Maximizing Profit

In the previous module we learned about different types of profit, how to calculate profit, and how firms can use profit calculations to make decisions—

Consider Jennifer and Jason, who run an organic tomato farm. Suppose that the market price of organic tomatoes is $18 per bushel and that Jennifer and Jason can sell as many as they would like at that price. Then we can use the data in Table 53.1 to find their profit-

The first column shows the quantity of output in bushels, and the second column shows Jennifer and Jason’s total revenue from their output: the market value of their output. Total revenue, TR, is equal to the market price multiplied by the quantity of output:

(53-

In this example, total revenue is equal to $18 per bushel times the quantity of output in bushels.

The third column of Table 53.1 shows Jennifer and Jason’s total cost, TC. Even if they don’t grow any tomatoes, Jennifer and Jason must pay $14 to rent the land for their farm. As the quantity of tomatoes increases, so does the total cost of seeds, fertilizer, labor, and other inputs. You will learn more about firm costs in Module 55.

Table 53.1Profit for Jennifer and Jason’s Farm When Market Price Is $18

| Quantity of tomatoes Q (bushels) | Total revenue TR | Total cost TC | Profit TR– |

| 0 | $0 | $14 | −$14 |

| 1 | 18 | 30 | −12 |

| 2 | 36 | 36 | 0 |

| 3 | 54 | 44 | 10 |

| 4 | 72 | 56 | 16 |

| 5 | 90 | 72 | 18 |

| 6 | 108 | 92 | 16 |

| 7 | 126 | 116 | 10 |

The fourth column shows their profit, equal to total revenue minus total cost:

(53-

As indicated by the numbers in the table, profit is maximized at an output of five bushels, where profit is equal to $18. But we can gain more insight into the profit-

Using Marginal Analysis to Choose the Profit-Maximizing Quantity of Output

AP® Exam Tip

The quantity of output at which MR = MC is the focus of firms and wise AP® exam takers because it is that quantity that maximizes profit for firms in every type of market structure.

According to the principle of marginal analysis, every activity should continue until marginal benefit equals marginal cost.

Marginal revenue is the change in total revenue generated by an additional unit of output.

The optimal output rule says that profit is maximized by producing the quantity of output at which the marginal revenue of the last unit produced is equal to its marginal cost.

The principle of marginal analysis provides a clear message about when to stop doing anything: proceed until marginal benefit equals marginal cost. To apply this principle, consider the effect on a producer’s profit of increasing output by one unit. The marginal benefit of that unit is the additional revenue generated by selling it; this measure has a name—

or

MR = ΔTR/ΔQ

In this equation, the Greek uppercase delta (the triangular symbol) represents the change in a variable.

The application of the principle of marginal analysis to the producer’s decision of how much to produce is called the optimal output rule, which states that profit is maximized by producing the quantity at which the marginal revenue of the last unit produced is equal to its marginal cost. As this rule suggests, we will see that Jennifer and Jason maximize their profit by equating marginal revenue and marginal cost.

Note that there may not be any particular quantity at which marginal revenue exactly equals marginal cost. In this case the producer should produce until one more unit would cause marginal benefit to fall below marginal cost. As a common simplification, we can think of marginal cost as rising steadily, rather than jumping from one level at one quantity to a different level at the next quantity. This ensures that marginal cost will equal marginal revenue at some quantity. We employ this simplified approach in what follows.

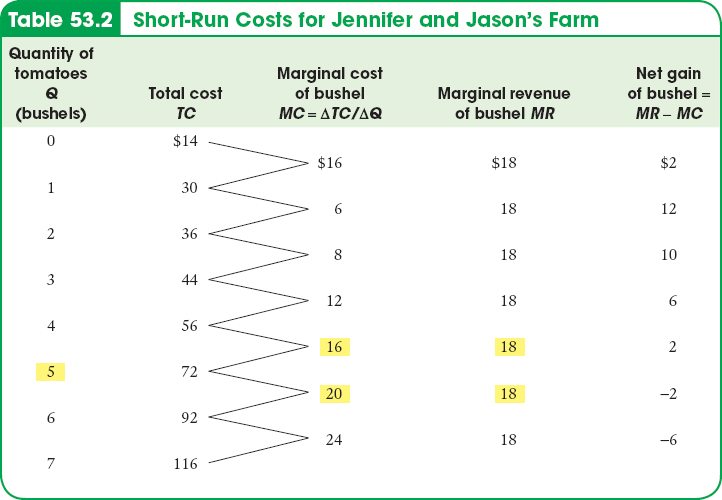

Consider Table 53.2, which provides cost and revenue data for Jennifer and Jason’s farm. The second column contains the farm’s total cost of output. The third column shows their marginal cost. Notice that, in this example, marginal cost initially falls as output rises but then begins to increase, so that the marginal cost curve has a “swoosh” shape. Later it will become clear that this shape has important implications for short-

The fourth column contains the farm’s marginal revenue, which has an important feature: Jennifer and Jason’s marginal revenue is assumed to be constant at $18 for every output level. The assumption holds true for a particular type of market—

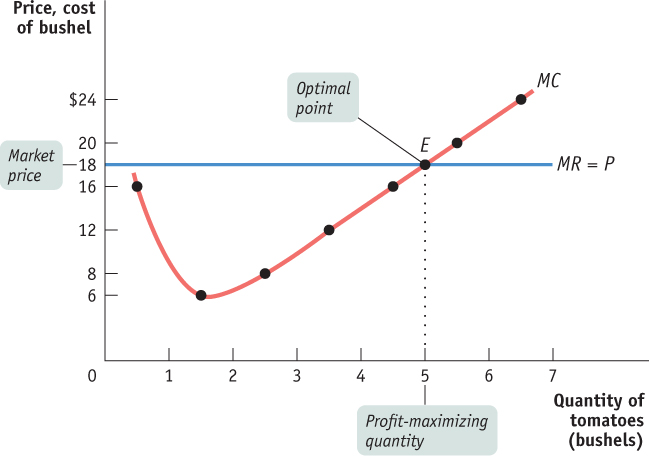

The marginal cost curve shows how the cost of producing one more unit depends on the quantity that has already been produced.

The marginal revenue curve shows how marginal revenue varies as output varies.

Figure 53.1 shows that Jennifer and Jason’s profit-

| Figure 53.1 | The Firm’s Profit- |

Does this mean that the firm’s production decision can be entirely summed up as “produce up to the point where the marginal cost of production is equal to the price”? No, not quite. Before applying the principle of marginal analysis to determine how much to produce, a potential producer must, as a first step, answer an “either–

AP® Exam Tip

If there is no output level at which MR = MC, the firm should produce the largest quantity at which MR is greater than MC.

To understand why the first step in the production decision involves an “either–

When Is Production Profitable?

Recall that a firm’s decision whether or not to stay in a given business in the long run depends on its economic profit—a measure based on the opportunity cost of resources used in the business. To put it a slightly different way: in the calculation of economic profit, a firm’s total cost incorporates the implicit cost—

So we will assume, as we always do, that the cost numbers given in Tables 53.1 and 53.2 include all costs, implicit as well as explicit, and that the profit numbers in Table 53.1 are economic profit. What determines whether Jennifer and Jason’s farm earns a profit or generates a loss? The answer is that whether or not it is profitable depends on the market price of tomatoes—

In the next modules, we look in detail at the two components used to calculate profit: firm revenue (which is determined by the level of production) and firm cost.