30 = $0.10, and Walter’s is $0.40 − $0.40 = $0.00. Total producer surplus is $0.30 + $0.20 + $0.10 + $0.00 = $0.60. With the tax, Zhang’s individual producer surplus is $0.20 − $0.10 = $0.10 and Yves’s is $0.20 − $0.20 = $0.00. Total producer surplus post-tax is $0.10 + $0.00 = $0.10. Thus, the total producer surplus lost because of the tax is $0.60 − $0.10 = $0.50.How much government revenue does the excise tax create?

With the tax, 2 cans of soda are sold, so the government tax revenue from this excise tax is 2 × $0.40 = $0.80.What is the deadweight loss from the imposition of this excise tax?

Total surplus is the sum of producer surplus and consumer surplus. Total surplus without the tax is $0.60 + $0.60 = $1.20. With the tax, total surplus is $0.10 + $0.10 = $0.20. Government tax revenue is $0.80. Deadweight loss from this excise tax is therefore $1.20 − ($0.20 + $0.80) = $0.20.