Determining the Optimal Input Mix

If several alternative input combinations can be used to produce the optimal level of output, a profit-

Cost Minimization

AP® Exam Tip

Employers will hire a factor of production only up to the point at which the MFC is equal to the MRP. This is similar to the principle you learned in the product market.

How does a firm determine the combination of inputs that maximizes profit? Let’s consider this question using an example.

Imagine you manage a grocery store chain and you need to decide the right combination of self-

If you can check out the same number of customers using either of these combinations of capital and labor, how do you decide which combination of inputs to use? By finding the input combination that costs the least—

Table 72.1Cashiers and Self-Checkout Stations

| Capital (self- |

Labor (cashiers) | |

| Rental rate = $1,000/month | Wage rate = $1,600/month | |

| a. | 20 | 4 |

| b. | 10 | 10 |

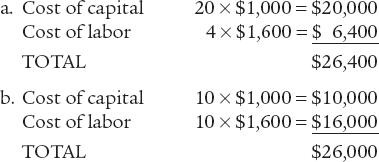

Assume that the cost to rent, operate, and maintain a self-

Clearly, your grocery store chain would choose the lower cost combination, combination b, and hire 10 cashiers and put 10 self-

When firms must choose among alternative combinations of inputs, they evaluate the cost of each combination and select the one that minimizes the cost of production. This can be done by calculating the total cost of each alternative combination of inputs, as shown in this example. However, because the number of possible combinations can be very large, it is more practical to use marginal analysis to find the cost-

The Cost-Minimization Rule

A firm determines the cost-

We already know that the additional output that results from employing an additional unit of an input is the marginal product (MP) of that input. Firms want to receive the highest possible marginal product from each dollar spent on inputs. To do this, firms adjust their combination of inputs until the marginal product per dollar is equal for all inputs. This is the cost-

(72-

AP® Exam Tip

You should know the cost-

To understand why cost minimization occurs when the marginal product per dollar is equal for all inputs, let’s start by looking at two counterexamples. Consider a situation in which the marginal product of labor per dollar is greater than the marginal product of capital per dollar. This situation is described by Equation 72-

(72-

Suppose the marginal product of labor is 20 units and the marginal product of capital is 100 units. If the wage is $10 and the rental rate for capital is $100, then the marginal product per dollar will be 20/$10 = 2 units of output per dollar for labor and 100/$100 = 1 unit of output per dollar for capital. The firm is receiving 2 additional units of output for each dollar spent on labor and only 1 additional unit of output for each dollar spent on capital. In this case, the firm gets more additional output for its money by hiring labor, so it should hire more labor and rent less capital. Because of diminishing returns, as the firm hires more labor, the marginal product of labor falls and as it rents less capital, the marginal product of capital rises. The firm will continue to substitute labor for capital until the falling marginal product of labor per dollar meets the rising marginal product of capital per dollar and the two are equivalent. That is, the firm will adjust its quantities of capital and labor until the marginal product per dollar spent on each input is equal, as in Equation 72-

Next, consider a situation in which the marginal product of capital per dollar is greater than the marginal product of labor per dollar. This situation is described by Equation 72-

(72-

Let’s continue with the assumption that the marginal product of labor for the last unit of labor hired is 20 units and the marginal product of capital for the last unit of capital rented is 100 units. If the wage is $10 and the rental rate for capital is $25, then the marginal product per dollar will be 20/$10 = 2 units of output per dollar for labor and 100/$25 = 4 units of output per dollar for capital. The firm is receiving 4 additional units of output for each dollar spent on capital and only 2 additional units of output for each dollar spent on labor. In this case, the firm gets more additional output for its money by renting capital, so it should rent more capital and hire less labor. Because of diminishing returns, as the firm rents more capital, the marginal product of capital falls, and as it hires less labor, the marginal product of labor rises. The firm will continue to rent more capital and hire less labor until the falling marginal product of capital per dollar meets the rising marginal product of labor per dollar to satisfy the cost-

The cost-

So far in this section we have learned how factor markets determine the equilibrium price and quantity in the markets for land, labor, and capital and how firms determine the combination of inputs they will employ. But how well do these models of factor markets explain the distribution of factor incomes in our economy? In Module 70 we considered how the marginal productivity theory of income distribution explains the factor distribution of income. In the final module in this section we look at the distribution of income in labor markets and consider to what extent the marginal productivity theory of income distribution explains wage differences.